Bitcoin investors barely broke a sweat in troublesome February

After coming close to breaching the $200 billion market cap again, Bitcoin’s downturn from $191 billion to $155 billion contributed to the world’s largest digital asset depreciating by 18 percent towards the end of February.

While market sentiment is clearly affected, according to Glassnode’s recent report, Bitcoin continues to gain the attention of investors across the world.

Since the start of March, market fundamentals have suggested that the asset is slowly breaking away from the short-term bearish rally. Now, according to the report, Bitcoin’s Reserve Risk is exhibiting low levels on the chart, a finding that suggests an attractive risk/reward ratio for any current investment in Bitcoin.

Source: Glassnode

Reserve Risk is defined as deferred spending as a result of HODLing at the current market price. In layman terms, when investors’ confidence is high in the market, but prices remain low, the attractiveness of the asset increases. The current low levels attained by the Reserve Risk suggest that holding a Bitcoin at its present valuation has profitable potential, when compared to the risk of entering the market.

Source: glassnode

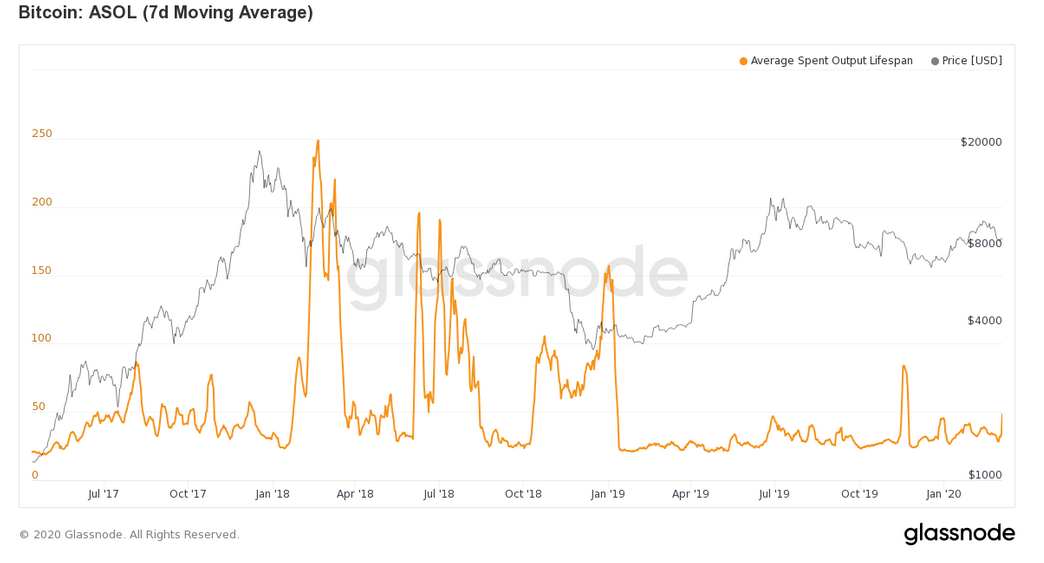

Another indicator that suggested that long-term position holders are not exiting the market is the ASOL. Average Spent Output Lifespan or ASOL represents the movement of Bitcoin HODLers in the market. A spike in the charts as observed above is a sign of exit, but according to glassnode analysts, the causation is due to Bitcoin ‘dust,’ which is a tiny amount of BTC sent across various addresses. The report added,

“When this activity is filtered out, ASOL levels remain low, supporting the thesis that long-term investors are not exiting their positions. Despite bitcoin’s recent dip, confidence remains high.”

Source: Glassnode

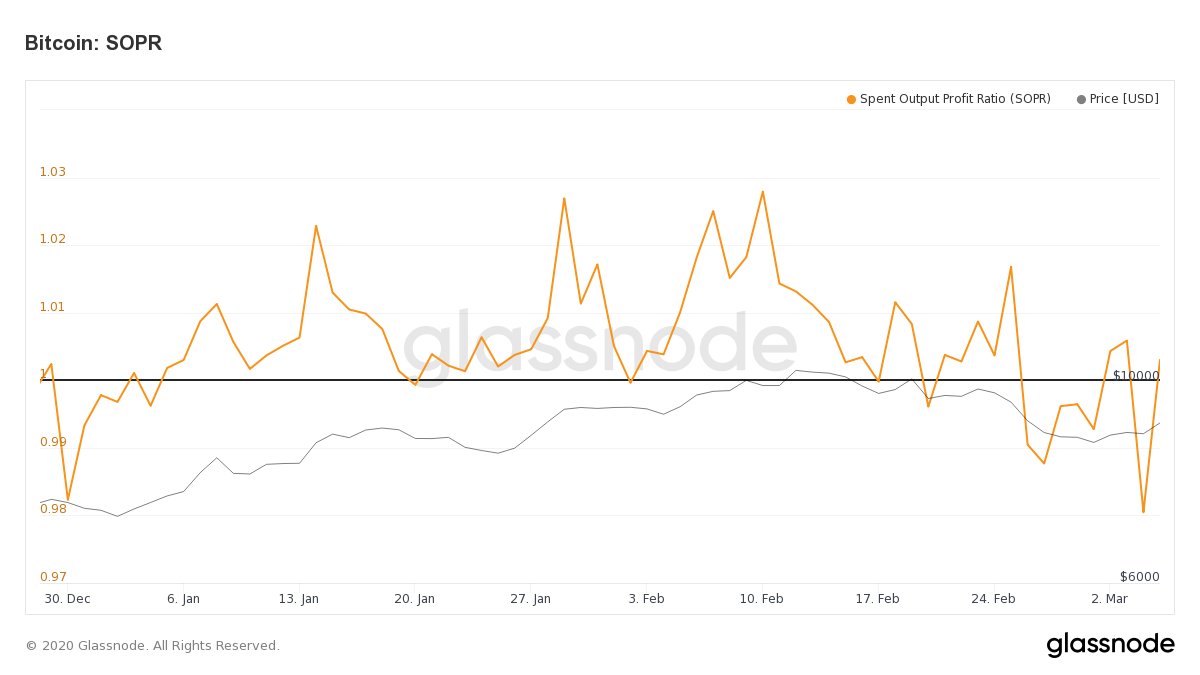

However, a major sign of profitability in the current Bitcoin market was pictured on the SOPR chart. Bitcoin’s Spent Output Profit Ratio, a metric that measures overall profit and losses using on-chain data, is currently above 1 on the charts.

Whenever the SOPR value is greater than 1, it implies that investors on average are selling at a profit rather than at a loss. Jumps above 1, such as the most recent one, usually take place in bear markets, but it is likely due to the fear that the price may continue to go down.

However, a mediation above 1 is also a sign of positive market sentiment from a long-term perspective.

Bitcoin’s volatile nature is playing out at its best in the current market, but a trend reversal observed in on-chain metrics and investors may suggest a turnaround in March.