How Bitcoin captured 40.7% of the NFT market – destroys Ethereum

- Bitcoin has taken 40% of the NFT market share.

- Three Bitcoin collections are now among the top 10 NFTs.

The introduction of Bitcoin [BTC] NFT Ordinals inscriptions marked the beginning of the NFT revolution on the platform. Since then, NFT activity has surged, with BTC NFTs now surpassing others in rankings.

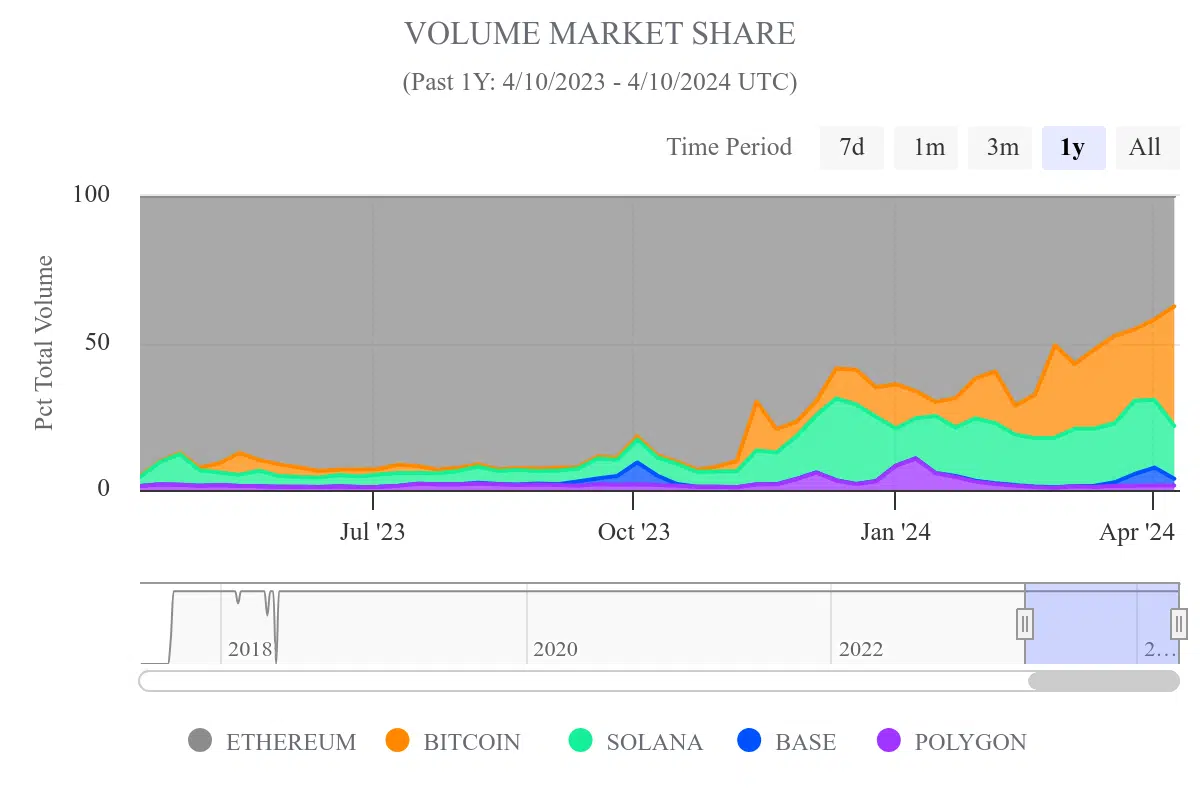

Additionally, recent data indicates that Bitcoin holds the highest market share in the NFT space.

Bitcoin takes charge of NFT volume

Analysis of data from NFT Pulse showed that Bitcoin currently holds the highest volume in the NFT market. At the time of this writing, the total trade volume on the platform amounts to $195 million, with Bitcoin accounting for $79.4 million of this volume.

Further examination showed that it now commands a market share of 40.7%, marking a significant shift from previous trends where Ethereum dominated.

Records also highlight its gradual ascent from holding the second-highest market share to its current position as the market leader in NFT trading volume.

Bitcoin NFT collections emerge as top contenders

According to data from DappRadar, three Bitcoin collections have secured positions among the top 10 NFT collections. Over the last 30 days, Runestone, Ordinal Maxi, and NodeMonkez have emerged as prominent players in the NFT space.

Among these, Runestone currently holds the top spot in popularity. It boasts over 48,000 traders and has witnessed a remarkable 100% increase in volume.

Recent discussions about an upcoming token launch and airdrop for holders have further fueled Runestone’s popularity.

Additionally, DappRadar data reveals that Ordinal Maxi and NodeMonkez hold the eighth and ninth positions, respectively, in the rankings.

A new leader in NFT volume?

Further analysis on Crypto Slam showed that Bitcoin currently boasts the highest NFT sales volume among all networks. As of this writing, it has recorded a sales volume of over $24 million in the last 24 hours, securing the top position.

Ethereum follows closely behind with a sales volume of $10.2 million, ranking second.

Is your portfolio green? Check out the BTC Profit Calculator

Furthermore, when examining the top trading collections, a Bitcoin collection leads the pack with over $10 million in sales. Zooming out to longer time frames, data from the past 7 and 30 days also reaffirms Bitcoin’s dominance in NFT sales.

Over the past seven days, its collection has generated sales totaling over $51.6 million, while over the last 30 days, it has surpassed $169 million in sales, further solidifying its position at the forefront of the NFT market.