Bitcoin

Bitcoin: How Metaplanet’s ¥4.5B bond issuance fueled BTC’s optimism

- Metaplanet’s latest announcement underpins robust spot demand for BTC.

- A comparison of spot vs. Bitcoin demand as Open Interest soars to new highs amid the latest rally.

Japanese company Metaplanet has announced plans to add to its Bitcoin purchases. This comes at a time when the cryptocurrency has been experiencing renewed demand, pushing to new highs above $107,000.

Metaplanet which has been dubbed the Japanese Microstrategy has been aggressively purchasing Bitcoin in 2024. The latest announcement revealed that the company will issue bonds worth ¥4.5 Billion.

This issuance is aimed at raising more capital to buy more BTC.

The development highlights the strong demand for Bitcoin as observed over the last few days. The same reason behind BTC’s latest push above $107,000.

Robust institutional demand has been fueling the momentum, and Metaplanet’s announcement highlights bubbling demand outside the U.S.

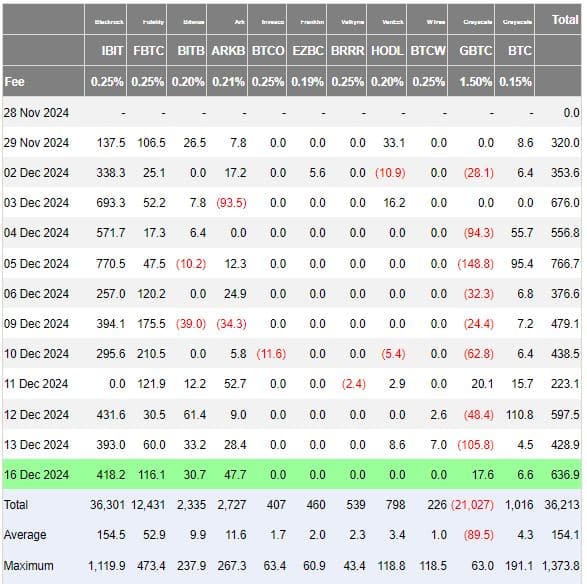

Demand in the U.S. also remained strong, and this was evident by positive Bitcoin ETF flows. The total ETF inflows recorded on 16 December amounted to $636.9 million.

The cryptocurrency has so far maintained a trend of continuous positive flows since the start of the month. Most importantly, this highlights robust spot demand currently in the market.

Robust spot Bitcoin demand

Based on the Bitcoin ETF flows, it is clear that spot demand has been quite heavy lately. A recent Cryptoquant analysis suggested that spot flows have been dominant in the cryptocurrency’s latest bullish push.

In addition, the analysis suggested that derivatives demand had cooled off slightly. The implication being that the market would be less immune to speculative pullbacks. However, a look at Bitcoin derivatives performance revealed a different outcome.

Bitcoin Futures Open Interest pushed to $67.19 billion in the last 24 hours, which marked a new ATH. This suggests that demand in the derivatives segment played a significant role in the latest rally.

The Open Interest spike was mostly backed by positive Funding Rates. Except a brief surge in negative Funding Rates between the 14th and the 16th of December.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The fact that Funding Rates have remained mostly positive suggests that short sellers have been on the sidelines. This is likely to avoid potential losses as prices go higher. This may explain why sell pressure has been limited as the price went higher.

Speaking of, the number of shorts liquidated on the 16th of December soared to $109.075 million. This was the highest amount of daily liquidations that Bitcoin recorded in the last seven days.