Bitcoin

Bitcoin holders sit tight as supply in profit crosses 80%

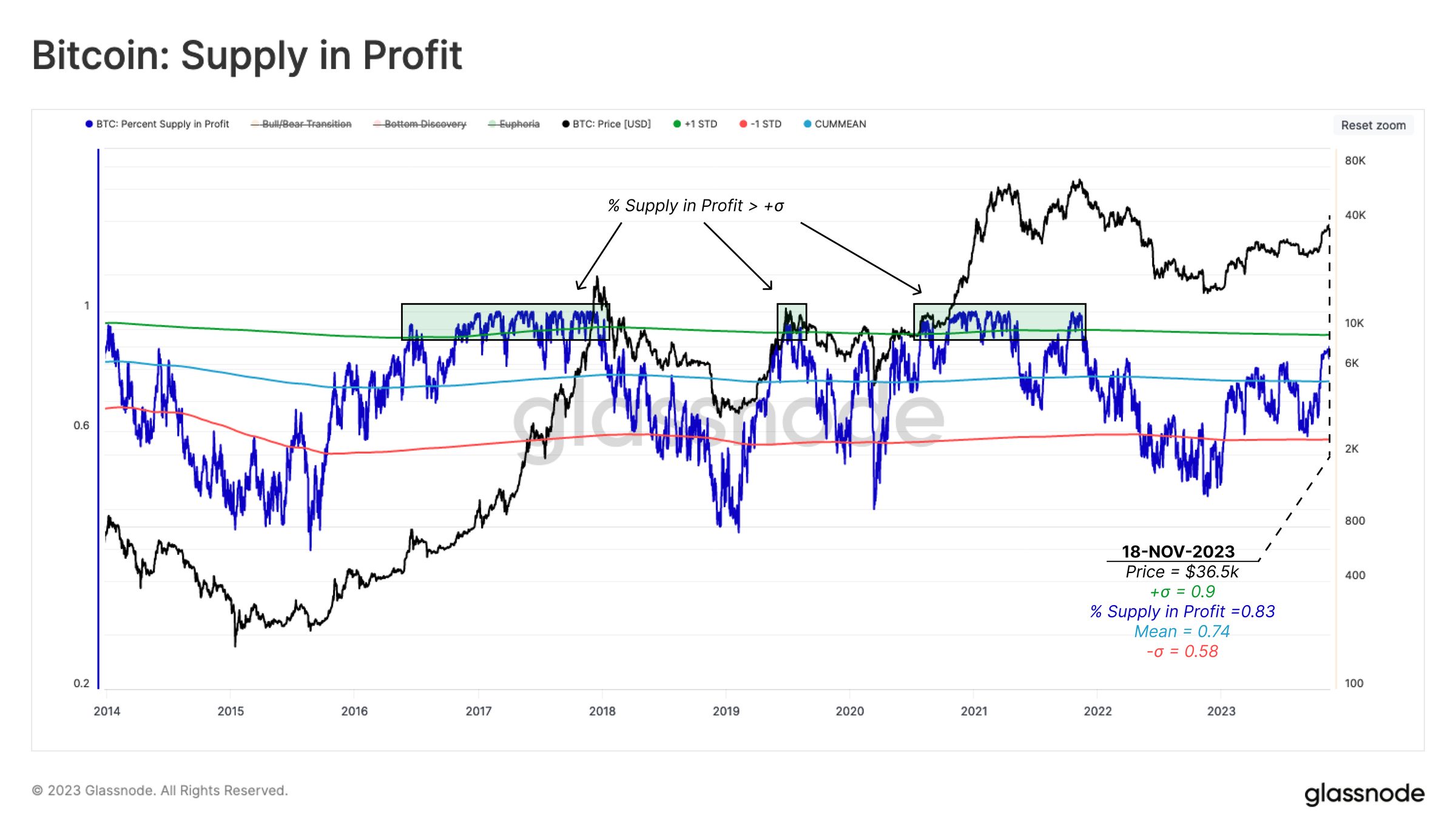

The percentage of Bitcoin’s total circulating supply now sits at a high of 83%.

- The percentage of Bitcoin’s supply in profit has exceeded 80%.

- While long-term holders stall on profit-taking, short-term holders have adopted a different approach.

The recent rally in Bitcoin’s [BTC] price has resulted in 83.6% of the coin’s total circulating supply being held in profit, Glassnode found in a new report.

According to Glassnode, at 83%, BTC’s current circulating supply in profit has surpassed historical averages and is approaching the higher band of +1 standard deviation at 90%.

AMBCrypto’s historical assessment of Bitcoin, spanning over the last five years, showed that any time its circulating supply in profit approached 90%, the market entered “the early stages of a bull market’s Euphoric phase.”

At this phase, most coins would be held in profit.

Glassnode noted that the current market cycle represents a bear/bull transition phase, where the percentage of BTC’s circulating supply ranges between 50% and 90%.

“The market has been within the Bear/Bull Transition phase for the past 10 months as it recovered from the 2022 bear trend. The majority of 2023 has traded below the all-time average, with the October rally being the first sustained break above,” the report stated.

But there is a catch

Despite the rise in the percentage of BTC’s circulating supply in profit, its unrealized profit is still considered “modest.”

Read Bitcoin’s [BTC] Price Prediction 2023-24

Glassnode found that the recent rise in Bitcoin profitability has not motivated the coin’s long-term holders to part with their holdings to book profits.

An assessment of BTC’s Unrealized Profit showed that it remains at the all-time mean level of 49%. The report described this level as:

“Significantly lower than the extreme levels of 60%+ seen in the euphoria phase of past bull markets.”

Glassnode further opined:

“This suggests that whilst a significant volume of the supply is in profit, most have a cost basis, which is only moderately below the current spot price.”

As BTC long-term holders (LTH) hold on to their coins, their share of the total circulating supply continues to rally. At 15 million BTC at press time, the LTH supply of the leading coin has consistently hit new all-time highs since November 2022.

On the other hand, short-term holders (STH) who frequently take profits have seen a decline in their coin holdings.

Glassnode found:

“Short-Term Holder supply has declined to 2.3M BTC, which is effectively a new all-time low.”