Bitcoin: Hashrate hits ATH, but what about price?

- BTC’s mining difficulty increased along with its hashrate.

- BTC’s price action, on the other hand, remained dormant.

Bitcoin’s [BTC] mining sector hit an all-time high in the last week, as its “combination of miner rewards and fees” crossed $46.7 million, according to a tweet on the 26th of November by IntoTheBlock.

Bitcoin hashrate reached a new all-time high this week! Thanks to the surge in Ordinals, The rising demand for Ordinals is significantly boosting mining profitability. The combination of miner rewards and fees hit an impressive $46.7 million, the highest in the past six months. pic.twitter.com/9aqQO4VutX

— IntoTheBlock (@intotheblock) November 26, 2023

Bitcoin’s hashrate reaches ATH!

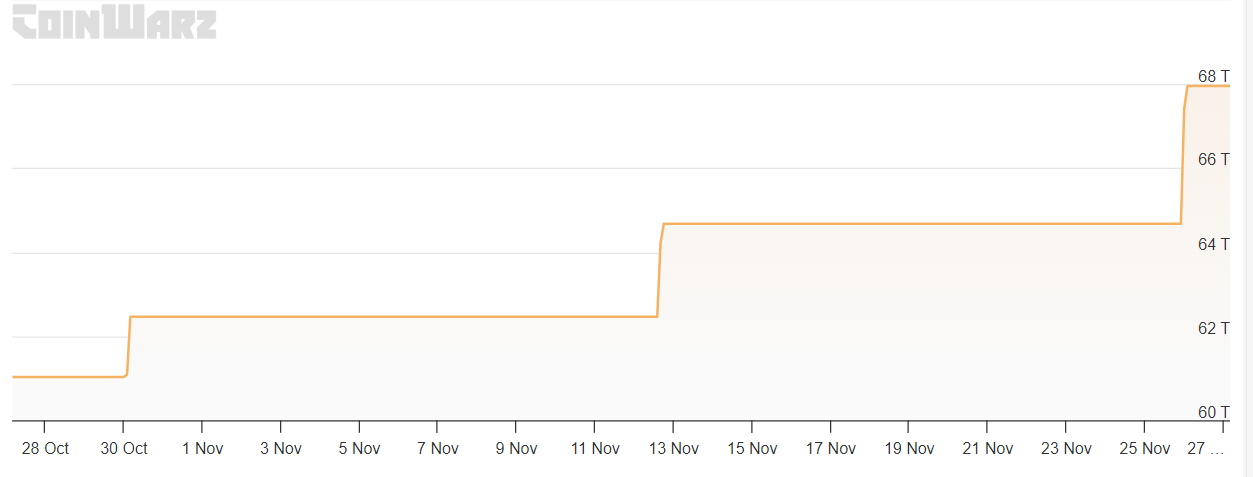

AMBCrypto took a look at Coinwarz’ data, which revealed that at the time of writing, BTC’s hashrate stood at 458.09 EH/s. An increase in hashrate means that there is an influx of new miners into the network.

Because of the hike in BTC’s hashrate, its mining difficulty also went up. As per Coinwarz, BTC’s difficulty stood at 67.96T at press time.

AMBCrypto also took a closer look at Bitcoin’s network health to better understand the causes behind its rising hashrate ahead of 2024’s halving.

Ordinals’ demand is rising

Though the hike in hashrate might be because of the upcoming halving, another reason behind the surge was the rise in BTC Ordinals’ demand.

IntoTheBlock’s tweet mentioned that the rising demand for Ordinals was significantly boosting mining profitability. To be precise, the combination of miner rewards and fees hit an impressive $46.7 million, the highest in the past six months.

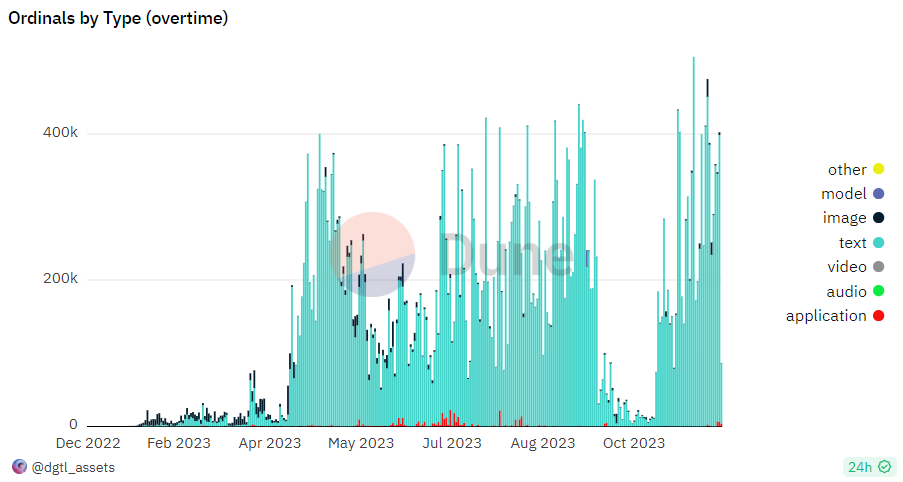

AMBCrypto then had a look at Dune’s data to see how Ordinals was doing. The total number of inscriptions until press time stood at 44,545,049.

Moreover, BTC’s number of daily inscriptions gained upward momentum over the last week, with the maximum number of inscriptions being “text” types, followed by “image” types.

The rise in Ordinals’ demand was also evident from its fees. AMBCrypto’s analysis found that the amount of Bitcoin inscription fees paid followed a similar increasing trend over the last few days.

Bitcoin is moving sideways

Even though the blockchain’s mining industry flourished, investors were not feeling their best as BTC’s price took a sideways path last week. According to CoinMarketCap, BTC’s price only moved marginally over the past seven days.

At the time of writing, BTC was trading at $37,381.51, with a market capitalization of over $730 billion.

Is your portfolio green? Check the Bitcoin Profit Calculator

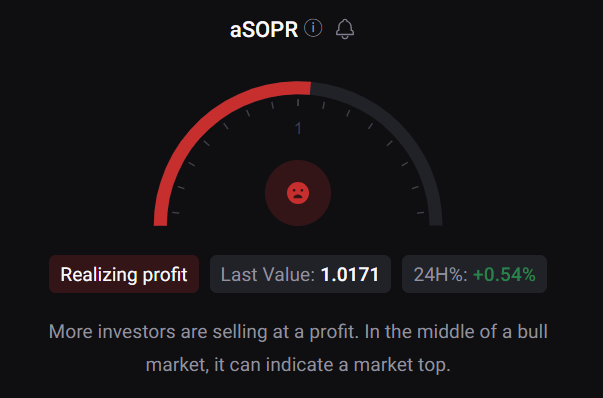

AMBCrypto’s analysis of CryptoQuant’s data revealed quite a few metrics that might have restricted BTC’s price from moving up. For example, BTC’s net deposits on exchanges were high compared to the last seven-day average, meaning that selling pressure was high.

Additionally, its aSORP was in the red. This suggested that more investors were selling at a profit, indicating a possible market top.