Bitcoin

‘Bitcoin halving’ sees increased interest, search volume spikes

According to bitcoinblockhalf.com, Bitcoin’s 3rd Bitcoin halving is still 27 days away at the time of writing this article but speculations surrounding the event are already on the rise.

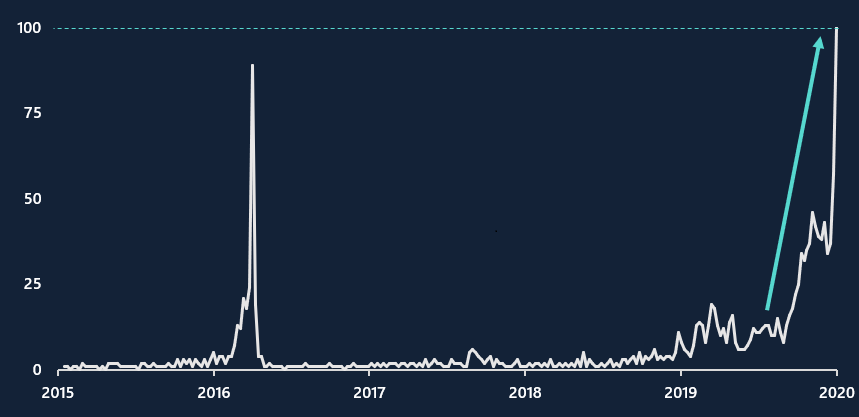

Recent reports had suggested that data from google trends were registering a major spike for the term ‘Bitcoin halving’, and according to Arcane Research, the search volume reached a new all-time high, surpassing its previous high during its last halving in 2016. Although the rise in search volume was expected, such a sharp rise before the halving might not be only because of the event.

Source: Arcane

The block reward of Bitcoin is coming down to 6.25 BTC from 12.5 BTC and some of the factors below may have stirred the search volume as well.

PlanB’s famous $100,000 prediction

Early last year, PlanB, an anonymous figure in the Bitcoin space entered the limelight in the community.

The anonymous figure is famously known for developing the Stock-to-Flow model of Bitcoin which factors in the increasing valuation of Bitcoin with respect to the decrease in supply.

The narrative quickly picked up pace after it was proven that Bitcoin had indeed followed the S2F model over the past few years. However, the prediction which caught everyone’s attention is that PlanB claimed that Bitcoin will reach a valuation of $100,000 post halving. Although he never mentioned an exact timeline, he believed it will happen somewhere between 2020 and 2023. Considering the broad period, traders might still be interested as the thought of BTC crossing $100,000 by the end of 2020 is next to impossible at this moment.

The conundrum with Bitcoin Cash and Bitcoin SV

The halving event for Bitcoin Cash and Bitcoin SV last week did not follow up with good news as both the coins registered a decrease in hashrate and difficulty. Keeping that in mind, proponents of Bitcoin may as well be a little worried themselves.

Hence, in order to understand how the halving may affect Bitcoin in the long-run, it is a calculative assumption that people were searching about the event to understand the necessary implications of reduced block rewards on BTC.

However, Arcane also suggested that the search volume for ‘Bitcoin’ was extremely high in comparison to ‘Bitcoin halving’ which may have been a factor as well, as people could have searched for the next keyword associated with the largest digital asset.

Bitcoin search volume dropped in China?

Source: Longhash

Interestingly, according to data from Longhash, Searches for Bitcoin had dropped down to a monthly low on Chinese search engine Baidu over the past month. Considering China is one of the major players in the digital asset industry, it is a peculiar occurrence.

However, it is important to factor in that the nation was dealing with the spread of COVID-19, and hence speculation for digital assets could possibly be the last thing on their mind.