Bitcoin

Bitcoin gets the better of Litecoin after a brief scare

The sharp spike observed over the week helped Litecoin narrow the gulf with Bitcoin on key network activity indicators.

- Bitcoin experienced higher user activity when compared to ETH and LTC.

- Ethereum continued to be the chain with the largest TVL.

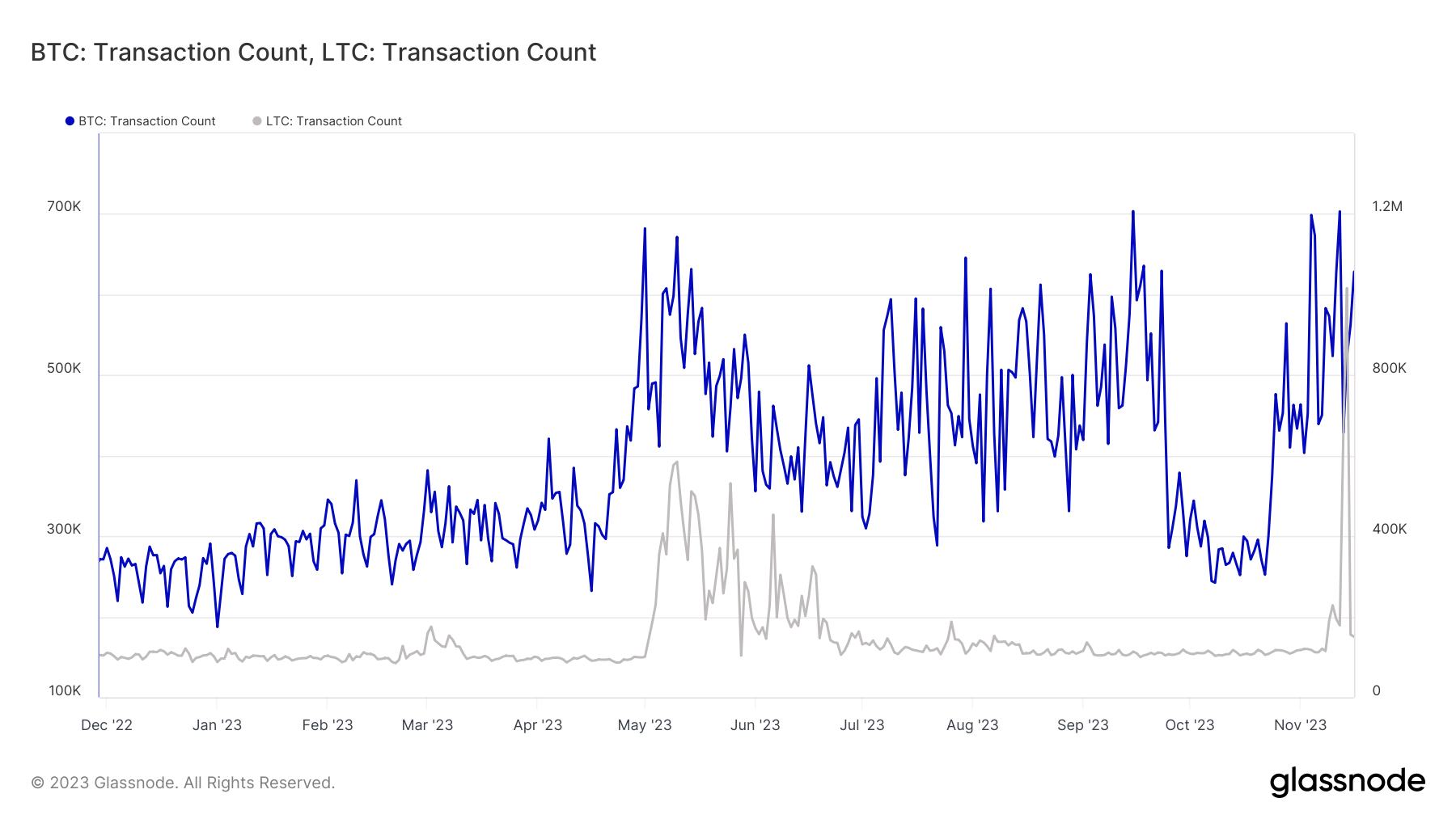

After a brief scare from Litecoin [LTC], Bitcoin [BTC] again surpassed the “Digital Silver” in daily transaction count, as per AMBCrypto’s examination of Glassnode’s data.

The graph showed 628,278 transactions on Bitcoin on 16th November, four times more than the count on Litecoin. Take note that Litecoin outperformed Bitcoin at least twice this week, during which the former clocked more than a million transactions.

Litecoin shows promise

However, Litecoin was trying to close the gap with the chain from which it had forked. According to another set of data from IntoTheBlock, it witnessed significantly high user activity of late.

Indeed, the daily active address count on Litecoin was 797,000, in comparison to Bitcoin’s 960,000. The sharp spike observed over the week helped Litecoin narrow the gulf with the largest proof-of-work (PoW) chain.

In fact, Bitcoin and Lithium were the two largest layer-1 (L1) chains in terms of engaged user base, IntoTheBlock stated. Following the two PoW chains was Ethereum, with 405,000 daily active addresses.

Ethereum leads in TVL

But while Ethereum lagged in on-chain activity, it continued to attract the most capital of any chain in the ecosystem.

According to CoinGecko, the total value locked (TVL) on Ethereum was a whopping $23 billion as of 16th November. This was due to it being the hub for smart contracts and decentralized applications.

The fact that Ethereum’s TVL was more than the total TVL of the next nine chains on the list demonstrated its dominance.

Due to its limitations in having complex smart contract functionality, Bitcoin could only manage inflows of $236 million.

A look at the price charts

While on-chain and DeFi metrics revealed exciting trends, the value of native tokens increased as well. The three assets, BTC, ETH, and LTC, showed a bullish trend, as seen below.

How much are 1,10,100 BTCs worth today?

Bitcoin, riding on the spot ETF wave, grew 27.83% over the last month. While Ethereum was a little slow to begin with, it too was energized by Blackrock’s spot ETH ETF application. The rally stretched ETH’s monthly gains to 24%.

Litecoin was comparatively subdued on the price charts, gaining just 14% in the last month. However, the crypto stands a lot to gain if network traffic picks up.