Bitcoin

Bitcoin flips gold on THIS front – Will BTC gain more ground now?

Will BTC maintain its strong momentum against gold amid BTC reserve expectations?

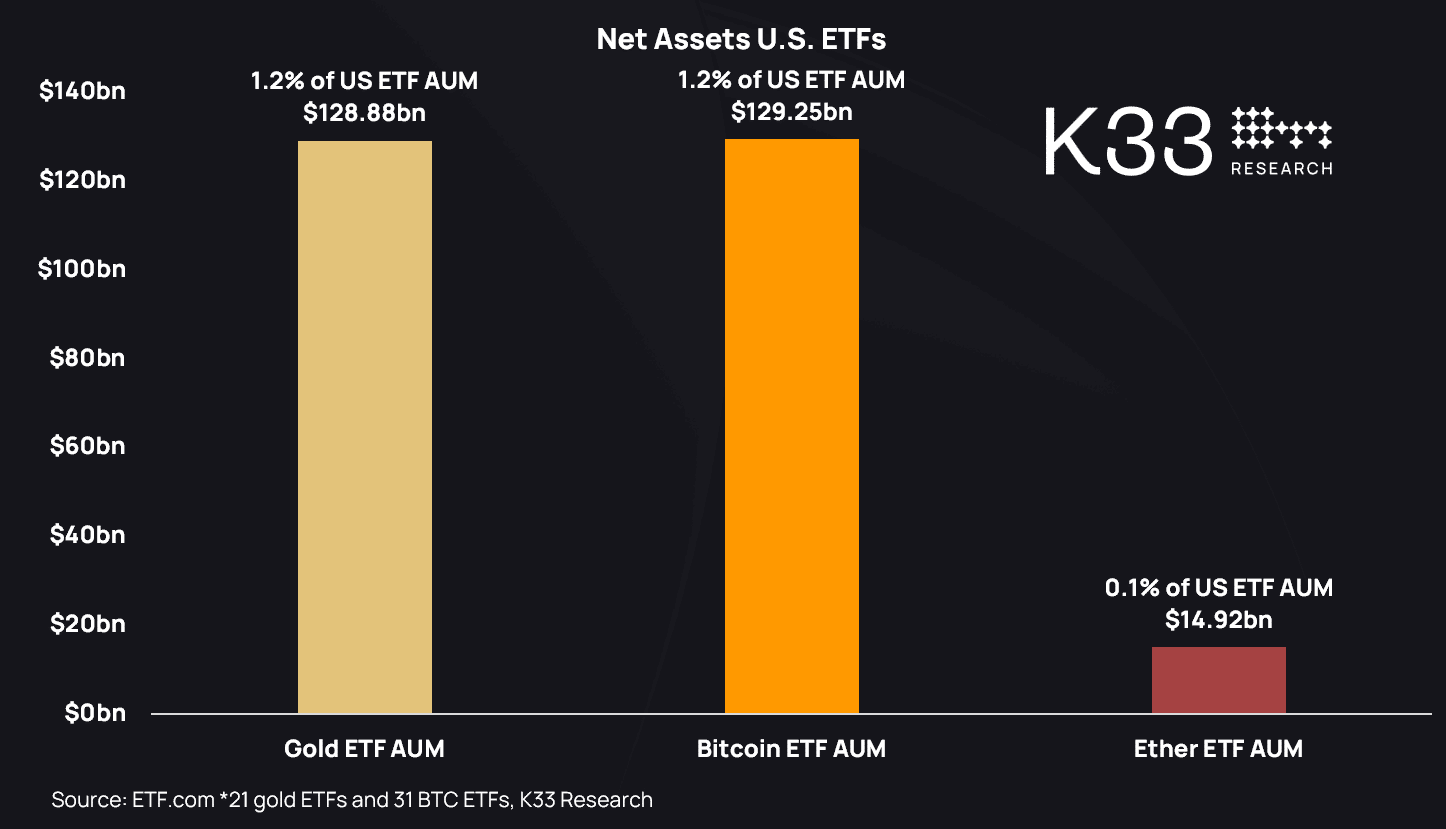

- The US BTC ETFs flipped gold ETFs in AUM as BTC topped $108K.

- BTC could soar as high as 122% against gold in the mid-term.

Bitcoin [BTC], the digital gold, has become a better alternative store of value against physical gold, at least based on recent market shifts in the US.

According to Vetle Lunde, an analyst at crypto-focused K33 Research, the US BTC ETFs’ assets under management (AUM) surged to $129.3 billion, surpassing US gold ETFs’ $128.9 billion.

Source: K33 Research

The record high for BTC ETFs’ AUM followed BTC’s jump to a new all-time high (ATH) above $108K earlier in the week.

BTC flips gold

Bloomberg’s Erick Balchunas confirmed Lunde’s update, but noted that $129 billion involved all US BTC ETFs, including spot and Futures.

Although gold maintained a slight lead on the spot ETFs against BTC, Balchunas underscored BTC’s growth in a year was remarkable. He said,

“If you include all bitcoin ETFs (spot, futures, levered) they have $130b vs $128b for gold ETFs. That said, if you just look at spot, btc is $120b vs $125b for gold. Either way, unreal we even discussing them being this close at 11 months”

On his part, renowned trader Peter Brandt projected that BTC could outperform gold by an extra 122%, citing a bullish cup and handle pattern formed by the BTC/gold ratio.

The ratio, which tracks BTC’s relative performance against gold, climbed to a new high of 40 and broke above the cup and handle pattern.

This could set the pace for Brandt’s target – A potential 122% BTC rally against gold.

That said, BTC’s preference as an alternative store of value could gain more momentum if the US establishes a BTC reserve.

Since the US elections, BTC has outperformed gold by nearly 60% and could be just the start of a larger move for market share as a store of value and hedging alternative.