Bitcoin falls below $60,000 level, caution over the sudden drop in altcoins price

In the US New York stock market on the 18th, the Dow Jones Industrial Average closed 75.6 points (0.2%) higher than the previous day, and the Nasdaq Index closed 130.2 points (0.82%) higher.

Among U.S. stocks related to crypto assets (virtual currency), MicroStrategy, which had been pointed out to be surging due to a short squeeze, plunged and suffered a major adjustment. It was down 18.6% from the previous day. The company continues to purchase and hold large amounts of Bitcoin using leverage, such as by raising funds through convertible bonds, and is trading at a premium.

In the crypto asset (virtual currency) market, Bitcoin (BTC) fell 3.5% from the previous day to 1 BTC = $65,000.

Bitcoin (BTC) has fallen sharply since reaching $73,750, breaking the all-time high of $69,000 set in November 2022.

Last Thursday’s rise in the producer price index suggested that inflation would remain high, dampening expectations for an early interest rate cut by the Federal Reserve.

Bloomberg points out that Google searches for “Bitcoin” have increased by the most in the past year. It pointed out that Google Trends data shows that Bitcoin has more searches than Taylor Swift or Beyoncé.

In addition to the rapid rise in major stocks such as Bitcoin (BTC), there is also a growing sense of overheating, with meme coins soaring, and many analysts are sounding the alarm.

Rekt Capital is one of them.

As of the 17th, he pointed out that based on past market cycles, Bitcoin could undergo a major correction before the halving and reach “dangerous territory” within a few days.

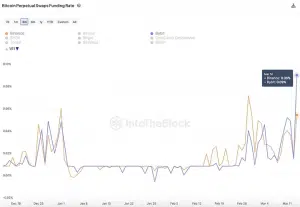

Lucas Outumuro, head of research at IntoTheBlock, pointed out that the funding rate in the futures market has reached the hottest level since October 2021.

In particular, the funding rates of major derivatives companies Binance and Bybit reached 0.06% (annualized 93%) and 0.09% (annualized 168%), respectively, suggesting a bias toward long positions.

Additionally, the total debt issued through DeFi (decentralized finance) lending platform Aave v3 has surged 2.14x since the beginning of the year. Wrapped Bitcoin (WBTC) volume has increased by over 10,000 BTC (approximately $700 million) in 2024.

Given this situation, IntoTheBlock analysts concluded that the high borrowing costs seen in the derivatives and DeFi markets risk causing a significant short-term correction in the crypto market.

The funding rate during the bull market at the beginning of 2021 was at a slightly higher level than the current level, but due to the unwinding of leveraged positions and a chain of stop-losses (forced liquidations), it plummeted by 55% from the ceiling in the second quarter. The market was affected by a complete ban on crypto assets (virtual currency) from China and a ban on Tesla’s introduction of Bitcoin payments.

The more leveraged positions accumulate, the greater the risk of increased volatility (price volatility). If the market moves against your expectations, your losses will be magnified by the amount of leverage you apply.