Bitcoin

Bitcoin: Here’s why the November 13 expiry might be a dud event

Bitcoin’s [BTC] price recorded its 2020 high of $16,177 today, on the 12th of November. Even though the cryptocurrency’s price had dropped under $16k at press time, the derivatives market has been underlining the active nature of the traders who are aiming for a higher price as 2020’s Q4 culminates.

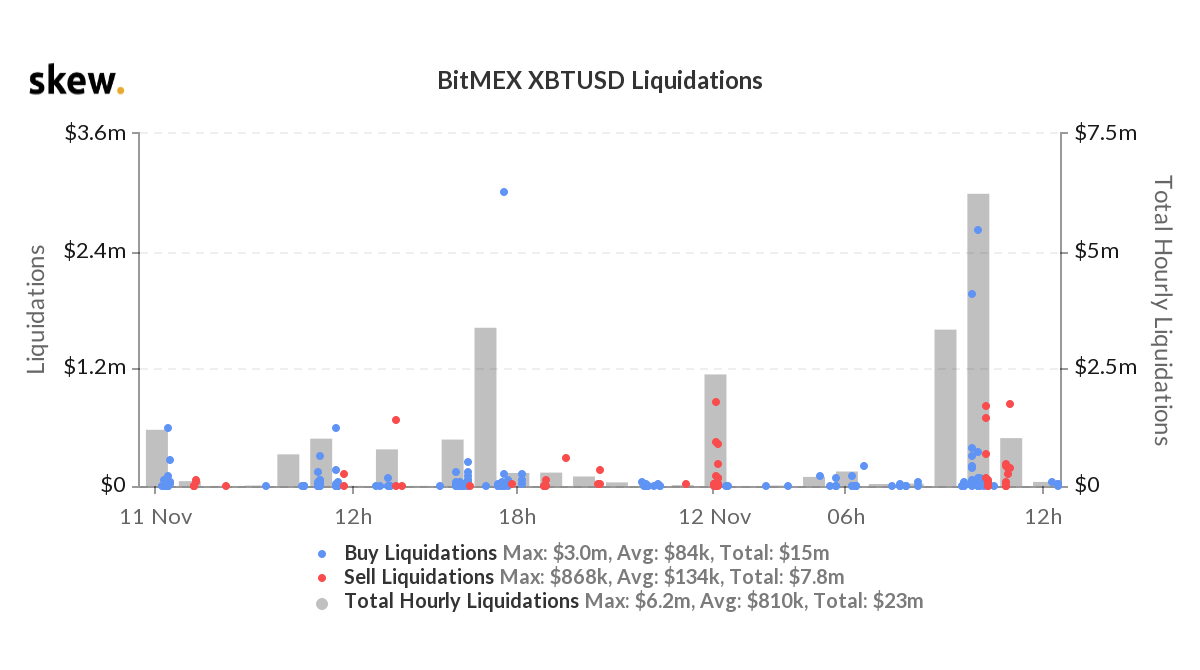

As the value of Bitcoin appreciated to $16k, liquidations on BitMEX exchange were significant. The short liquidations helped the value of the digital asset rise dramatically in an hour, however, there wasn’t much volume to support the price at this value. On the contrary, the sellers in the market took this as an opportune time to make a profit and they sold their BTCs. The price of the crypto-asset soon collapsed under $16k.

Source: Skew

At press time, the total daily liquidations stood at $23 million, wherein the buy liquidations were worth $15 million and the selling liquidations were worth $7.8 million. Here, it is worth noting that BTC had not reached the aforementioned price level since 2018 and it may take a few more tests to hold a value above this level.

Meanwhile, the Options market saw the Puts taking precedence over Calls, meaning the market is potentially preparing to sell BTC in the future. With a strike of 19.4k preceding others, the traders’ expectations seemed to be clear.

The Put/Call ratio was inching closer to 0.7, a figure that would turn the fate of the BTC Options to a bearish one. At press time, the ratio was noted to be 0.67, a result of the cryptocurrency’s sudden price movement.

Source: Skew

As the market braces for another run-up above $16k, the November contracts have been on the rise. According to Skew, a total of 135.3k BTC Options contracts are to expire this month. The first major installment of this expiration will be witnessed on 13 November, a day when 35.1K BTC Options contracts are set to expire. However, looking at the resistance at $16k and the support at $15.5k, the expiry may turn out to be a dud event.