Bitcoin exchange supply hits six-year low – What caused the dip?

- Bitcoin’s supply on centralized exchanges has fallen consistently since 2020.

- This meant coin holders have increasingly adopted a long-term investment outlook.

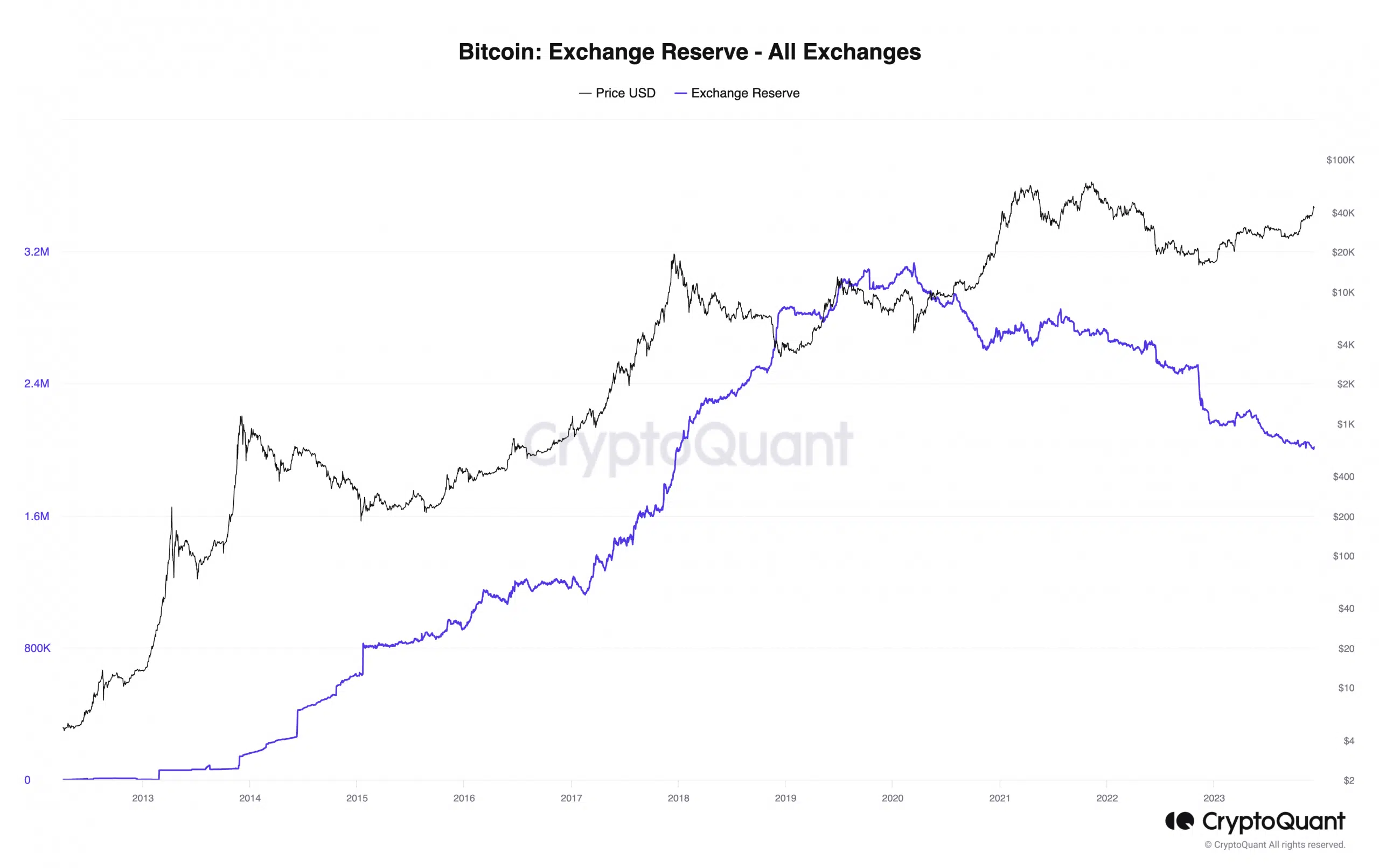

The amount of Bitcoin [BTC] held on centralized cryptocurrency exchanges has dropped to its lowest level since December 2017, according to on-chain data obtained from CryptoQuant.

The leading coin’s exchange reserve peaked at 3.08 million on 2nd March 2022, after which it began to decline. As of this writing, 2.01 million BTC remain on exchanges, representing a 34% decrease in the last three years.

Why the decline?

The plunge in the amount of BTC held on centralized exchanges, reaching a six-year low, can be seen as a direct consequence of the FTX collapse and the broader turmoil within the crypto industry.

Investors, shaken by the FTX debacle and the increased scrutiny from regulators like the SEC, are opting to take control of their assets, turning away from centralized platforms and embracing self-custody solutions.

This trend towards self-custody indicates a growing sentiment among investors that BTC is a long-term asset worth holding rather than actively trading.

As of this writing, BTC traded at an 18-month high of $43,000. On-chain data revealed that many long-term holders have refused to sell their coins in anticipation of more profits.

However, a closer assessment of long-term investor trading activity revealed that a subset of this investor class remains underwater. In a recent report, pseudonymous CryptoQuant analyst IT Tech found:

“The cohort that invested in BTC 2-3 years ago, for instance, is still grappling with an average realized price of $45,000, resulting in an ongoing average loss.”

Nevertheless, over the years, market participants have increasingly seen BTC as a long-term asset that should be held. Hence the steady decline in its exchange reserve.

Why this might be a problem

However, as BTC exchange reserve continues to fall, it can significantly impact market liquidity. This is because as fewer investors hold their BTC on exchanges, there would be less coins available for trading.

This would result in a shallower order book, where the number of buy and sell orders decreases. This might make it difficult for large orders to be executed.

Read Bitcoin (BTC) Price Prediction 2023-24

With fewer orders available, the difference between the bid and ask prices would widen. This might result in an increase in the cost of trading BTC, as traders have to pay more to execute their orders.

Lastly, reduced liquidity can increase price volatility, as small orders can significantly impact the market price.