Bitcoin, Ethereum, XRP plunge – Here’s what triggered the crash

- Bitcoin, Ethereum, XRP led the recent market crash following U.S. inflation fears.

- Options market sentiment was cautiously optimistic ahead of Donald Trump’s presidential inauguration.

On the 7th 0f January, Bitcoin [BTC] gave back its New Year gains on what analysts linked to hotter-than-expected U.S. economic data.

BTC dropped from $102K to $94.5K, triggering a market-wide bloodbath. Ethereum [ETH] dumped nearly 10% to $3.3K, but Ripple [XRP] moderately declined by 6%.

Bitcoin, Ethereum, XRP: Victims of sell-off

The broader market sell-off followed a sticky inflation in the U.S. services sector as tracked by the Institute for Supply Management (ISM) Purchasing Managers Index (PMI).

The price paid for inputs climbed to high levels, which were last seen in early 2023, reflecting the recent Fed inflation concern.

Reacting to the data, crypto analyst Benjamin Cowen noted,

“The real reason it is going up is due to ISM prices paid, which also just came in: actual: 64.4, estimated: 57.5, prior: 58.2. Has not been this high since Feb. 2023, making the market wonder if perhaps the Fed cut too soon?”

Another risk factor was a likely resilient U.S. labor market. Recent data showed more job openings than expected.

This meant that the slow Fed rate cut path in 2025 could be reinforced, limiting cheap capital that fuels risk-on assets like BTC.

Trading firm QCP Capital pinned the sell-off on Job openings data and stated,

“JOLTS job openings surged to 8.1M (vs. 7.74M forecast), sparking risk-off sentiment as long-term bond yields spiked. This triggered ~$206M in liquidations within an hour.”

QCP added that Friday’s upcoming NFP (nonfarm payroll) data could further gauge the state of the U.S. labor markets and impact the BTC price trajectory.

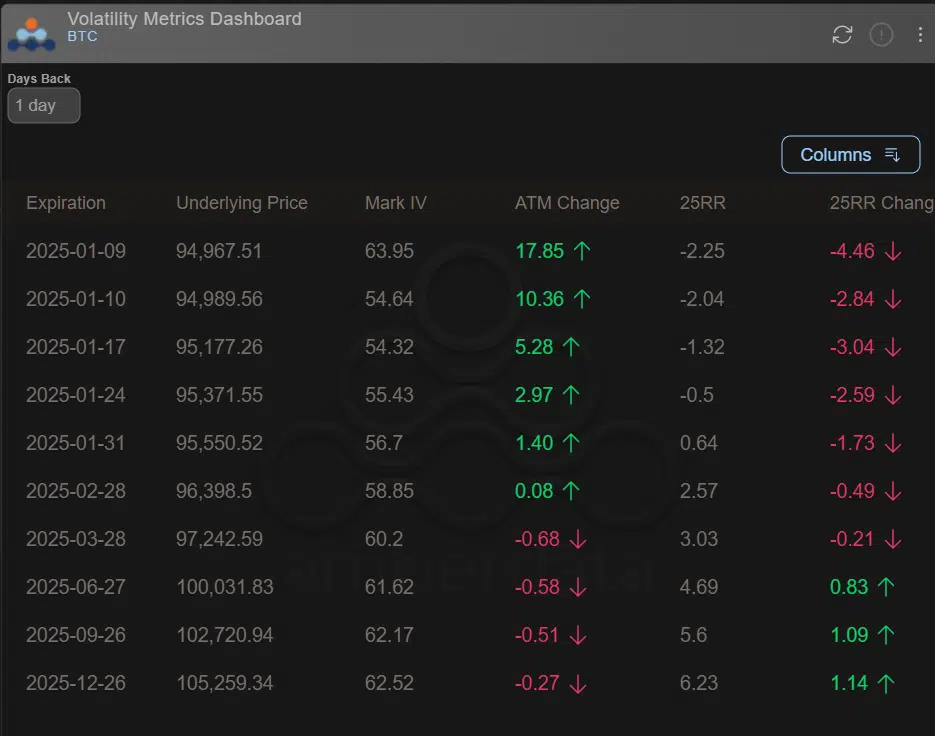

In the meantime, the 25-Delta Risk Reversal (25RR), an indicator that gauges the volatility premium between calls (bullish bets) and puts (bearish bets, downside protection), was negative for the 10th of January and 17th option expiry on Deribit.

The 24-hour negative skew suggested increased hedging activity against downside moves as demand for puts exceeded calls. This underscored a cautious negative sentiment.

Source: Amberdata

However, the 25RR for the option expiry on the 31st of January was almost neutral at 0.65, indicating a slight premium for calls and indicated a moderate bullish to neutral bias.

Additionally, with the expected U.S. debt ceiling debate, the macro front could trigger wild price swings for BTC and overall markets.