Bitcoin, Ethereum CMBI indexes perform well, but small-cap assets take the cake

A monumental week is now finally over for Bitcoin, with the world’s largest digital asset completing its 3rd Bitcoin halving on 11 May. The crypto-asset registered a minor dip 2 days before the event but post-halving, the token underwent another surge to consolidate above the $9000 range.

At press time, Bitcoin had sustained a position above $9500, with the cryptocurrency seeming to look incredibly strong at this range over the past three days.

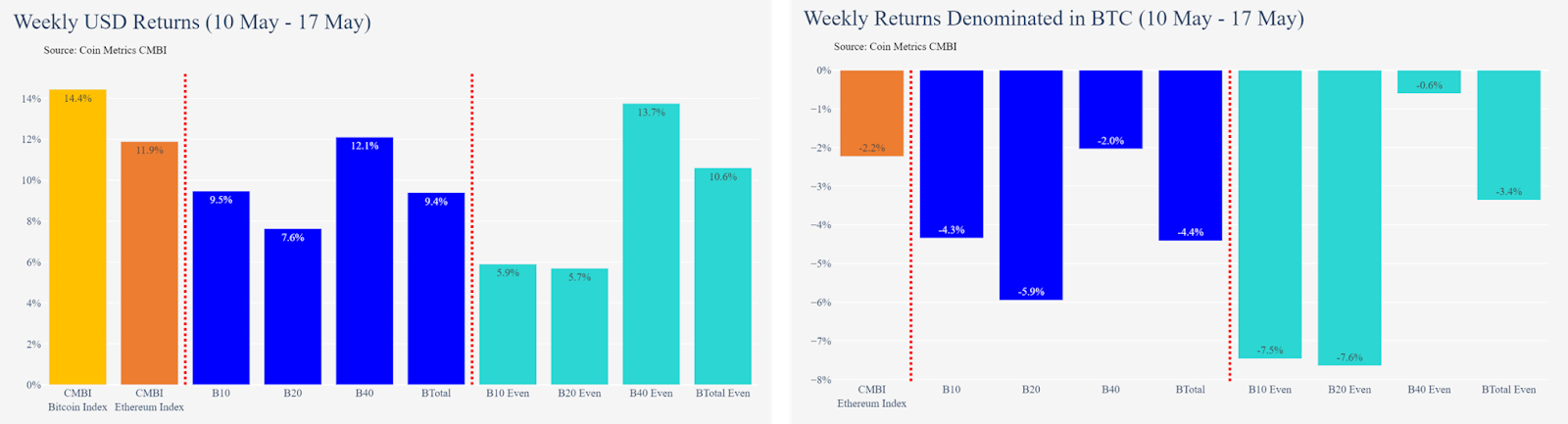

On evaluating the past week, Coinmetrics’ CMBI and Bletchley index found that the crypto-asset had managed to outperform Ethereum over the past week. The CMBI Bitcoin index registered strong returns of 14.4 percent on the charts, while Ethereum remained close behind at 11.9 percent.

However, in spite of the strong performances at both Ethereum’s and Bitcoin’s end, Bletchley’s weight index 40 for small-cap assets pointed to a tremendously lucrative week.

Source: Coinmetrics

With returns of over 12.1 percent, it was a stark difference from the lows of the previous week. The growth of small caps assets can also be verified by Weiss Crypto Ratings.

Source: Weiss Crypto Ratings

As observed in the charts, the collective small-caps assets ratings jumped from 1812, all the way up to 2168, at press time. Some of the major assets that led the small-cap performance over the week included the likes of STEEM, DigiByte, and OmiseGO.

Source: Weiss Crypto Ratings

On the other hand, the mid-cap assets found it difficult to find their rhythm back in the market after a collective dip on the 12th of May. The crypto-assets registered a rise following the drop, but it has not been as impressive as that of the small-cap assets.

Here, it is important to note that the situation may largely change over the course of the next week since, after the halving, the entire digital industry may be in for a correction phase.