Bitcoin crosses $37K: Do on-chain metrics support the move

- The NVT ratio exited bearish territory after a long time.

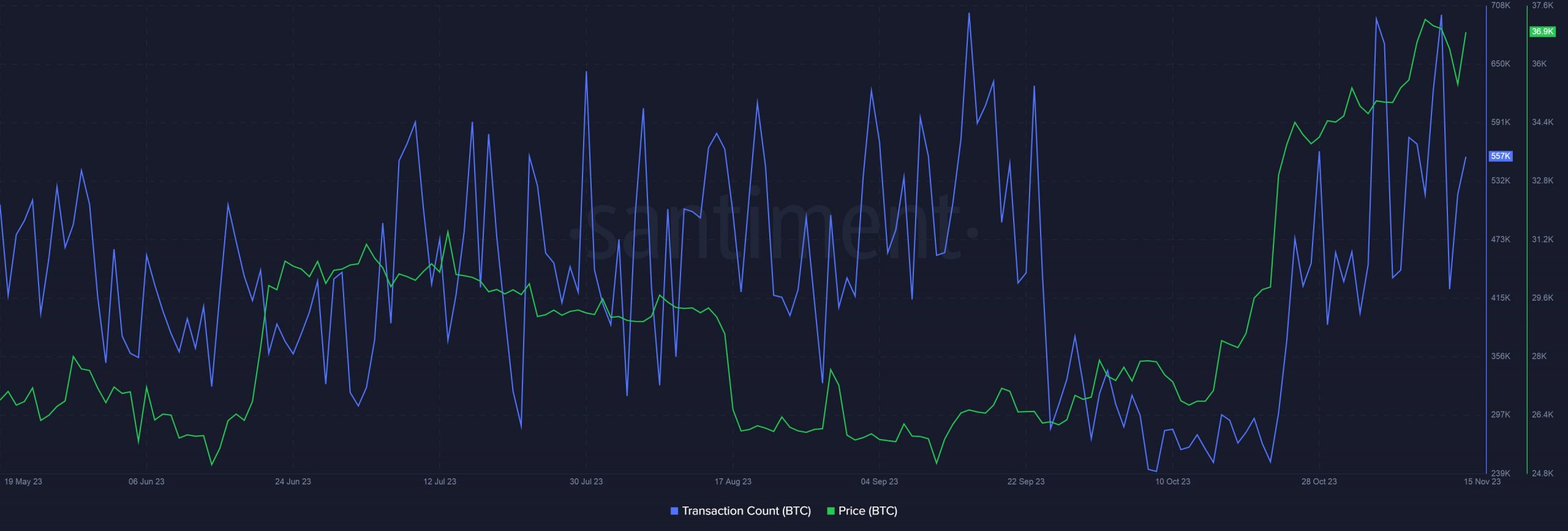

- The transaction count moved in tandem with the price rise.

The world’s largest digital asset Bitcoin [BTC] rose back above $37,000 in the last 24 hours, sustaining the interest of bullish market participants.

The rally has resulted in a 32% spike in Bitcoin’s market cap over the last month, AMBCrypto found out after examining CoinMarketCap’s data.

As Bitcoin gained momentum, one of its crucial growth potential metrics revealed a healthy picture.

Network activity matches market cap growth

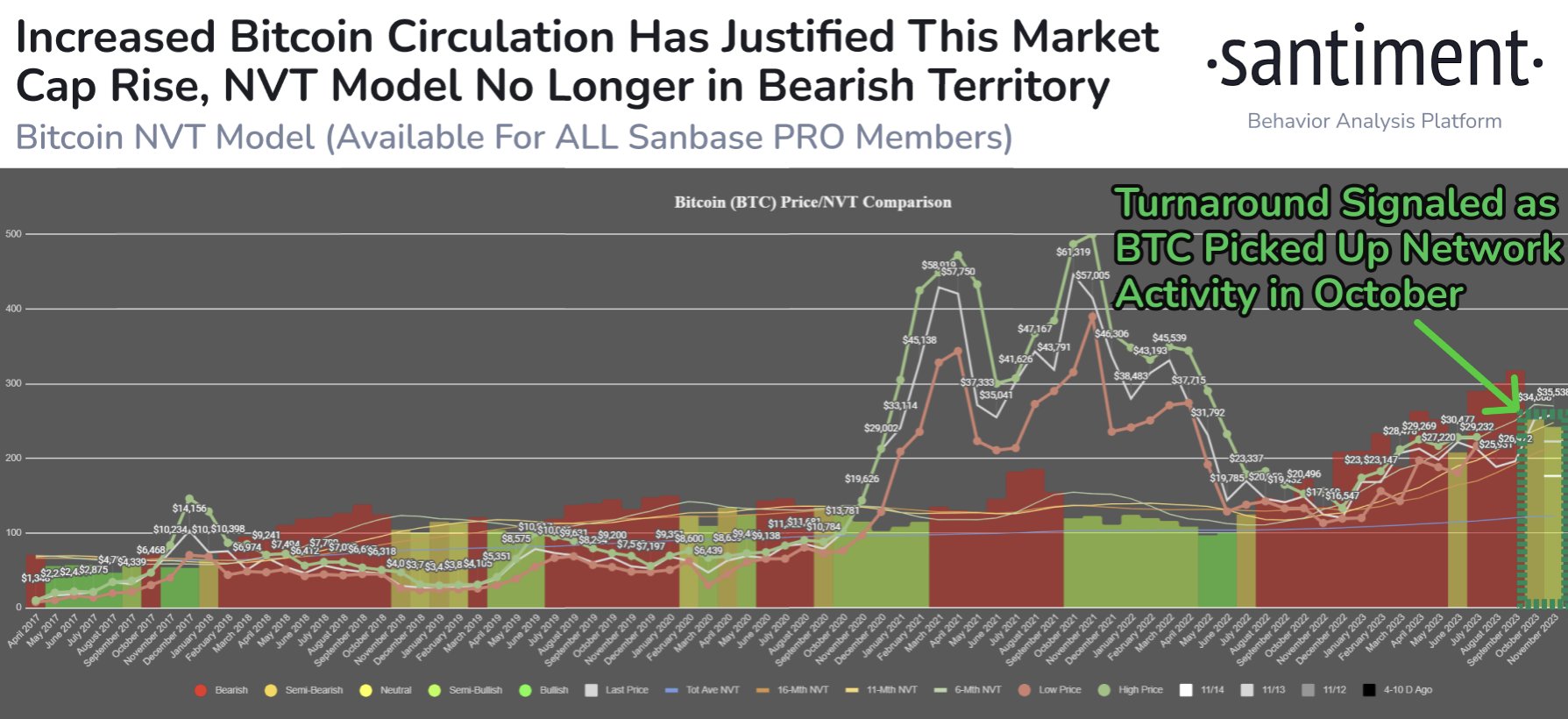

The asset’s Network Value-to-Transaction (NVT) ratio significantly improved over the last month, according to an X post by on-chain analytics firm Santiment. In fact, the ratio exited bearish territory after spending the majority of 2o23 in it.

The recovery was made possible due to a sharp uptick in network activity in October.

The NVT ratio determines if a crypto asset’s valuation is higher than the value being transmitted on the network. Think of it as an equivalent to the Price-to-Earnings ratio used commonly in the equity markets.

A higher value implies that the asset is overvalued compared to its on-chain transactions and vice versa.

The shift in Bitcoin’s NVT ratio reflected a sustained rise in Bitcoin’s network activity that matched its market cap growth. Indeed, the number of transactions on the proof-of-work (PoW) blockchain moved in tandem with the price rise, as per Santiment.

With emphasis on network fundamentals being higher than ever in Web3, the scenario boded well for Bitcoin’s long-term prospects.

Rally drives speculative interest

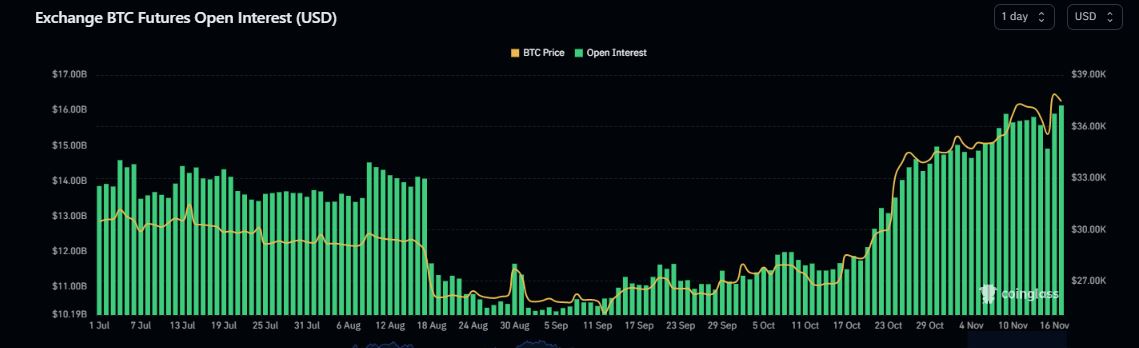

BTC’s ongoing rally continued to energize derivatives markets as well. The Open Interest (OI) in futures contracts went past $17 billion in the last 24 hours, the highest point since April, according to Coinglass.

The month-long uptrend has resulted in a 54% jump in the dollar value locked in active contracts.

Is your portfolio green? Check out the BTC Profit Calculator

Moreover, Bitcoin market participants continued to be greedy, as per Hyblock Capital. This meant that they were in the mood to buy more.

In the short term, such buying pressure could be a helpful catalyst for Bitcoin’s market value growth.