Bitcoin Cash faces a crisis disguised as its ‘halving’

UPDATE: Bitcoin Cash underwent its halving at block height 630,000, with the block reward having fallen to 6.25 BCH. Antpool, one of the industry’s foremost miners, was the one to have mined this block.

In approximately an hours’ time, Bitcoin Cash will undergo its 1st ever halving since splitting from Bitcoin’s chain back in 2018. The anticipation is high in the community as users knew this is the first event of the overall halving season. Bitcoin SV is undergoing its halving on 9th April, and Bitcoin would have its 3rd halving on the 14th of May.

However, bringing the attention back to Bitcoin Cash, the network currently has its plate-full and the imminent halving in the next few hours could only add up to its current list of burdens.

Bitcoin Cash Security: From Bad to Worse?

For starters, the number of question marks raised over its network security is off the charts at the moment.

As we all know, a halving event means the reduction of block subsidy or block rewards. According to BCH’s current valuation, miners are looking at estimated block rewards of approximately $1703 after the halving, whereas BTC miners would be receiving around $45,687 after halving if the prices remain around the same range.

However, at the moment, BTC miners are receiving $91,375 in block rewards per block, which technically means after 7 hours, a reward for mining on the Bitcoin Cash network will be roughly 1.87% of the reward for mining on the Bitcoin network.

It is a calculative guess that many miners would not be satisfied with such low subsidy and there is a possibility they would either undergo capitulation or they would be re-directing their hash power to Bitcoin.

Bringing us to the next dilemma: 51% attack

If Bitcoin Cash’s price was currently consolidating near its 2020 peak, a sense of security would have still prevailed as not all miners would have idealized shifting their hash power to BTC. However, an absence of pre-halving pump and current consolidation under $300, stacked all the odds against Bitcoin Cash.

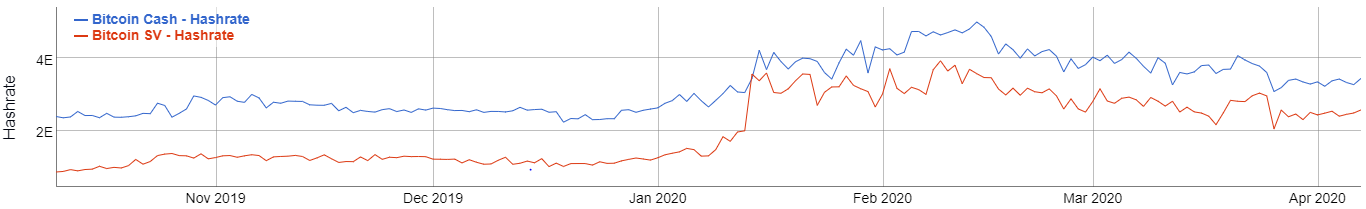

Source: bitinfochart

If fundamental metrics are observed, over the past 30 days, BCH’s hash rate is down by 30 percent from its 2020 peak at 3.44 EH/s and down by 55 percent from its all-time high. The network health is evidently at a weakened state, and a slash in block rewards could make matters even worse.

Hence, if the hash rate further declines after miners start cutting their computing power and transferring it to Bitcoin, the chances of a 51 percent attack on Bitcoin Cash’s network only rises and it opens up a possibility for the malicious entities to take advantage of BCH’s network.

With Bitcoin miners avoiding capitulation after the recent difficulty adjustment, its hash rate and other metrics such as MVRV ratio indicated a stable state, which will only attract BCH miners after the halving.

A possible storm is approaching Bitcoin Cash, and only time will tell how it is going to deal with the adversity.