Bitcoin: Asia saw more borrowing than lending in 2019 as compared to Europe

Bitcoin, the revolutionary cryptocurrency hovers at $9,300, awaiting a surge. As the wait extends, there are other factors at play that affect the price. Although BTC is said to be an uncorrelated asset, it isn’t fully disjoint. There are, however, economic factors that play a crucial role in shaping Bitcoin’s price. One obscure, yet mostly ignored factor is lending and borrowing, especially when it is coupled with the geographical conditions.

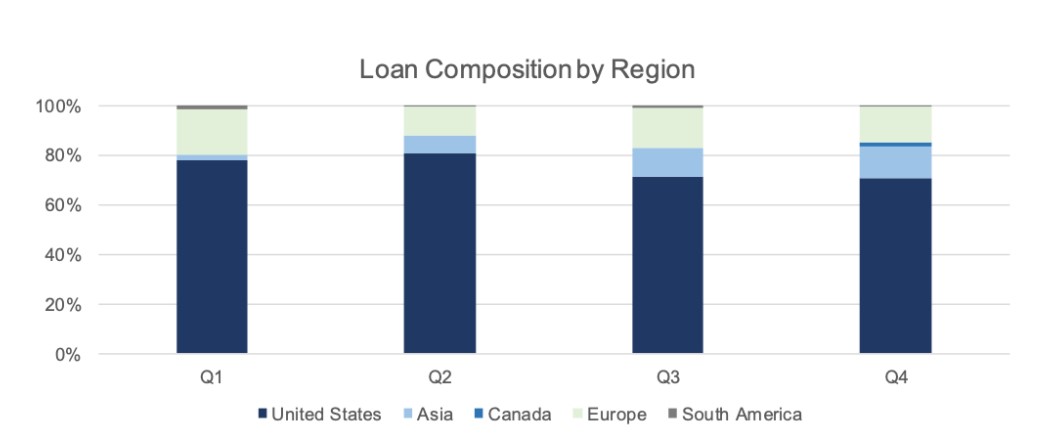

Genesis Capital, a crypto lending service provider’s recent report elaborated on how lending/borrowing is distributed and is also dependent on global socio-political factors. According to Q4 reports, most of the loan composition came from the U.S., which is one of the leading countries when it comes to regulation and providing clarity for emerging technology – cryptocurrencies. Europe and Asia were the next highest contributors after the U.S.

Source: Genesis Capital

Moreover, the report noted that there was a substantial increase in lending activity specifically in Asia and Europe. Moreover, Asia and Europe made up over 25% of their loan portfolio and has been growing consistently quarter over quarter.

In addition, the rising trade tensions between the U.S. and China have caused a major wave of effects seen in both markets. However, it is known that China restricts capital outflows from Yuan to other currencies, especially, the dollar. This restriction, according to Genesis capital, has caused a strong demand for cash in China. However, in the U.S. or Europe lending prevailed as compared to borrowing.

Genesis Capital stated:

“In Asia – specifically China, Hong Kong, Singapore and Japan – we’ve seen much more borrowing than lending. In China we’ve noticed miners looking to leverage their businesses and generate additional cash to either upgrade their facilities or use for working capital.”

Further, Asian countries such as Hong Kong and Singapore have been much more trading-centric. Many of the crypto-native trading firms and delta-neutral desks operate here and have been growing rapidly