Bitcoin as legal tender in Argentina: Wishful thinking or logical conclusion?

- Bitcoin surged to an ATH in the Argentinian market on the day Javier Milei was elected president.

- There existed a correlation between the growing preference for cryptos and soaring inflation.

The elevation of Argentina’s far-right politician Javier Milei as the country’s new president has generated significant interest in crypto circles.

In fact, the king of cryptos, Bitcoin [BTC], rose above $37,000 on the news and has held on to its gains until press time, according to CoinMarketCap.

A strong pitch for Bitcoin

The optimism stemmed from the president-elect’s strong support for Bitcoin in particular and cryptocurrencies in general. As the news of his election started to trickle in, a video started doing the rounds on social media highlighting his pro-Bitcoin stance.

In the clip, he can be seen making profoundly controversial remarks on Argentina’s Central Bank and existing financial system.

Second Bitcoin President.

Congratulations to @JMilei on his landslide victory in Argentina. pic.twitter.com/CNOqFbb5Q8

— Balaji (@balajis) November 20, 2023

Milei called the Central Bank a “scam” and a tool that the establishment uses to harass the public with inflationary tax. On the contrary, he projected Bitcoin as the way to return monetary power to the people.

Inflation becomes a sticking topic

The liberal ideas were rooted in Argentina’s worst inflation in three decades, which has triggered a cost-of-living crisis in the South American nation.

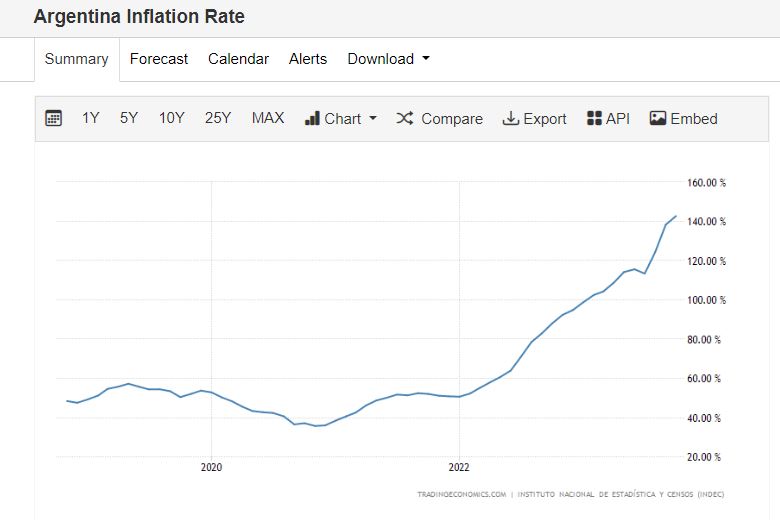

The inflation rate in Argentina increased to 142.70% in October 2023, the highest since the hyperinflationary phase of the early 90s. And the worst might still be ahead for Argentines, as Trading Economics forecasted an inflation rate of 170% by the end of the ongoing quarter.

The national currency Argentinian Peso (ARS) has been on a multi-year downtrend since the Covid-19 pandemic. Its value in relation to the U.S. Dollar (USD) plunged more than 50% in the past year; data analyzed by AMBCrypto showed.

With people struggling to make ends meet, the soaring inflation became a hot issue in the presidential election. Milei, known for his anarchical views, fought the election on an anti-Central Bank plank, vowing to disband the organization if voted to power.

Against this context, his election holds significant value for currencies which could potentially replace ARS as the legal tender in the country.

While the president-elect hasn’t signaled any intention of making BTC the legal tender as yet, his past endorsements have given hope to enthusiasts.

Milei also praised the scarcity-driven growth model of Bitcoin, in contrast to the money-printing model of Central Banks, which he claimed makes the currency lose value.

Bitcoin surged to an all-time high (ATH) in the Argentinian market on the day he became president. This suggested that the public at large agreed with the views of the populist leader.

The onset of cryptos in Argentina

It was important to understand the reason behind Argentines’ preference for cryptos. It’s common knowledge that when a native currency undergoes massive devaluation, people look to convert their savings to safe-haven assets like the U.S. Dollar (USD).

Conventional methods of exchange like commercial banks and online forex services could be time-consuming. What’s the next option – stablecoins, or maybe even Bitcoin?

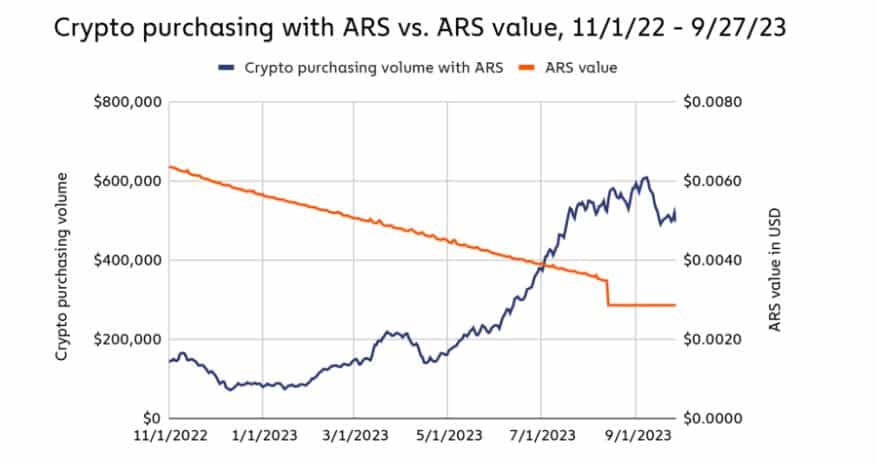

According to a recent report by Chainalysis, there existed a correlation between a growing preference for cryptos and soaring inflation. Indeed, the volume of digital assets purchased with Argentinian Peso increased as the currency fell in value.

Interestingly, the average Argentine was driving this change. As per the 2023 Global Crypto Adoption Index, Argentina was ranked 15th in the top 20 countries in grassroots adoption.

Experts diverge on possible outcomes

However, the question still remained — Will Bitcoin become the legal tender in the second-largest South American economy?

Rahul Maradiya, Co-Founder & Global CEO of AI-powered blockchain system CIFDAQ, said that the question was missing an entire point.

He said:

“What’s notable about Javier Milei’s ascension is the same thing that’s notable about Tom Emmer in the United States. There’s somebody in a position of authority in a country of consequence who is not only willing to have a conversation about crypto, but who actively sees its value proposition.”

Read Bitcoin’s [BTC] Price Prediction 2023-2024

On the other hand, prominent crypto journalist Colin Wu sounded a bit more pessimistic. In his blog post, he stated that Milei’s immediate focus would be on reforming the central banking and finance sectors.

He did not see Milei advocating for cryptos immediately after becoming president.