Binance delisting wave spurs double-digit declines: What now?

- Binance plans to delist six altcoins caused immediate double-digit drops in their value.

- Binance’s native cryptocurrency BNB rises by 0.835%, but the bearish sentiment lingers.

In a move reminiscent of its past actions, Binance, one of the world’s largest cryptocurrency exchanges, has announced the delisting of six altcoins.

Binance’s delisting plans

Starting 26th August 2024, at 03:00 UTC, Binance will delist all spot trading pairs associated with Ellipsis [EPX], PowerPool [CVP], ForTube [FOR], Reef [REEF], Loom Network [LOOM], and VGX Token [VGX].

This decision would affect pairs such as CVP/USDT, EPX/USDT, FOR/BTC, FOR/USDT, LOOM/BTC, LOOM/TRY, LOOM/USDT, REEF/TRY, REEF/USDT, and VGX/USDT.

Following the removal, all active trade orders involving these pairs will be automatically canceled by the exchange.

Needless to say, this announcement triggered sharp declines in the value of these altcoins, with each experiencing double-digit drops immediately following the news.

Remarking on the same, X (formerly Twitter) user under the name Brill said,

“REEF is going lol, never fall in love with your bag guys.”

This decision comes shortly after Binance revealed its plans to list Toncoin, signaling a strategic shift on the platform.

The announcement noted,

“At Binance, we periodically review each digital asset we list to ensure that it continues to meet a high level of standard and industry requirements. When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it.”

It further added,

“Our priority is to ensure the best services and protections for our users while continuing to adapt to evolving market dynamics.”

Factors considered while delisting tokens

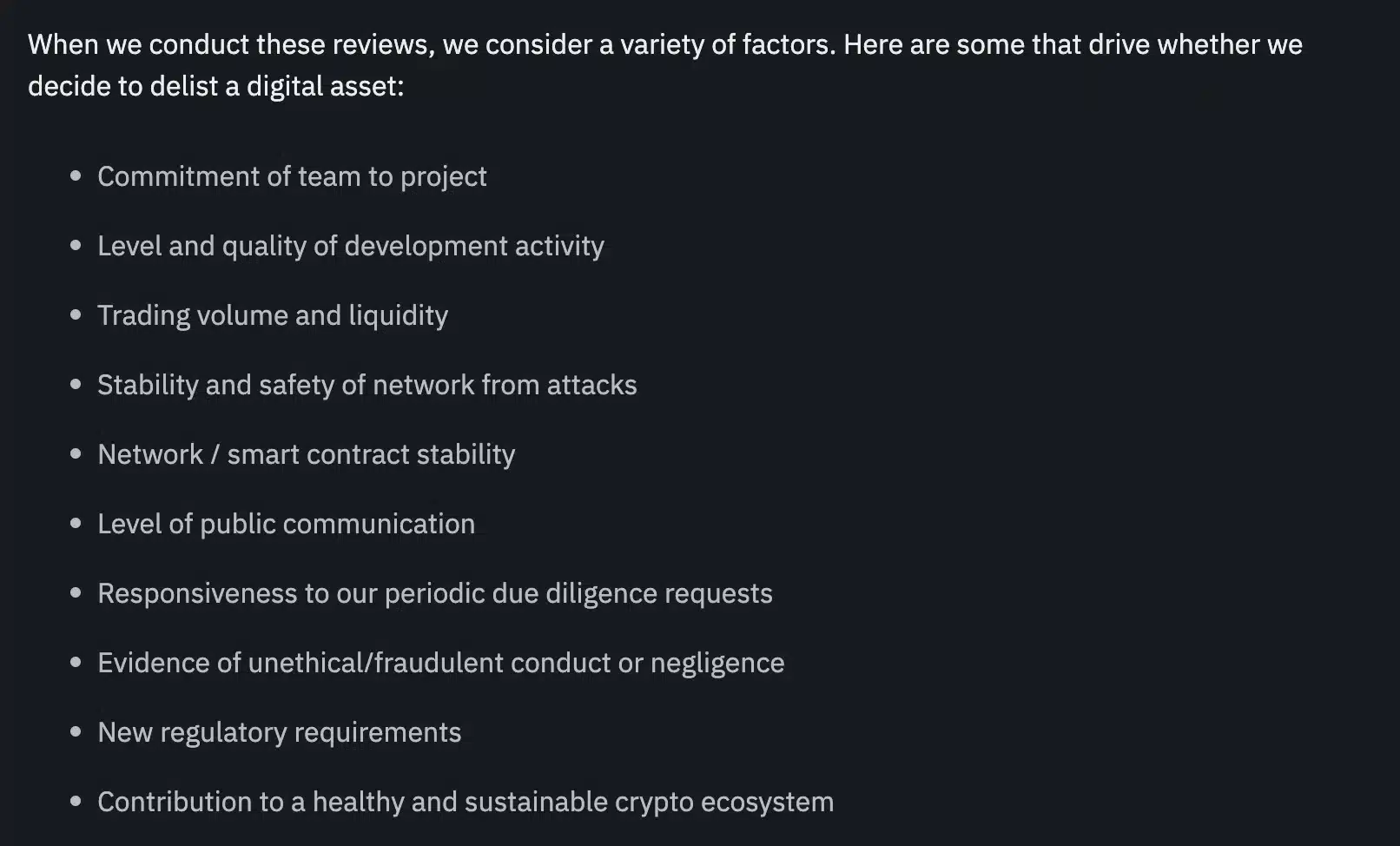

Binance considers several key factors when deciding whether to delist a digital asset, including the project’s team’s commitment, the level and quality of development activity, trading volume, liquidity, and the stability and safety of the network.

Additionally, the platform evaluates public communication, the project’s responsiveness to due diligence requests, and any signs of unethical conduct or negligence.

New regulatory requirements and the asset’s overall contribution to a healthy and sustainable crypto ecosystem also play a crucial role in the decision-making process.

BNB market trend

Meanwhile, Binance’s native cryptocurrency BNB has risen by 0.835%, trading at $520.37 and showing positive movement on the daily chart.

Despite this uptick, the RSI remains below the neutral level at 46, indicating that bearish sentiment persists even as the coin trends upward.