Avalanche ASC-20 transactions surge: How about AVAX?

- Transactions on the network increased because of a new token standard.

- AVAX’s volume fell while the TVL decreased slightly.

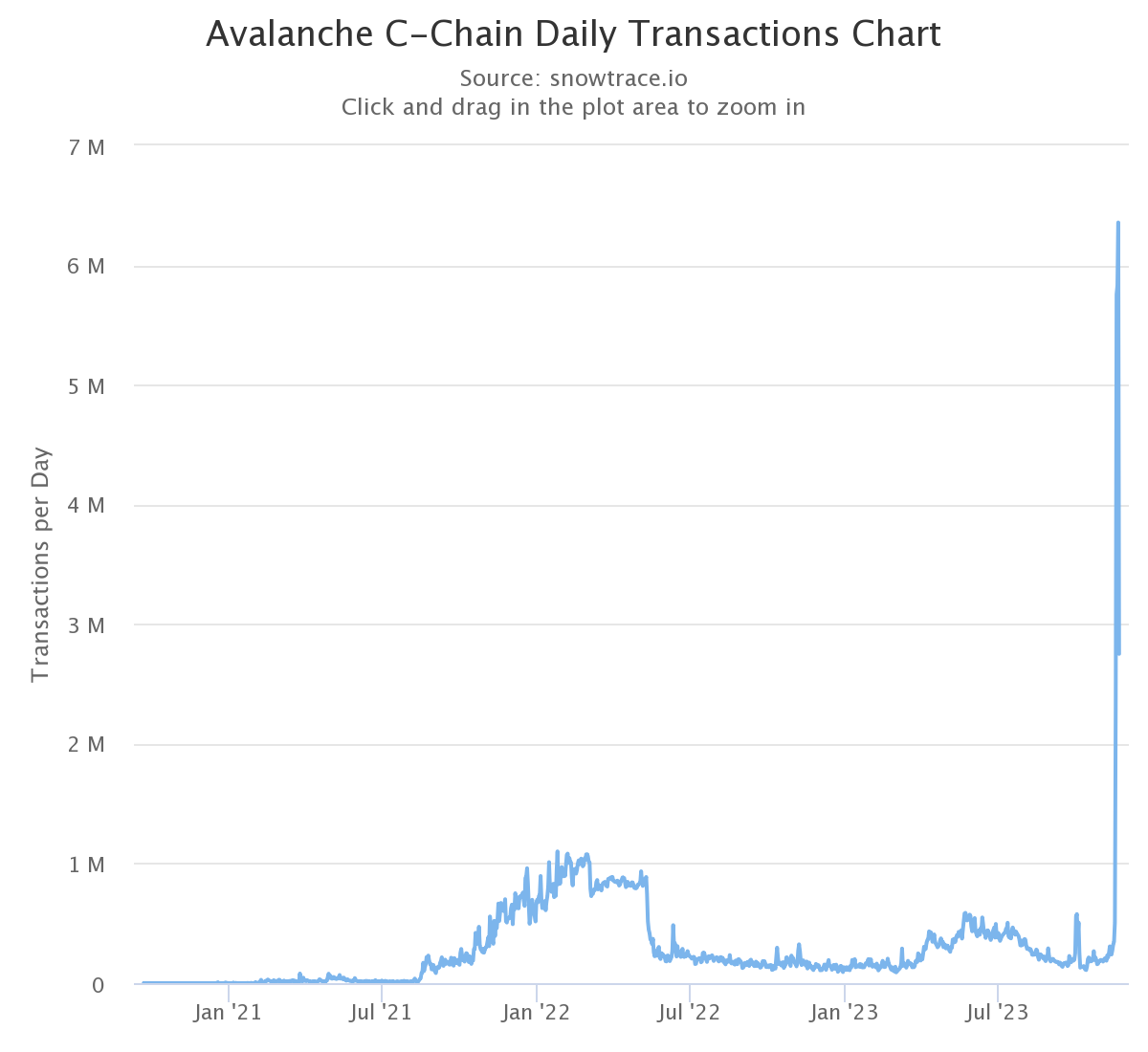

According to SnowTrace, Avalanche’s [AVAX] C-chain blockchain explorer, transactions on the network were as high as 6.35 million on 23rd November representing one of the highest-ever daily participation on the blockchain.

While many wondered what happened, AMBCrypto found out the reason. Details from our findings showed that the inscriptions on ASC-20 were responsible for the hike. ASC-20 tokens are similar to Bitcoin Ordinals BRC-20 and Dogecoin’s [DOGE] DRC-20.

AVAX is not caught in the middle

For context, inscriptions are pieces of metadata that can be added to the smallest unit of a cryptocurrency. So, rather than inscribing on sats, ASC-20 inscriptions are done on the Avalanche blockchain.

However, at press time, the number of transactions had fallen to 2.75 million. This indicates declining interest in trading the fungible assets built using AVAX.

For AVAX, its price has not been positively affected by the surge in transactions. At the time of writing, AVAX’s value was 20.67.

This value indicates an 11.38% plunge in the last seven days. Furthermore, AVAX’s volume, after its rise to 1.2 billion on 22nd November, has been declining.

As of this writing, the volume was down to 356.65 million. The declining volume alongside the falling price is a sign that the token’s direction was becoming weak.

For this reason, there could be a shift in the downward direction, and AVAX may soon reverse to the upside.

TVL moves sideways as others prepare

In terms of the Total Value Locked (TVL), data from DeFiLlama showed that the metric decreased slightly in the last 24 hours. At press time, Avalanche’s TVL was $638.93 million.

The TVL measures the U.S. dollar value of assets locked in a blockchain. It is also an important indicator of investor interest in a protocol. The higher the TVL, the more trustworthy a protocol is perceived to be.

On the other hand, a decrease in the TVL means that market players are refraining from interacting with a protocol. In Avalanche’s case, it seems participants are waiting for the right opportunity before committing liquidity to the protocol.

Additionally, ASC-20 is one of the numerous experiments that has come out of the Avalanche blockchain in recent times.

A few weeks ago, the Layer-1 (L1) project gained market attention. This was due to the introduction of Stars Arena, a Social Finance (SocialFi) platform.

Read Avalanche’s [AVAX] Price Prediction 2023-2024

However, exploits on the platform made sure that market players reduced activity on the network. Meanwhile, ASC-20 is not the only token standard following in Bitcoin and Dogecoin’s footsteps.

Around the same period, Fantom [FTM] also experienced an increase in transactions due to its own FRC-20. There are also speculations that Solana’s [SOL] SPL-20 is about to hit the market.