Assessing the state of Cosmos as its network activity dips

- Cosmos’ network activity has been on a decline in the last week.

- ATOM’s open interest has seen a drop during the same period.

Proof-of-Stake (PoS) sovereign blockchain Cosmos Hub [ATOM] has witnessed a decline in network activity since 18th November, data from Artemis showed.

AMBCrypto found that on 23rd November, the number of unique wallet addresses that completed at least one transaction on the chain was 17,000. This represented a 60% drop from the 43,000 daily active addresses recorded on 18th November.

Due to the low user activity on the network, the number of transactions completed daily on the network has seen a decline as well. As of 23rd November, Cosmos’ daily transaction count totaled 52,140, marking a 39% decline in on-chain transactions in the last week.

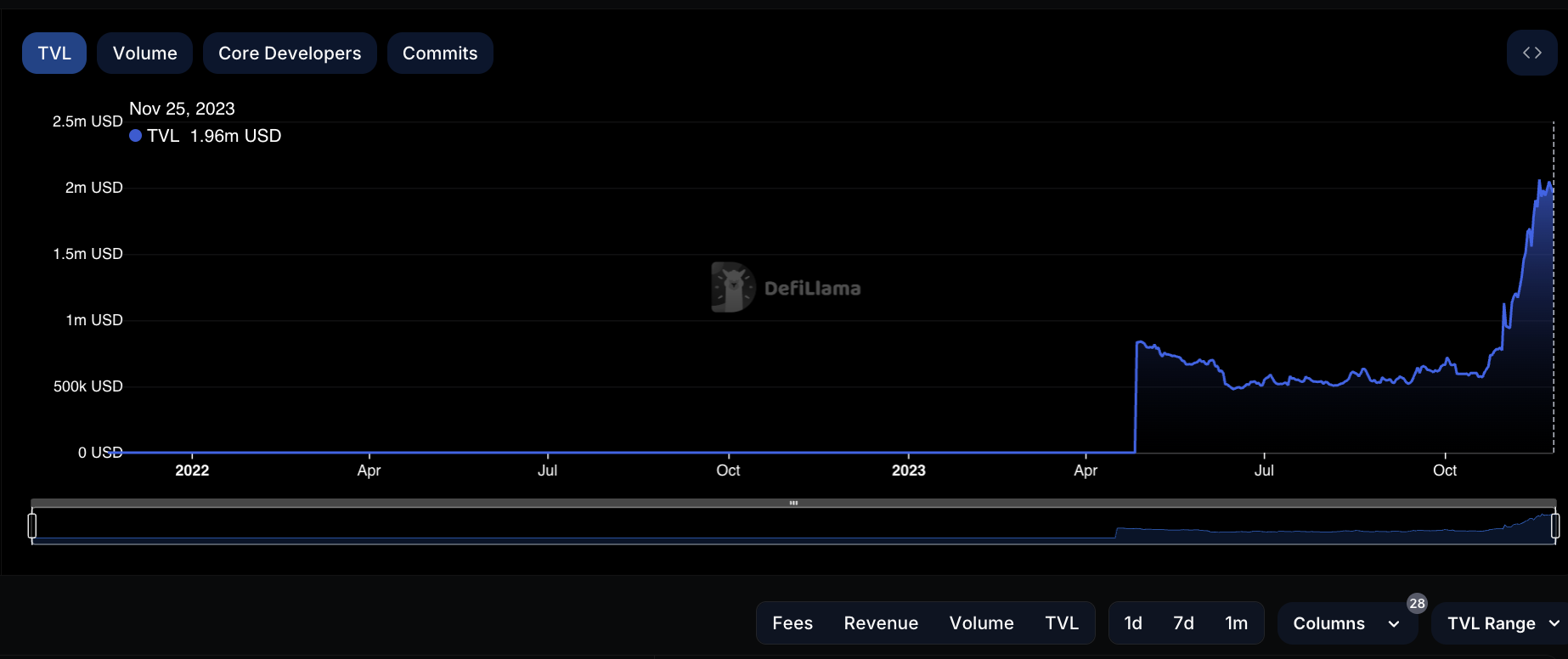

Despite the decreased demand for the chain, Cosmos’ decentralized finance (DeFi) ecosystem continues to see a sharp uptick in total value locked (TVL). At press time, the network’s TVL stood at $1.96 million, rising by 73% since the beginning of November.

At this value, Cosmos’ TVL currently stands at an all-time high.

State of ATOM

In ATOM’s futures market, its open interest embarked on a decline on 19th November, and remained in a downtrend at press time. At $106.31 million as of this writing, ATOM’s open interest has fallen by 10% in the last seven days.

When an asset’s open interest declines in this manner, it means that traders are closing their positions, as they become increasingly less confident about the asset’s future direction.

ATOM’s open interest decline coincides with the price consolidation experienced in the last week. Interestingly, during that period, market participants have opened more long positions than short.

However, with prices stuck in a narrow range, long traders have been forced to liquidate their positions.

When an asset’s long liquidations exceed short liquidations, it can be interpreted as a sign of strong selling pressure and a potential reversal in the market trend.

How much are 1,10,100 ATOMs worth today?

This is because more traders are being forced to sell their long positions, indicating a loss of confidence in the asset’s ability to continue rising.

In the token’s spot market, accumulation persists amongst daily traders. ATOM’s key momentum indicators observed on a 24-hour chart showed that the market continued to favor accumulation, despite sideways price movements.