Are Solana whales taking a step back?

- Solana whales unstaked a large amount of SOL.

- Panic around potential dump grew, as the price fell. However, sentiment around SOL remained positive.

On 12th November, Whale Alert flagged two big Solana [SOL] transactions, each over $30 million. The first one sent 325,222 SOL, worth more than $18.6 million, to the Binance exchange.

It appeared that the interest in SOL was slowly starting to die down.

Whales make a sudden move

According to lookonchain’s data, a big Solana holder withdrew 505,034 SOL, sending most to Binance and Kraken.

A whale unstaked 505,034 $SOL ($31.7M) today and transferred 505K $SOL ($31.7M) out, most of which was deposited to #Binance and #Kraken.

The whale still has 2.9M $SOL($184M) staked.https://t.co/pe5QVhXcYl pic.twitter.com/9jeCk6hGdd

— Lookonchain (@lookonchain) November 16, 2023

Another whale unstaked 2.16 million SOL, moving 1.3 million SOL worth $77 million out. Of this, 312,868 SOL landed in Binance and Kraken.

Another whale"H4yiPh" unstaked 2.16M $SOL($128M) yesterday and transferred 1.3M $SOL($77M) out.

Of which 312,868 $SOL($18.56M) was deposited to #Binance and #Kraken.

The whale still holds 863K $SOL($51.5M) in wallet and 9.86M $SOL($584M) in staking.https://t.co/gKB6CQ2iyF pic.twitter.com/5Emsn83hhC

— Lookonchain (@lookonchain) November 17, 2023

Price takes a hit

Large withdrawals by whales may create selling pressure on SOL, potentially causing a drop in its price. The movement of significant amounts to exchanges could signal intentions to sell, impacting market sentiment and leading to increased volatility in SOL’s value.

Additionally, if more large holders follow suit, it might contribute to a broader market correction.

The reception around these movements has largely been negative, with many market participants anticipating a dump. The price of SOL fell by 12.66% in the last 24 hours. However, the decline in price wasn’t enough to establish a bearish trend.

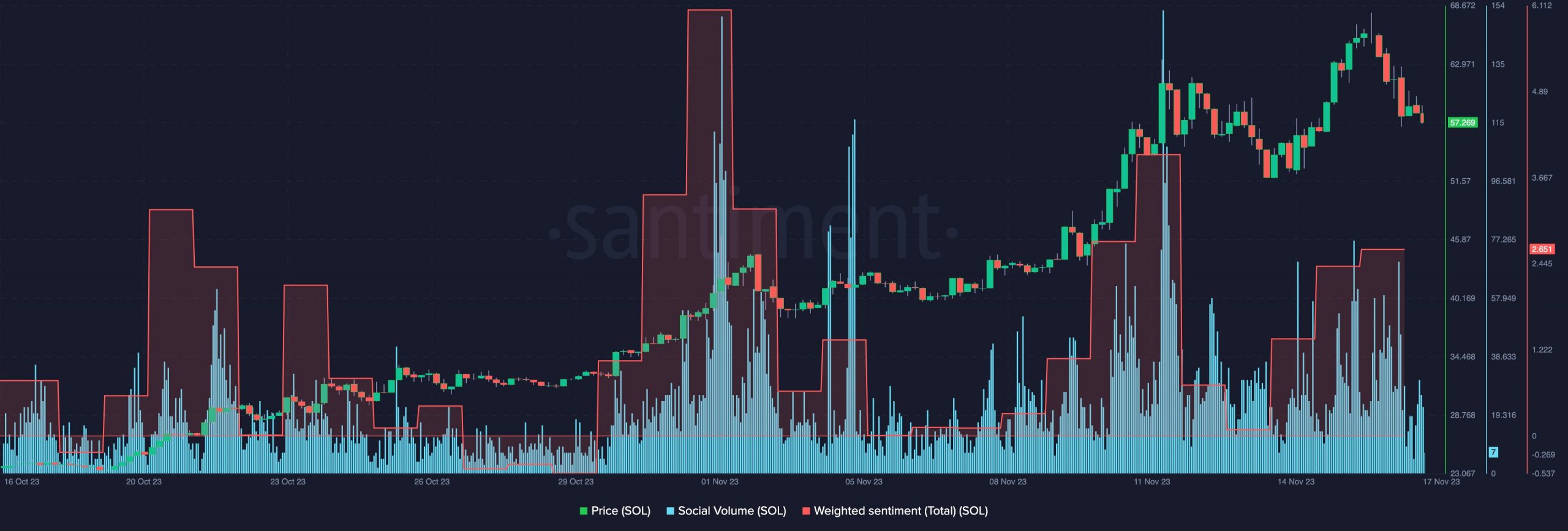

On the social front, the social volume around Solana spiked. This showed that people were talking a lot about Solana on social media networks.

The weighted sentiment around Solana also remained high, implying that despite the correction, the overall outlook of people on social media towards Solana remained positive.

The positive social media sentiment could help SOL retain its current levels in the future. Another major factor that could play a role in SOL maintaining its momentum, would be the state of its protocol.

After looking at token terminal’s data, it was seen that the Solana protocol was doing well.

Is your portfolio green? Check out the SOL Profit Calculator

The number of active users on the network has grown by 161% in the last month. Moreover, the revenue generated by Solana has also increased.

The performance of Solana’s network could aid Solana’s price going forward.