Ethereum: All the reasons why ETH whales stopped buying!

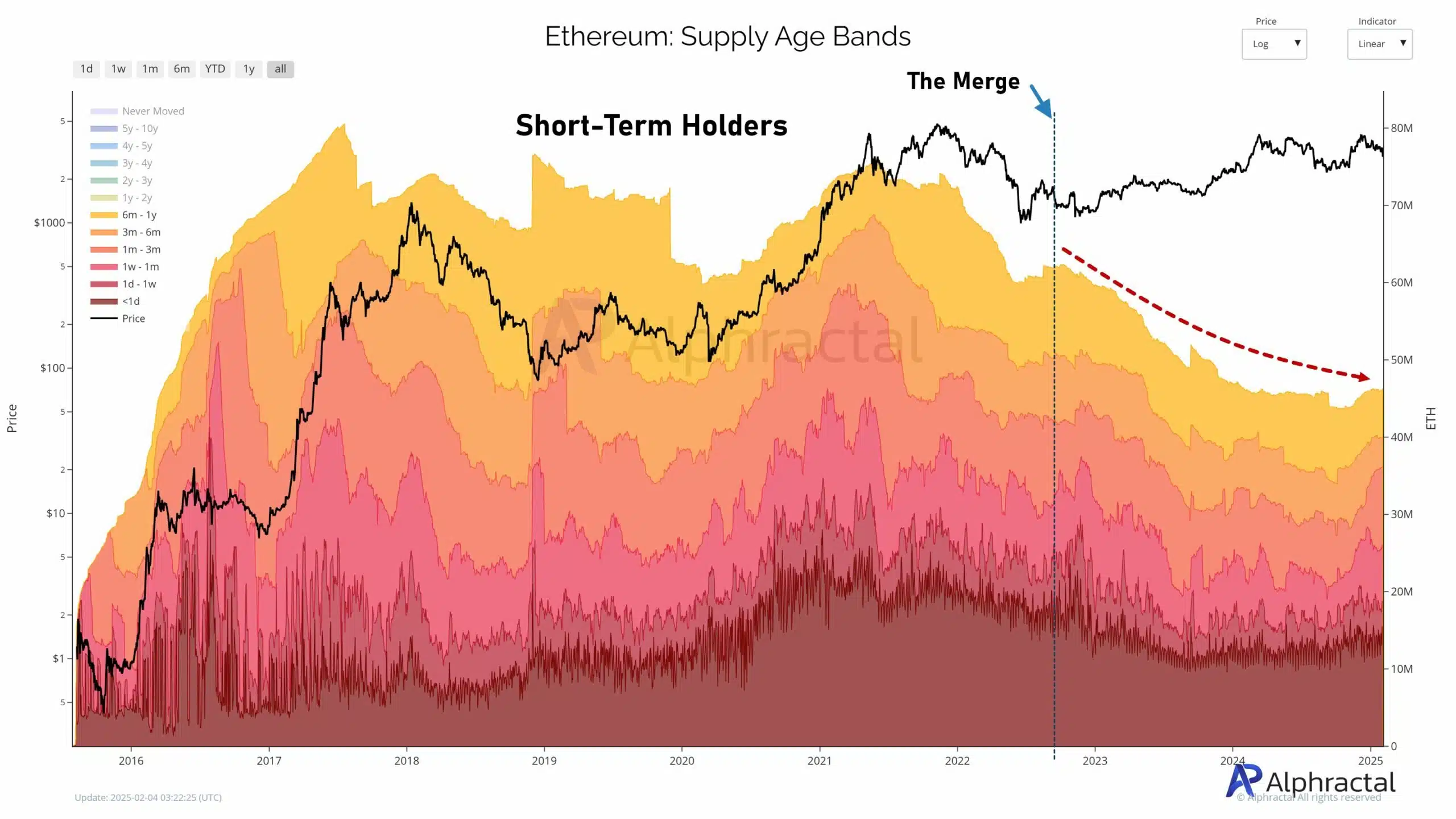

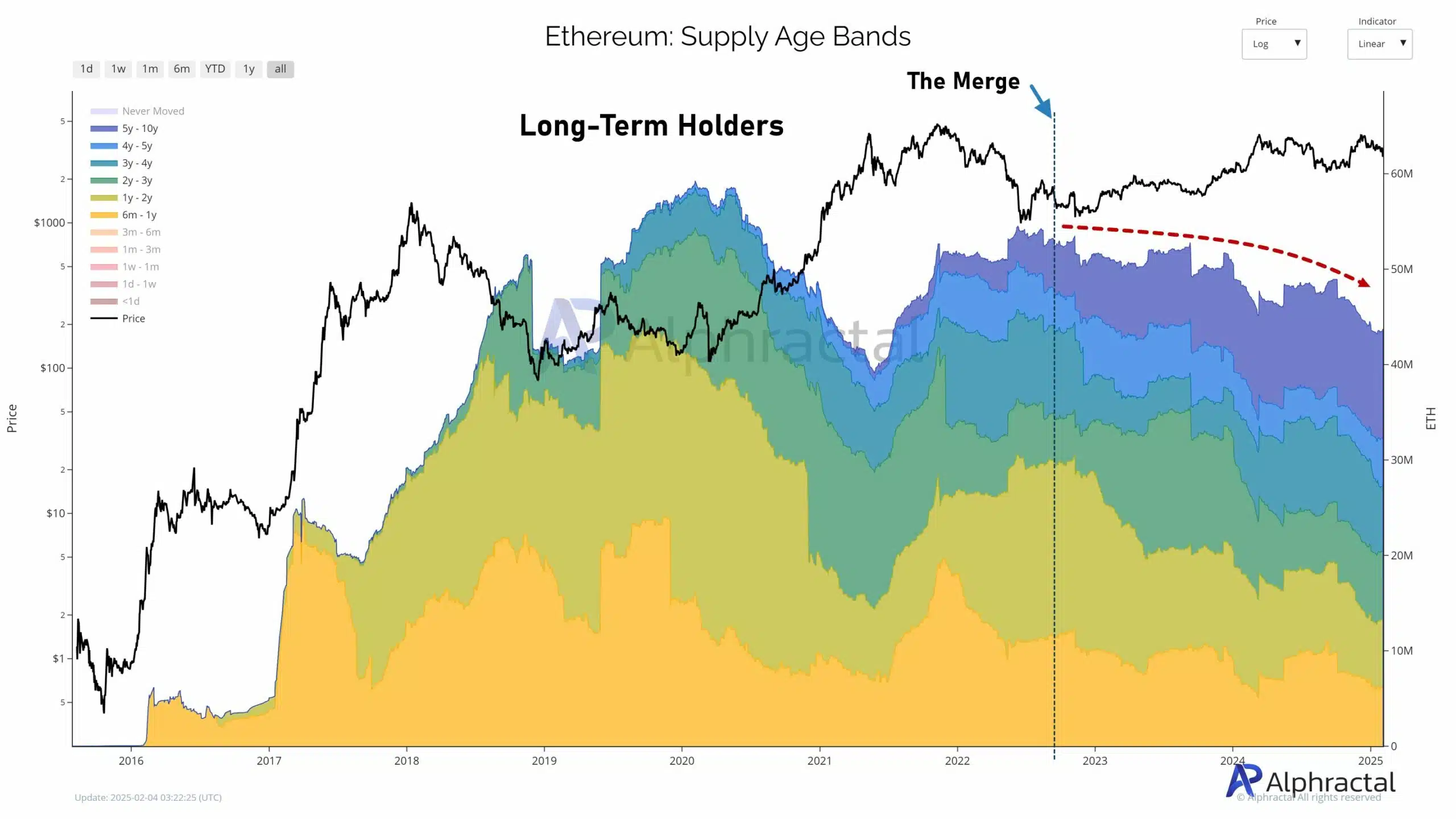

- Post-Merge, both long-term and short-term holders are reducing Ethereum accumulation.

- Whales holding large ETH balances show stagnation, signaling cautious sentiment.

Ethereum’s [ETH] much-anticipated transition from PoW to PoS in a move dubbed as “The Merge” in September 2022 was hailed as a groundbreaking shift for the blockchain industry.

Fast forward nearly two years, and the optimism surrounding the upgrade has begun to fade.

Both long-term and short-term Ethereum holders have sharply reduced their accumulation, raising questions about the long-term impact of the PoS transition.

This shift in sentiment is further evident in Ethereum’s recent performance, with ETH plummeting 27% during the latest market sell-off.

As the landscape for digital assets grows more uncertain, the question remains: Has Ethereum’s post-Merge path set it up for sustained growth, or is it struggling to regain its footing amidst tightening market conditions?

The Merge: Game-changer or setback?

Ethereum’s switch from PoW to PoS in September 2022 aimed to improve energy efficiency, security, and scalability. Unlike PoW, where miners use computational power to validate transactions, PoS relies on validators who stake ETH to secure the network.

This drastically reduces energy consumption – by over 99% – and lowers entry barriers for network participation.

However, this transition marginalized miners, and according to Joao Wedson, drastically reduced ETH accumulation by both long-term holders (LTHs) and short-term holders (STHs).

With large entities, former miners, and major funds also avoiding ETH purchases, concerns about Ethereum’s post-Merge market resilience continue to mount.

Ethereum: Declining accumulation and stagnation among whales

Ethereum’s supply dynamics have changed notably since the Merge, with LTHs and STHs significantly reducing their accumulation.

The data reveals that LTHs, who once held ETH for extended periods, have sharply cut back on buying. STHs have also shown a noticeable decline in their holdings.

This trend indicates a shift in investor behavior, possibly due to market uncertainty, diminished staking rewards under PoS, or broader bearish sentiment.

Additionally, the Ethereum Supply by Address Size chart highlights stagnation among large holders, particularly whales holding over 100,000 ETH, who have shown little movement since the Merge.

This suggests a cautious, wait-and-see approach, indicating a lack of confidence in the market’s immediate future and a potentially lower liquidity environment.

The ripple effects

Ethereum’s PoS transition pushed miners out, reducing their regular liquidations and easing selling pressure.

However, this shift has impacted exchange inflows, with fewer contributions from miners and declining activity from LTHs and STHs.

This could create a supply bottleneck and tighten liquidity. On the demand side, Ethereum’s ecosystem struggles to compensate for reduced accumulation.

Metrics like gas fees, DApp usage, and DeFi volume show limited growth, reflecting muted network activity.

Combined with bearish sentiment from on-chain and social data, questions about Ethereum’s ability to sustain price momentum remain unresolved.

Is your portfolio green? Check the Ethereum Profit Calculator