After Bitcoin Futures, BTC Options suggest return of retail investors

Bitcoin’s derivatives market is currently enjoying a very fruitful period.

After Bitcoin’s price breached the $7000-mark on 6 April, the impact of the movement directly flooded into the Futures and Options market.

In fact, previously it has been reported that the Open Interest for BTC Futures on the institutional platform CME had risen over 48 hours, suggesting the possible return of investors back into the market.

Now, according to Skew analysis, it would seem that retail investors are making a dash back into BTC Options Contracts as well.

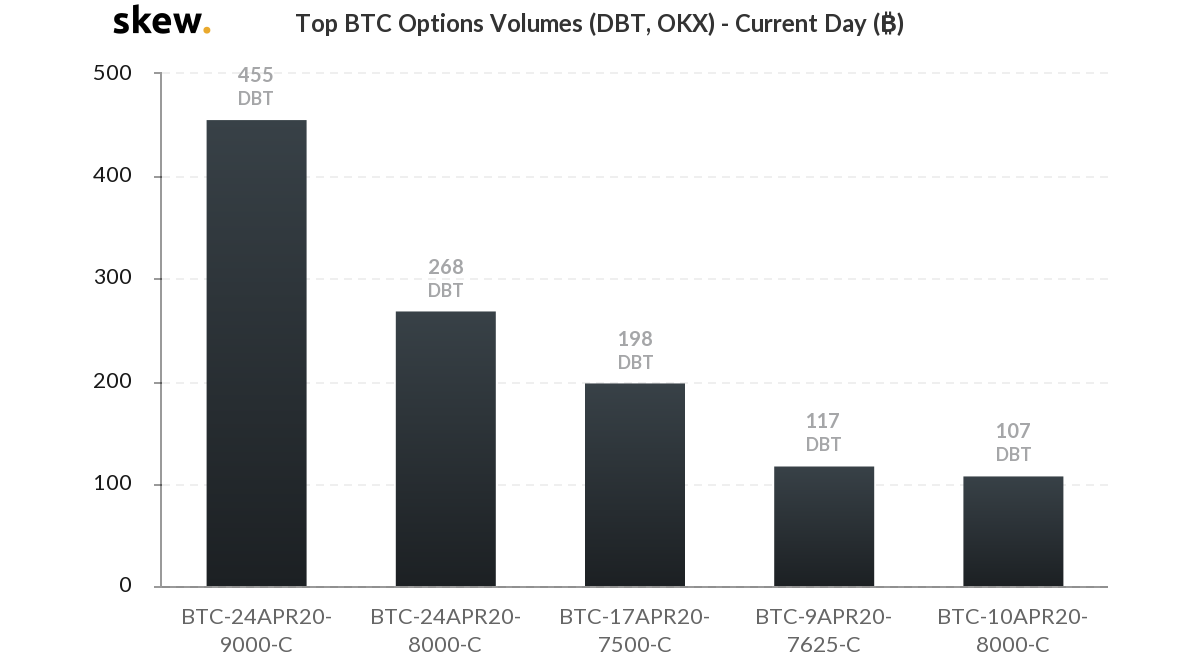

Source: Skew

According to the attached chart, 723 BTC Options contracts were traded in call-buys over the past 24-hours, with 455 contracts expecting the price to eclipse the $9000 mark by 24 April. 268 BTC Options would be put in place for Bitcoin to cross $8000 by the 24th. A total of 107 BTC contracts were also hopeful of the world’s largest cryptocurrency crossing the $8000-mark by the 9th of April.

In cohesion with the above data, an increase in Open Interest can also be observed across various retail exchanges in the market.

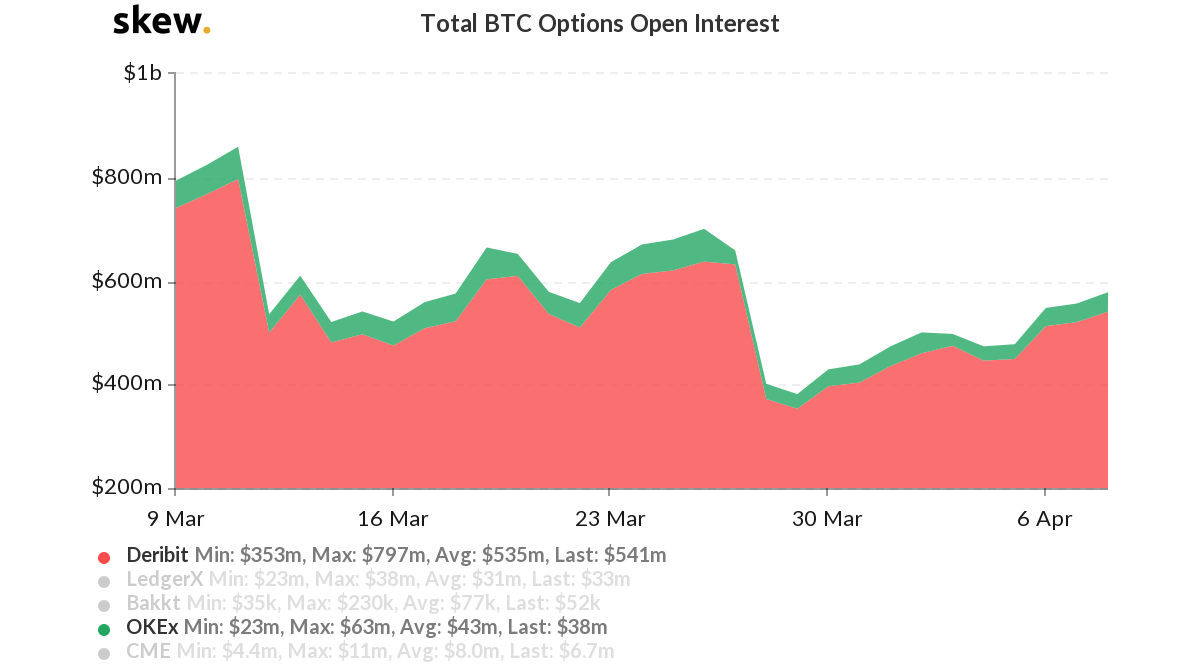

Source: Skew

BTC Options’ Open Interest on Deribit improved from under $350 million on 29 March to $541 million on 8 April. This is a steady rise when compared to the OI over the past month, with OKEx maintaining a similar spike in interest as well after its OI rose from $23M to $38M.

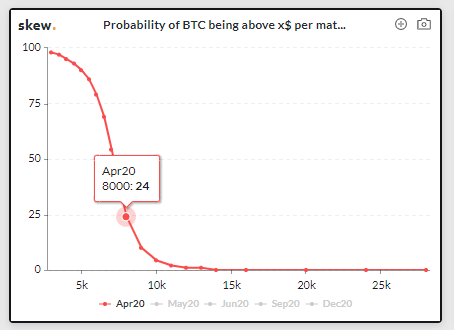

Source: Skew

Bitcoin’s probability index also presented positive signs as the index suggested a possibility of 24 percent against Bitcoin crossing $8000 by the end of the month. In fact, there was also a 10 percent probability against Bitcoin overtaking the $9000-mark.

However, the trading volume on the respective platforms pictured a rather discouraging sight as it lacked the same level of activity. However, it should be noted that this could also mean that investors are slowly starting to move in after breaking away from the backwardation phase, a phase that was sustained for the majority of the month of March.

With Bitcoin’s price consolidating higher on the charts again, it is possible that traders would move on from their predictions of an expected drop below spot prices.