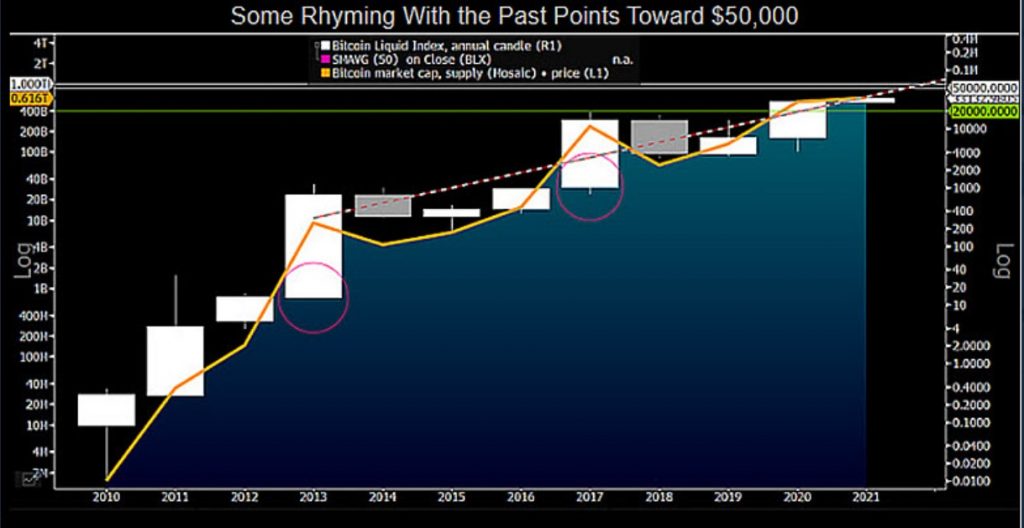

After $40K, this strategist is sure Bitcoin’s $50K milestone is within reach

Senior commodity strategist for Bloomberg Intelligence, Mike McGlone stated today that Bitcoin’s price has the potential to reach $50,000 and that prospects of the digital asset to revisit old highs around $20,000, were diminishing for Bitcoin. The analyst took to Twitter on 7 January and also said that Bitcoin may be a better asset to invest in rather than gold, as of this month.

Image Source: Twitter

According to the financial expert’s analysis in October 2020, Bitcoin could continue appreciating in price and eventually reach the $100,000 milestone by 2025. McGlone based this macro outlook on the asset’s growing popularity, which was also seeing increasing adoption, however at a slower pace, at the time.

Moreover, on-chain market intelligence firm Glassnode recently suggested that Bitcoin could rally to much bigger figures. The firm correlated current market conditions to the crypto’s earlier price surge in 2017 when Bitcoin increased tenfold.

Contrastingly, financial strategist and founder of Rosenberg Research and Associates Inc, David Rosenberg considers Bitcoin to be in a market bubble at present. The former Merrill Lynch chief economist intends to avoid investing in the crypto, at least for the next twelve months, and instead aimed to invest in the areas that “are not bubbly and that have a lot of catch-up potential.”

Further, where others see Bitcoin as a hedge against inflation, gold advocate and longtime Bitcoin critic Peter Schiff remains unconvinced about the popular crypto. He often refers to the digital asset as a bubble and believes that in the event of inflation, that is when “institutions finally start to worry,” they would rather invest in gold instead of Bitcoin.

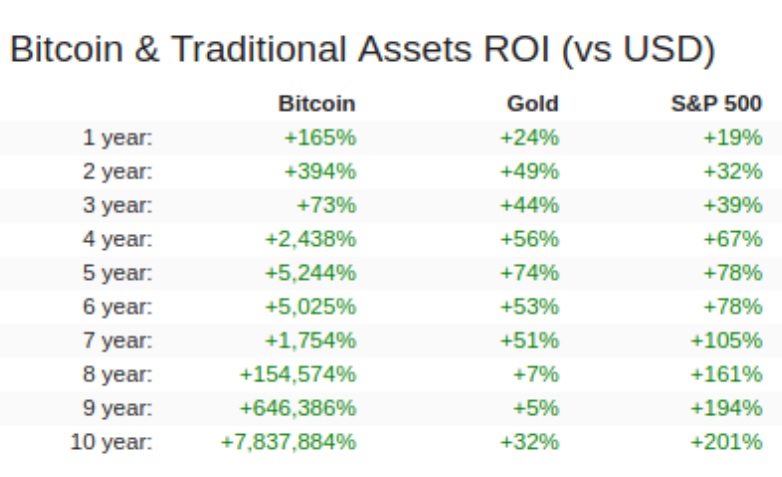

Messari co-founder Dan McArdle found that Bitcoin outperformed everything over the last ten years. The digital asset noted 7,837,884% gain in the last decade, while gold returned a 32% profit seen in the image below:

Image Source: Twitter

At press time, Bitcoin price is trading at $38,475.46 shortly after the asset breached another ATH at $40,000.