A look into Ripple’s ODL platforms: XRP/PHP index notes another ATH

The cryptocurrency market started to collapse on 8 March with Bitcoin [BTC] breaching support at $8k. Similarly, the price of the third-largest crypto asset, XRP also fell by 17.75% and fell as low as $0.20037, a value it hasn’t seen since 10 January. At press time, the market was trying to recover and the value of XRP was at $0.20900.

Source: XRP/USD on Trading View

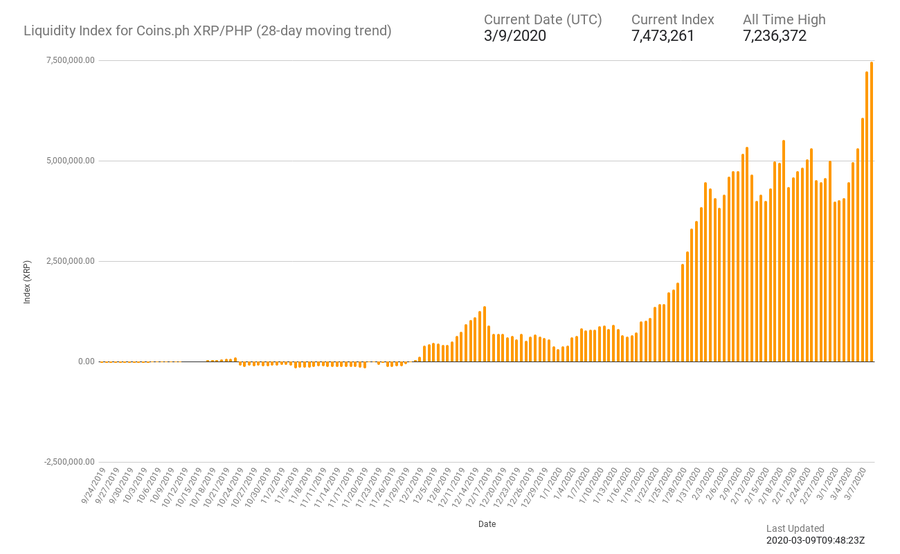

Even though the spot market price was cracking under pressure, Ripple’s on-demand liquidity platforms were noting increased liquidity. According to liquidity indicator on Twitter, Liquidity Index Bot highlighted that the XRP/PHP Index was reporting strong growth over the past week, and marked a new high on 9 March.

According to its latest data, the day’s progress was at 42%, where the liquidity has already peaked at 7.47 million, higher than its previous peak at 7.23 million.

Source: Liquidity Index Bot

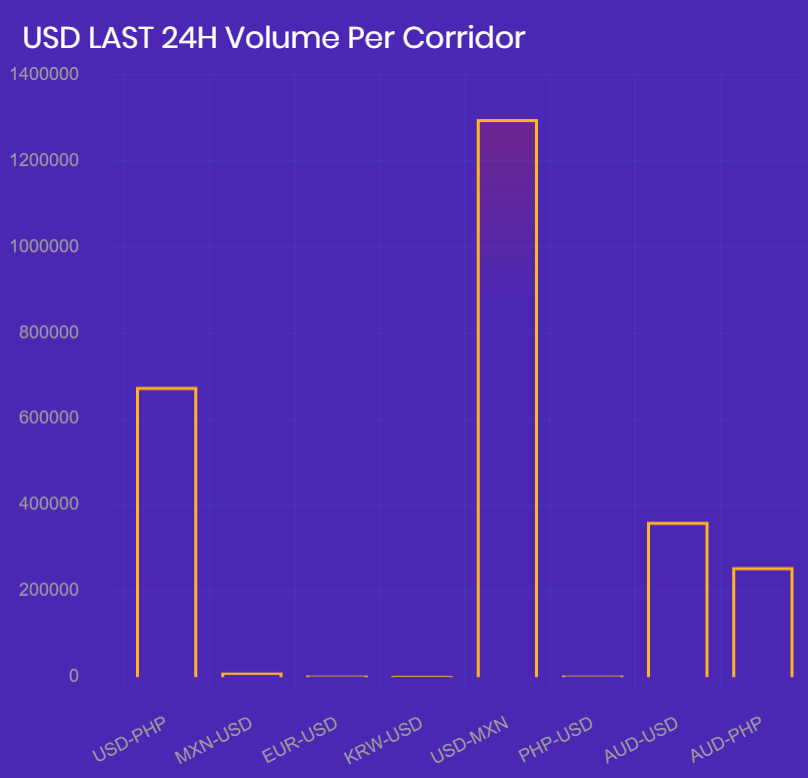

The remittance to the Philippines has been on the rise, as the USD-PHP and AUD-PHP corridors report and increased volume. According to Utility Scan, the 24-hour volume on the aforementioned corridors was $674,826 and $255,149. Whereas, the most popular corridor remained USD-MXN with a volume of $1.29 million.

Source: Utility Scan

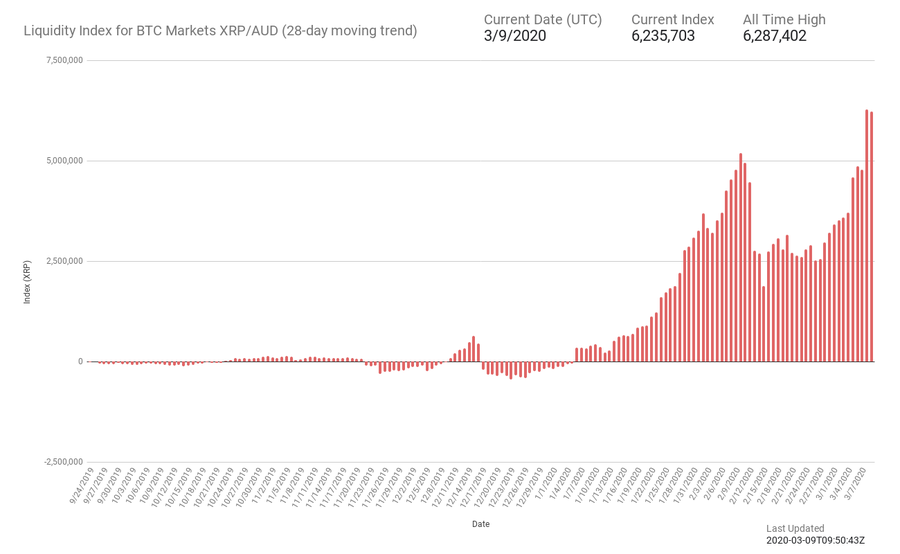

Other XRP indices were also noting increased liquidity at press time. XRP/AUD was reporting liquidity of 6.23 million, which was close to its all-time high at 6.28 million.

Source: Liquidity Index Bot

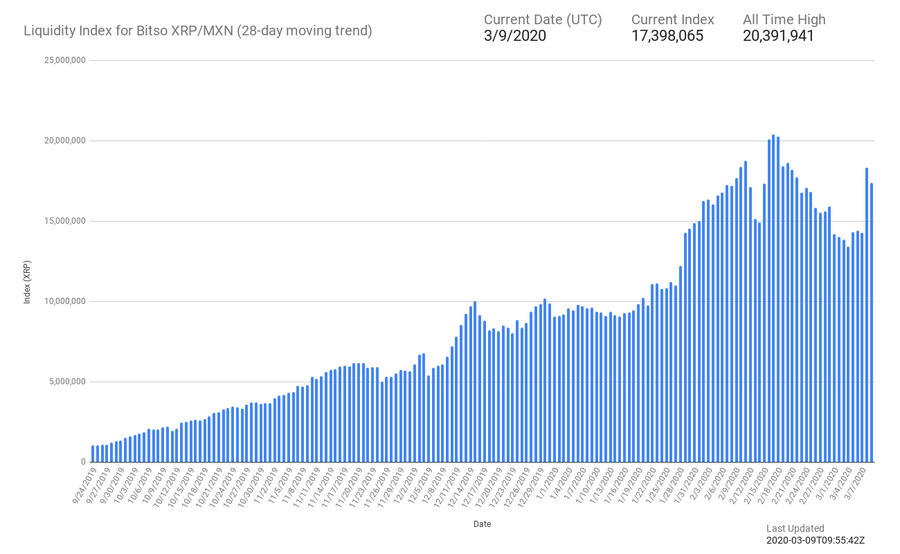

Whereas, the top-performing index XRP/MXN has been showing reduced liquidity on its platform. The index had marked its all-time high on 18 February with liquidity at 20.39 million. On 9 March, its liquidity had reached 17.40 million.

Source: Liquidity Index Bot

However, the overall volume has seen an upward movement with the introduction of new corridors. The total volume noted on the on-demand liquidity platform since 27 October 2019 was around $483.97 million. The platform’s daily volume stood at $16.79 million, according to Utility Scan.

Source: Coinstats