Bitcoin exchange activity spikes: Are sell-offs around the corner?

- Elevated BTC exchange inflows hint at selling pressure and market volatility risks.

- Mixed signals from Coinbase Premium and funding rates point to bearish sentiment.

Bitcoin [BTC] has recently shown mixed market movements, prompting analysts to closely track on-chain data for insights into its short-term outlook.

On-chain metrics reveal a shift in exchange activity, with Tether [USDT] experiencing significant outflows while Bitcoin inflows remain elevated.

This imbalance in market dynamics could signal increased selling pressure, potentially leading to further price corrections in the near term.

Bitcoin exchange: Liquidity shift point to short-term downside risk

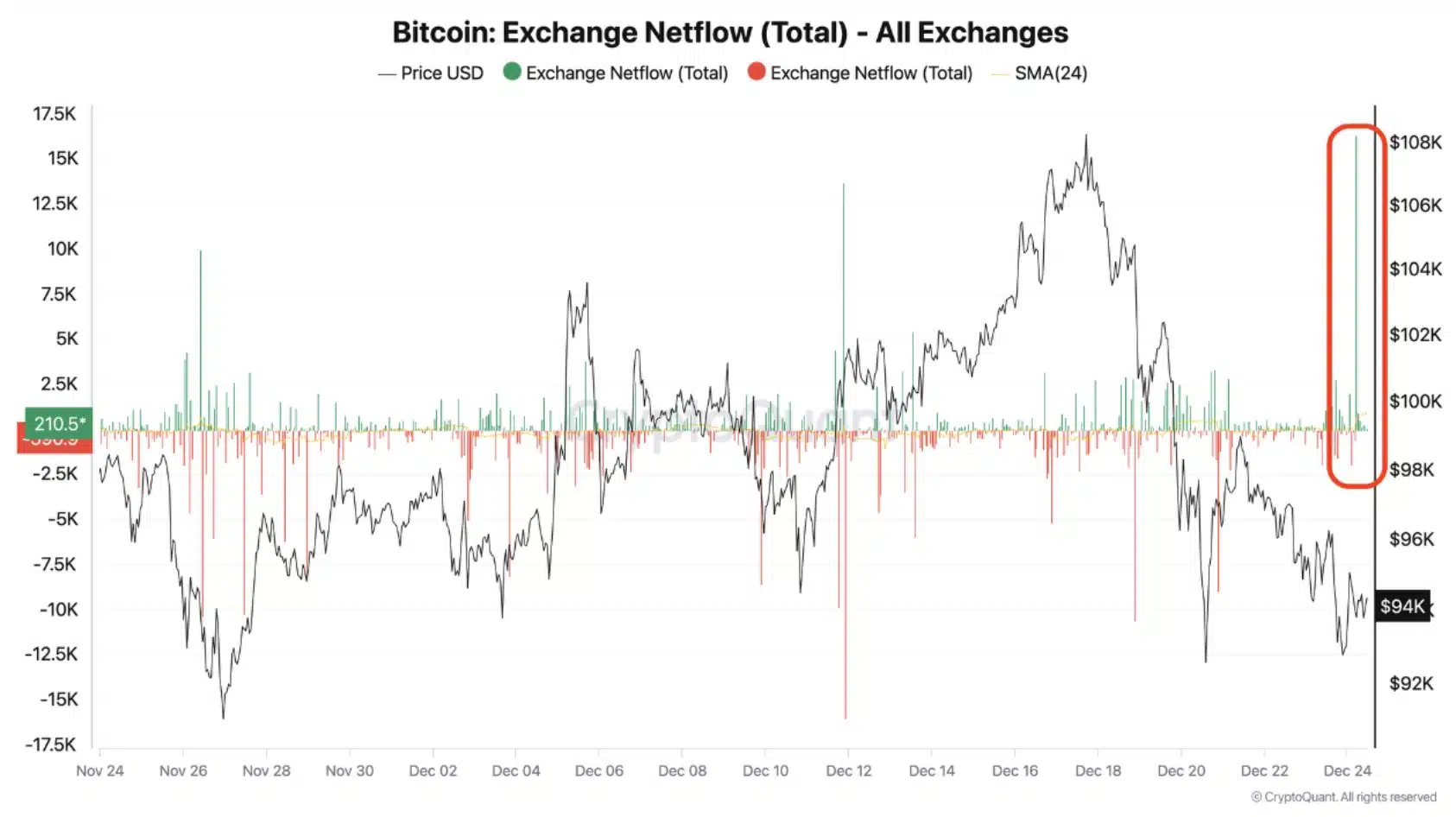

Recent data from CryptoQuant analyst Onatt reveals a notable shift in Bitcoin’s spot market activity, with over 15,000 BTC flowing into exchanges – an indicator typically associated with an increased likelihood of sell-offs.

Alongside this, substantial Tether outflows suggest a reduction in liquidity within these exchanges, creating an imbalance in market dynamics.

Historically, such movements have often preceded short-term price declines, as traders and institutional investors adjust their portfolios amid rising market volatility.

Despite these warning signs, Onatt emphasized that while the current trend points to potential downside risk in the near term, there is no significant macroeconomic catalyst that would trigger a prolonged bearish trend. The analyst stated:

“This combination of factors may suggest further short-term downside in Bitcoin’s price. However, there is no macroeconomic reason to expect a sustained bearish trend following this correction.”

While the market shows mixed signals, these factors indicate that Bitcoin may experience short-term pressure, but without a larger, fundamental catalyst to drive long-term decline.