Bitcoin: What SOPR ratios say about BTC’s next move

- At the time of writing, BTC was slumping for the fourth day.

- Bitcoin’s SOPR, however, shows positive trends from LTH.

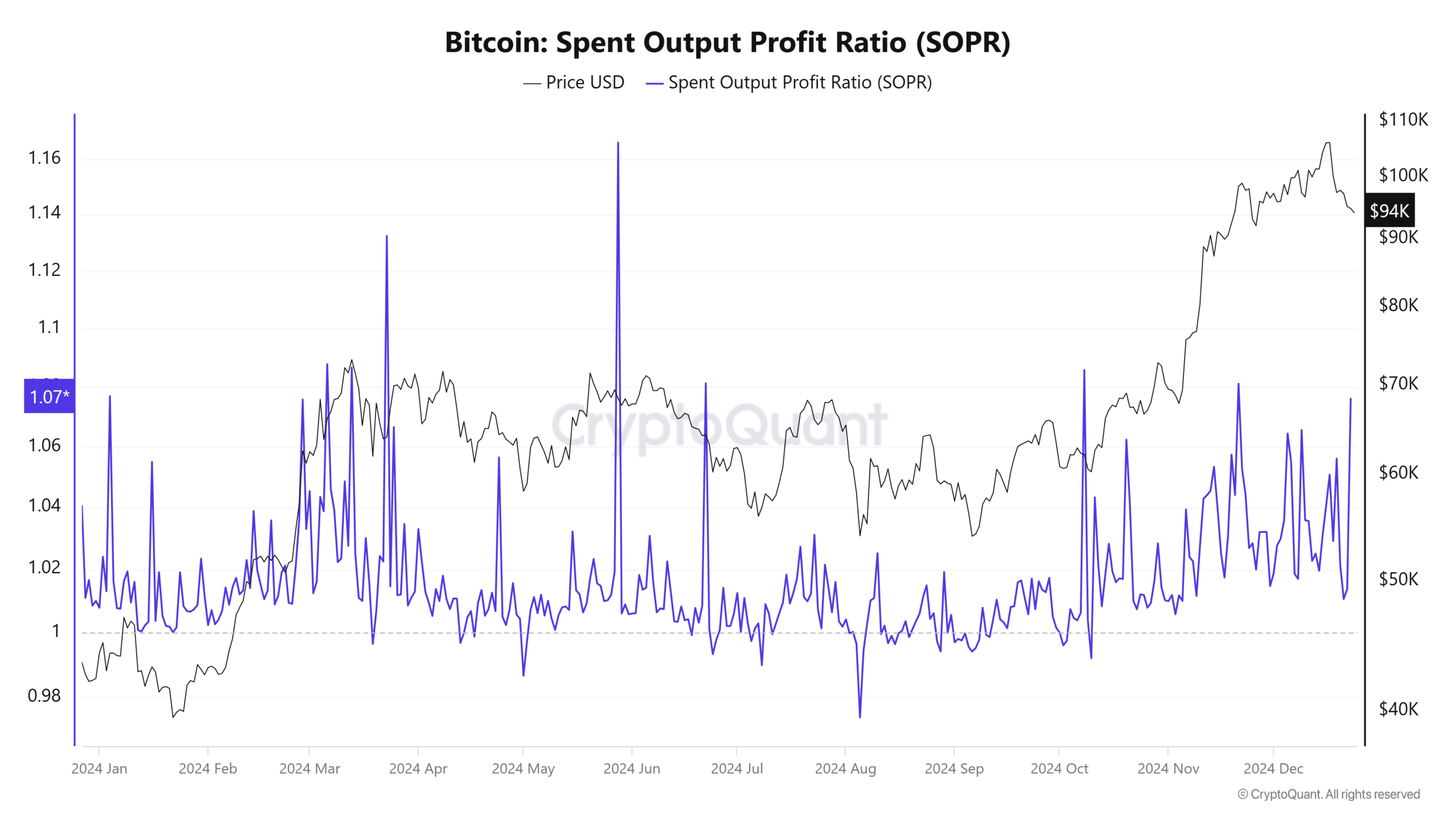

As Bitcoin[BTC] hovered near $94,000, the Spent Output Profit Ratio (SOPR) and the Long-Term Holder (LTH) and Short-Term Holder (STH) SOPR ratio charts offer valuable insights into the market’s dynamics.

While these metrics reflect profitability and sentiment among different investor classes, the price chart suggests that Bitcoin is entering a critical phase. Are long-term holders holding firm for a potential rally, or could further consolidation be on the horizon?

Bitcoin SOPR metrics highlight investor conviction

Analysis of the SOPR metric shows Bitcoin remains above the neutral threshold of 1.0, signaling that most Bitcoin transactions occur at a profit. This is a positive indicator reflecting confidence among market participants, particularly during periods of price volatility.

Historically, a stable or rising SOPR during corrections often precedes a recovery, suggesting sellers are taking profits rather than exiting positions in panic.

The LTH SOPR/STH SOPR ratio highlights the divergence in sentiment between long-term and short-term holders. Long-term holders are steadfast, with minimal selling activity at current price levels. Conversely, short-term holders show reduced activity, indicating profit-taking or cautious positioning.

These metrics collectively suggest strong support from experienced holders who remain confident despite Bitcoin’s recent pullback.

Bitcoin key levels under threat

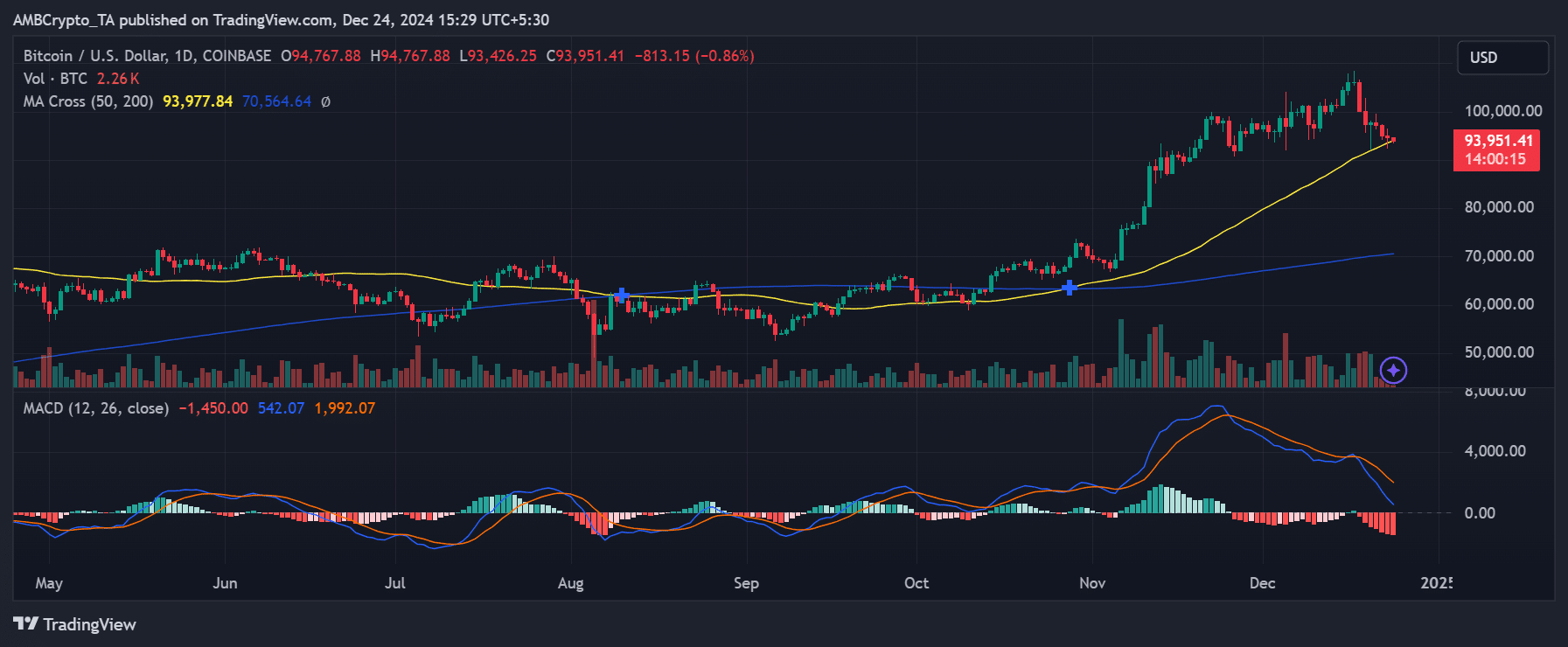

The price chart analysis reflects Bitcoin’s struggle to maintain its bullish momentum after peaking near $99,000. It is trading just above its 50-day Moving Average (MA) at $93,977, which acts as a critical support level.

A sustained breach below this level could trigger a deeper correction, potentially testing lower support zones around $92,000.

The MACD indicator on the chart reflects bearish momentum, as the MACD line has crossed below the signal line. The declining histogram bars further indicate increasing selling pressure, which aligns with the slight pullback observed in recent sessions.

Additionally, trading volumes are diminishing, suggesting that the current phase is marked by reduced market participation.

LTH and STH behavior: A foundation for recovery?

The SOPR metrics, coupled with price chart trends, underscore the resilience of long-term holders.

The steady accumulation by these participants indicates confidence in Bitcoin’s long-term value. At the same time, short-term holders’ reduced activity reflects caution but does not signal panic selling.

If Bitcoin manages to defend its key support levels and SOPR metrics remain above 1.0, this could pave the way for a resumption of the broader uptrend.

However, any failure to maintain these levels could lead to extended consolidation as bearish momentum continues to challenge the market’s upward trajectory.

– Read Bitcoin ( BTC) Price Prediction 2024-25

Bitcoin’s SOPR metrics and price chart offer a mixed but insightful picture of the market. While long-term holders’ confidence and steady profitability provide a strong foundation, short-term bearish signals cannot be ignored.

Investors should closely monitor the $93,977 support zone and SOPR trends for clues about the next major price movement.