Bitcoin

Metaplanet shares up by +10% after latest Bitcoin purchases, loan

- Metaplanet’s BTC purchases have gone down well in the market

- More firms might soon adopt BTC as part of their treasury reserves

Metaplanet, a Japanese firm known for its aggressive Bitcoin acquisition strategy, saw its share price soar following the completion of a JPY 1 billion loan. The company has been likened to MicroStrategy in its approach, buying Bitcoin to hedge against inflation and as a store of value.

Metaplanet now holds over 360 BTC, worth around $23 million at press time.

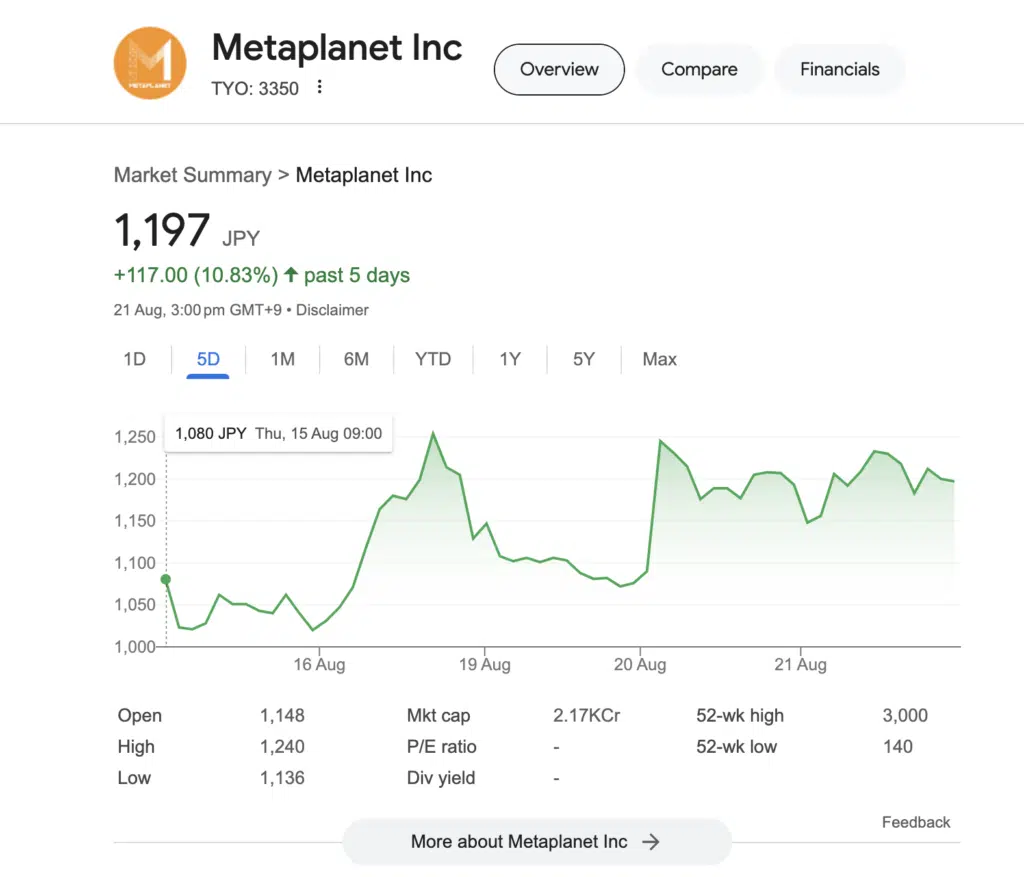

In fact, Metaplanet’s stock has consistently surged after each BTC purchase, reflecting investor confidence in its strategy. So was the case at press time too, with the same up by +10% in the last 5 days on the back of this news.

The company’s interest in the cryptocurrency isn’t limited to buying the asset either. For instance, just last month, it joined the ‘Bitcoin for Corporations’ initiative, in support of other firms that view Bitcoin as a viable treasury reserve asset.

Before that, the firm announced a JPY 10.08 billion Gratis Allotment of Stock Acquisition Rights to facilitate the purchase of more BTC.

Similarly, MicroStrategy’s shares have also seen notable gains following their Bitcoin acquisitions, demonstrating the market’s positive response to such moves.