FLOKI tests key resistance: Is a 50% price hike likely?

- Despite a red weekly chart, over 70% of FLOKI investors were in profit.

- Metrics revealed that buying pressure on the memecoin was high.

FLOKI bears dominated the week as they pushed the memecoin’s price down. However, the memecoin was on the verge of breaking above a resistance, which could result in a massive price rise in the coming days.

Let’s check FLOKI’s state to find out whether a breakout was likely.

FLOKI’s bullish prospects

FLOKI’s price dropped by more than 5% in the last seven days. The last 24 hours saw a change in the trend as the memecoin’s value surged marginally.

At the time of writing, the memecoin was trading at $0.0001146 with a market capitalization of over $1 billion.

As per IntoTheBlock’s data, over 55k FLOKI addresses were in profit, which accounted for more than 70% of the memecoin’s total addresses.

Apart from that, the number of FLOKI investors holding the memecoin for more than 1 year also remained stable, indicating long-term holders’ confidence in the memecoin.

Investors’ confidence might pay off soon, as ZAYK Charts, a popular crypto analyst, pointed out an interesting development in a latest tweet.

As per the tweet, FLOKI was testing a horizontal resistance. A successful breakout above the pattern might trigger a 50% bull rally. If that happened, then investors might witness the memecoin touching $0.00017.

Which direction is FLOKI headed?

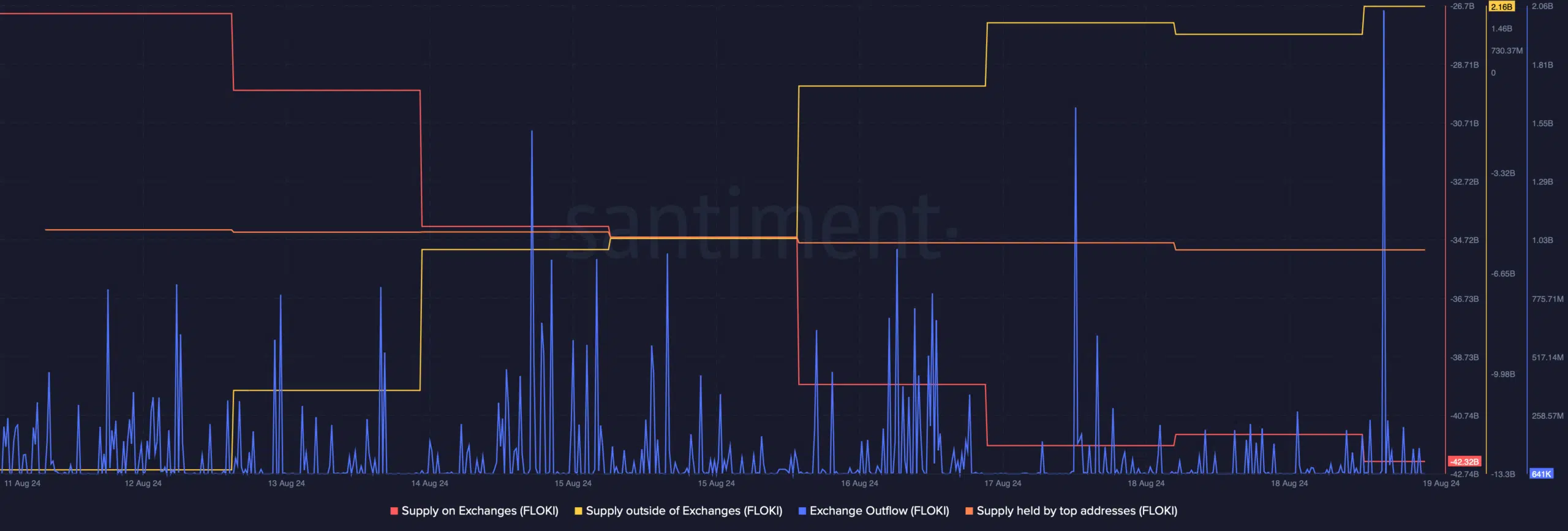

Since there were chances of a massive bull rally, AMBCrypto checked the memecoin’s on-chain data. As per our analysis of Santiment’s data, buying pressure on FLOKI increased substantially.

This seemed to be the case as the memecoin’s supply on exchanges dropped substantially while its supply outside of exchanges increased. The fact that investors were buying FLOKI was further proven by the rise in its exchange outflow.

However, whales opted to sell the memecoin as the supply held by top addresses dropped. Therefore, AMBCrypto checked Hyblock Capital’s data to find out what whales were up to.

The memecoin’s whale vs retail delta increased from 9 on the 18th of August to over 42 on the 19th of August. This indicated that whales were increasing their exposure in the market.

We then checked FLOKI’s daily chart to see whether technical indicators hinted at a successful breakout above the aforementioned resistance.

The technical indicator MACD displayed a bullish crossover. Its Money Flow Index (MFI) also registered a sharp uptick, hinting at a price increase in the coming days.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

In the event of a price increase, FLOKI might first target $0.00014. Liquidation would rise at that level, which might result in a short-term price correction. However, if the bears gain control, then the memecoin might plummet to $0.00009.