$17 for Bitcoin worth $1B? What restarted the on-chain vs TradFi debate

- The concerned wallet belonged to Coinbase Prime Custody.

- The transfer highlighted cost advantages of on-chain transactions over traditional platforms.

A large Bitcoin [BTC] transaction caught the attention of the cryptocurrency market, prompting discussions and theories about the nature of the transfer.

What happened?

A wallet sent 15,519 Bitcoins, worth $1.1 billion, on Saturday, by paying a little over $17 to get the transaction validated.

The transfer was brought to light by popular crypto commentator MartyParty, who said that the wallet belonged to Coinbase Prime Custody.

The sheer amount of transfer left on-chain observers in awe, with one X (formerly Twitter) user, Vivek, speculating that it was a purchase from a nation state, much like El Salvador.

However, the defining aspect of the transaction that evoked a lot of reactions was the significantly lower fees. Users pointed out that such a massive amount would cost much higher within the traditional framework of banks and wired transfers.

BTC back into the spotlight in 2024

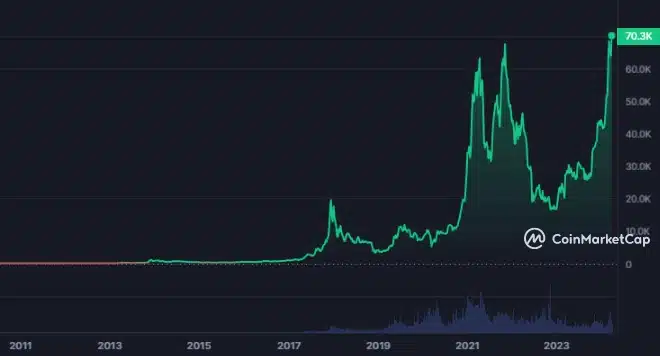

Bitcoin’s price surge in 2024 has put the spotlight back on its relative advantages over traditional finance.

The king coin has had a terrific start to 202, surging 66% year-to-date (YTD), per CoinMarketCap. It also broke its previous all-time high (ATH) during this bull run.

The crypto space is now awaiting Bitcoin’s next halving. The key event in the coin’s life cycle has historically preceded strong price appreciation.

The halving in July 2016 was followed by a 3x rise in BTC’s value over the next 12 months. Similarly, the last halving in May 2o20 saw the king coin explode by 500% in the following year.

How was this different from TradFi?

Typically, most banks set a limit per transfer or in a day. So, if one wants to go for larger amounts in one hit, they’d need to get it cleared from banks and other financial institutions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In case of international transfers, they might need permission from both the host and recipient country.

Moreover, settlement is not immediate, and it might take several business days before the recipient gets the money.