$900 million in Bitcoin ‘breaks the streak’ – Here’s what you need to know

- Bitcoin’s recent corrective price action was blamed for the lower inflows.

- Genesis Global’s liquidation of bankruptcy assets drove outflows from GBTC.

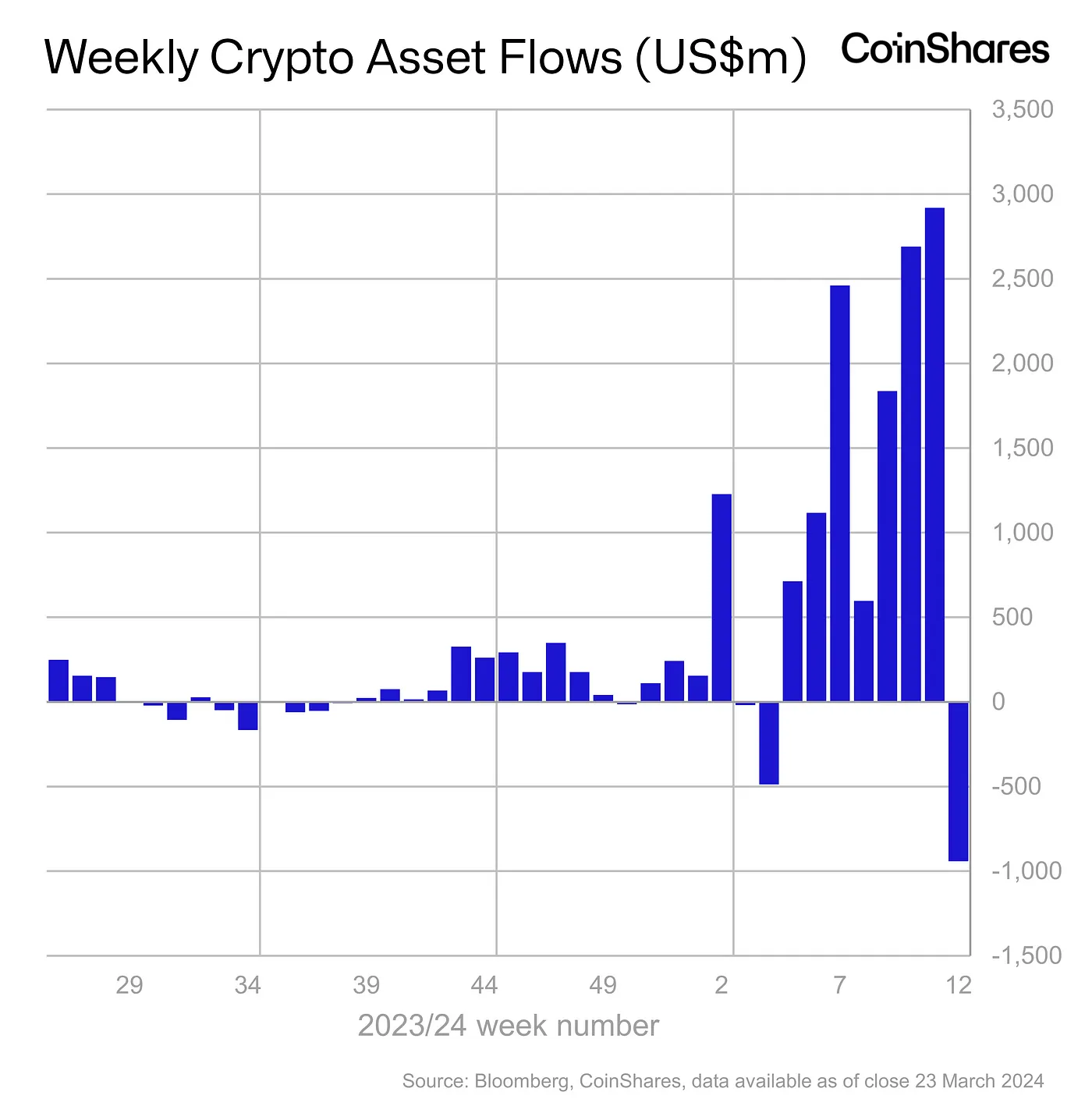

Investment funds tied to Bitcoin [BTC], the world’s largest cryptocurrency, witnessed net outflows last week, snapping a 7-week streak of inflows.

Investors go bearish on Bitcoin

According to the latest report by digital asset management firm CoinShares, institutional investors sold more than $900 million in Bitcoins last week.

The latest exodus impacted Bitcoin-based funds’ year-to-date (YTD) figures, which still looked impressive, with nearly $12 billion in inflows.

Moreover, the total assets under management (AuM) plunged to $68 billion, marking a significant drop of 8.8% from the week prior.

Note that AuM is considered an important performance gradient of a fund. A higher AuM typically attracts higher investments.

Exploring the ‘why’ of it all

According to CoinShares, Bitcoin’s recent price correction, during which it lost nearly 10% of its value, made investors cautious. So, there were significantly lower inflows into the newly-launched spot ETFs in the U.S.

Indeed, about $1.1 billion in Bitcoins was purchased on a net basis by the new issuers last week, almost half of the total outflows from the incumbent Grayscale Bitcoin Fund (GBTC).

This represented the highest difference between the two cohorts since their listing in early January.

Bloomberg ETF analyst Eric Balchunas had stated last week that the outflows from GBTC were primarily due to the liquidation of bankruptcy assets by Genesis Global.

He reiterated that Genesis was simply redeeming GBTC shares to reallocate them to the new spot ETFs, something which he dubbed as a “net neutral event.”

Read Bitcoin’s [BTC] Price Prediction 2024-25

A report card of other altcoins

Apart from Bitcoin, investment products linked to other top cryptos also experienced substantial outflows.

While funds tied to Ethereum [ETH] saw $34 million worth of sell-offs, Solana [SOL]-linked funds witnessed 5.6 million of net outflows. Interestingly, the rest of the cryptocurrency space performed relatively well, collecting inflows of $16 million.