Chainlink surges 8% after a sharp drop – What caused the U-turn?

- Chainlink was up by more than 8% in the last 24 hours.

- Most metrics and market indicators looked bullish on LINK.

Chainlink’s [LINK] price registered a sharp decline on the 19th of January 2024, which raised concerns. However, things turned in LINK’s favor soon, as the token was quick to recover. But will this uptrend last?

Are Chainlink whales buying?

Chainlink’s price witnessed an unexpected drop in its price in the recent past as its value fell to $14.71. When the token’s price dropped, a whale used that opportunity to accumulate LINK.

Lookonchain posted a tweet pointing out this episode. As per the tweet, after LINK’s price plummeted, a whale spent $8.9 million to buy 601,949 LINK at $14.81 with three new wallets. This suggested that the whale was confident of a LINK recovery.

After the price of $LINK dropped today, a whale spent 8.9M$ to buy 601,949 $LINK at $14.81 with 3 new wallets.https://t.co/W7BjWM2XsP pic.twitter.com/xlFPqWv4ko

— Lookonchain (@lookonchain) January 19, 2024

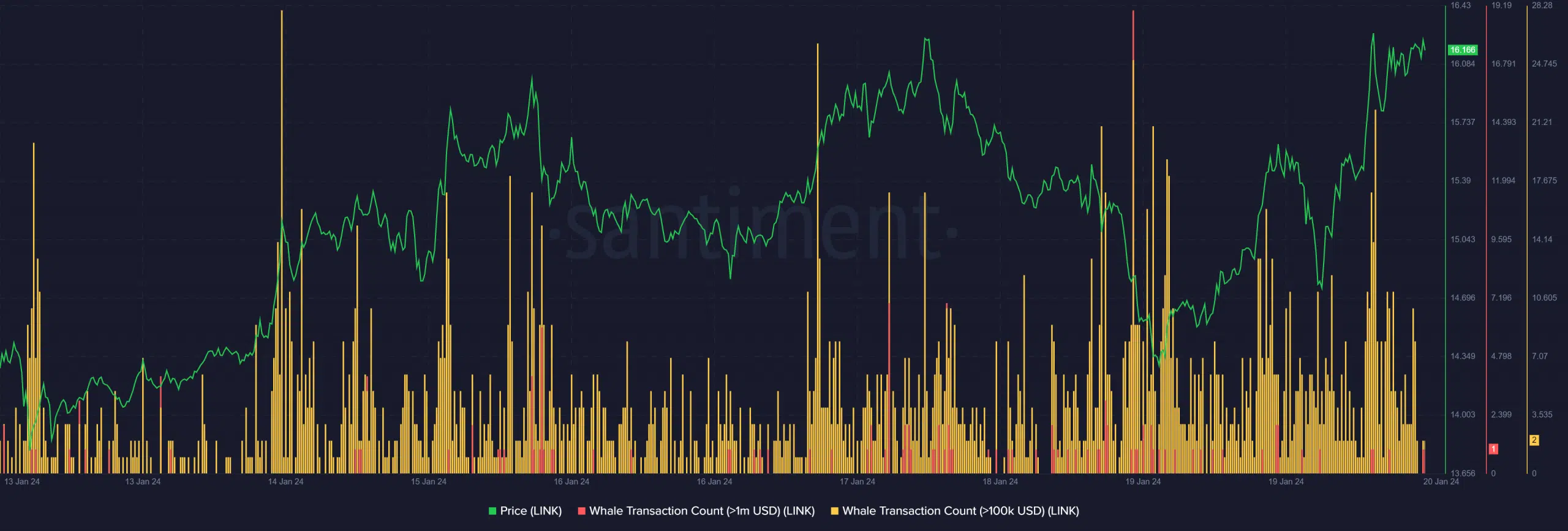

While one whale bought LINK, AMBCrypto checked Santiment’s data to see whether this trend was also true for the overall market. Our analysis revealed that whale activity around the token actually registered an increase on the 19th of January 2024.

This was evident from the considerable rise in Chainlink’s number of whale transactions. In fact, as per Whalestats, LINK was the 10th most purchased token among the top 100 ETH whales in the last 24 hours.

Chainlink recovered quickly!

Whales’ confidence in Chainlink paid off soon enough as the token recovered from its price correction pretty swiftly.

According to CoinMarketCap, in the last 24 hours alone, LINK was up by more than 8.%. At the time of writing, LINK was trading at $16.15 with a market capitalization of over $9.1 billion, making it the 12th largest crypto.

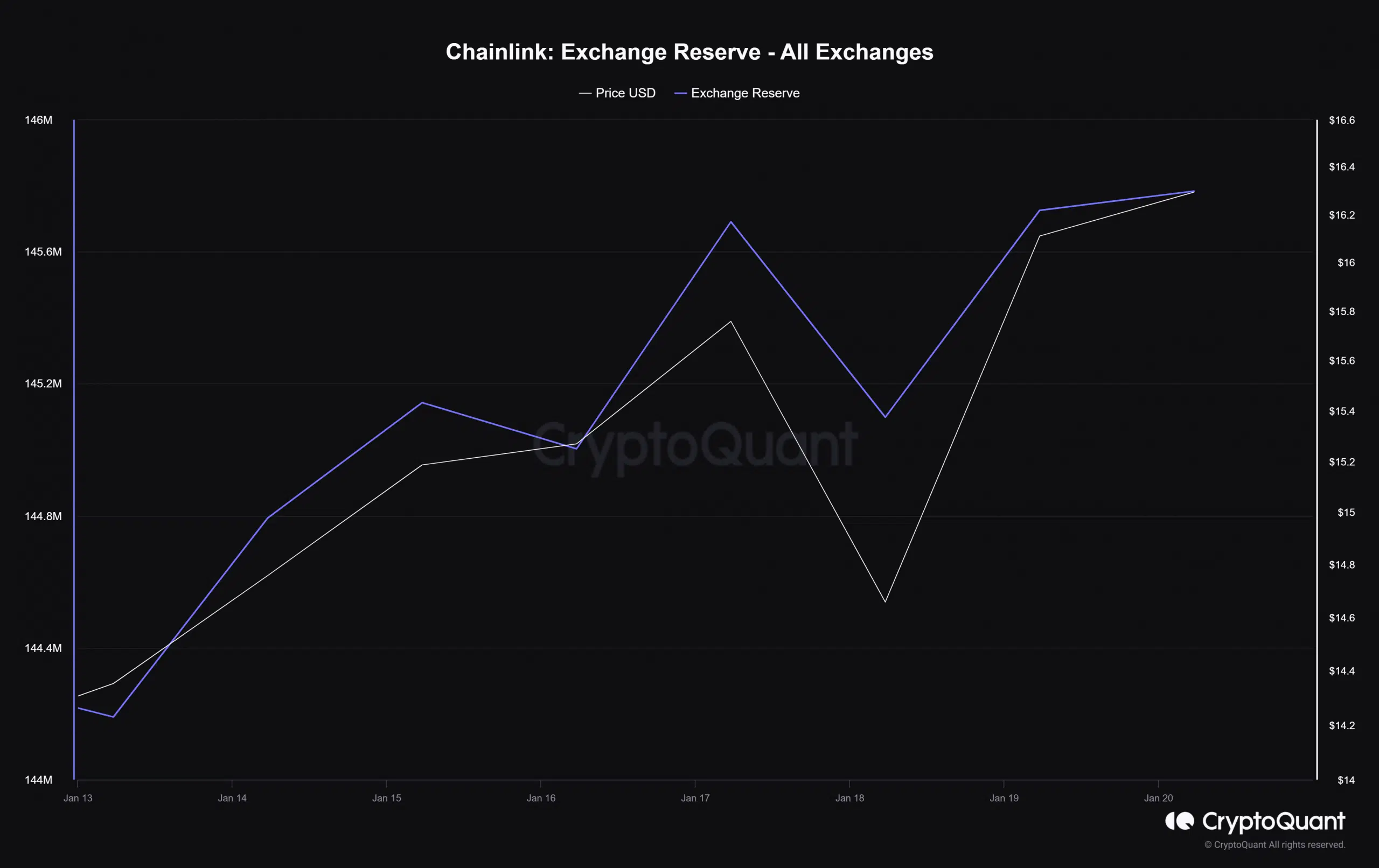

It was surprising to see that, despite the recent uptrend, investors were selling LINK.

When AMBCrypto checked CryptoQuant’s data, we found that LINK’s exchange reserve shot up sharply over the last week, which is generally a bearish signal.

Though the exchange rate was high, the rest of the on-chain metrics looked optimistic.

For instance, Chainlink’s MVRV ratio registered an uptick in the recent past. Things on the derivatives side also looked bullish, as its Binance funding rate was green.

Moreover, LINK’s open interest also shot up. Whenever the metric rises, it hints that the possibility of a trend continuation is high.

Realistic or not, here’s LINK’s market cap in BTC terms

To better understand what to expect from LINK, AMBCrypto checked its daily chart. We found that both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks and were moving above the neutral mark.

This clearly indicated that Chainlink might be able to maintain its price uptrend in the coming days.