What Ethereum’s future holds as whales make a splash

- Ethereum whales held around 38% of the total supply at press time.

- ETH’s supply has continued to decline.

Throughout the year, Ethereum [ETH] whales have consistently made strategic moves, and recent reports indicated a noteworthy increase in their holdings.

Ethereum whales gather more supply

According to IntoTheBlock, the percentage of Ethereum supply held by large investors, known as whales, has increased over the year. The data showed a growth from 32% in January to around 35%.

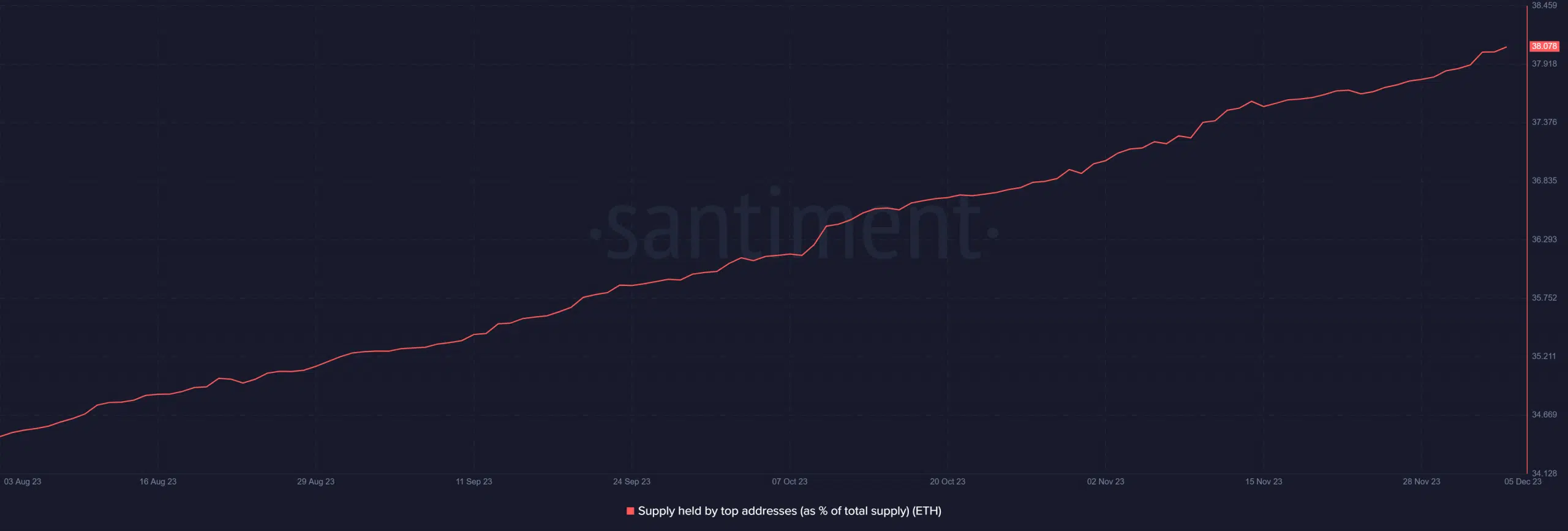

Further examination of whale holdings on Santiment also showed an increase.

Initial observations of the chart showed a clear upward trend in the past few months. In August, the percentage of whale holdings stood at about 34%, but as of this writing, it was over 38%.

An important question thus arises: How has this surge in holdings affected the overall supply of Ethereum on exchanges?

Ethereum: Supply on Exchanges continues to decline

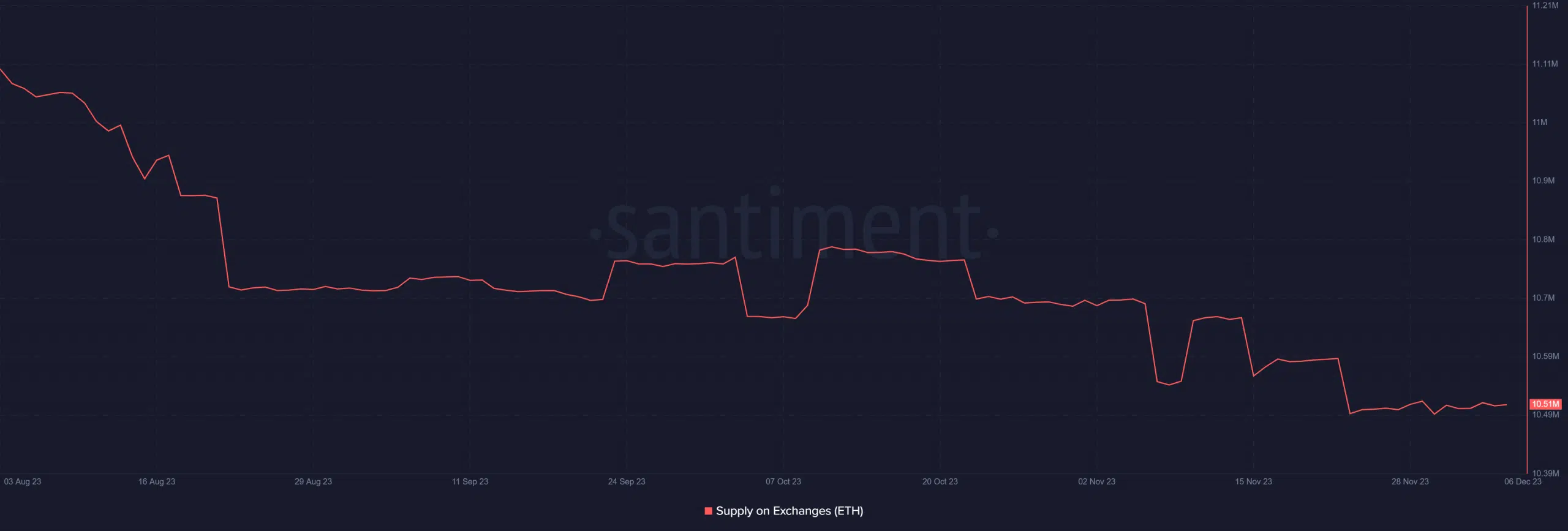

The Ethereum supply on exchanges has exhibited minimal fluctuation in the recent period. However, it has shown a significant decrease over the last six months.

Chart analysis showed a decline of nearly 1 million units between August and the present. As of this writing, the exchange supply was around 10.51 million.

Connecting the dots between the trends in exchange supply and the holdings of Ethereum whales, one might infer that the accumulation by large investors has influenced the overall supply.

The reduction in supply on exchanges implied a decrease in liquidity, which could exert a positive influence on the price trend.

ETH uptrend comes to a halt

AMBCrypto’s examination of Ethereum’s daily price trend showed a consistent accumulation by whales across various price ranges. Preceding this recent report, the chart indicated a continuous increase in the value of ETH over the past six days.

Read Ethereum’s [ETH] Price Prediction 2023-24

The uptrends resulted in around an 11% increase in value. However, at the time of this writing, there was a slight decline of almost 2%. Despite the decline, it has managed to maintain a stable price of around $2,200.

It’s noteworthy that if the percentage of supply held by these whales begins to diminish, it could signify capitulation. This is a crucial consideration, as a substantial release of volume onto exchanges might adversely impact the price trend.