Will Bitcoin break into the $40k range soon?

- Bitcoin has broken into the $39,000 price range.

- The king coin’s Funding Rate climbed to 0.01% at press time.

Bitcoin [BTC], hovering around the $40,000 price range at press time, has approached the brink of crossing this threshold in the past 48 hours.

Bitcoin moves closer to $40,000

Over the past few weeks, Bitcoin has experienced fluctuations in its value, alternating between increases and declines. Despite this, it consistently maintained a position within the $37,000 price range.

Recent discussions have revolved around the anticipation of Bitcoin’s potential movement toward the $40,000 mark. A closer examination of the daily timeframe revealed that over the last three days, BTC has inched closer to this threshold.

As of the close of trading on the 1st of December, Bitcoin witnessed a 2.6% increase in value, settling at around $37,200. Subsequently, on the 2nd of December, it further surged by 2.0%, concluding trading at over $39,000.

At press time, there was a marginal decline of less than 0.5%, marking its highest point since May 2022.

AMBCrypto’s analysis of the above chart also showed that Bitcoin’s Relative Strength Index (RSI) was indicating a strong bullish trend. As of this writing, the RSI line was nearly crossing into the oversold zone.

Furthermore, the short moving average (yellow line) continued to provide support at around the $35,000 price region.

More Bitcoin addresses are yet to become active

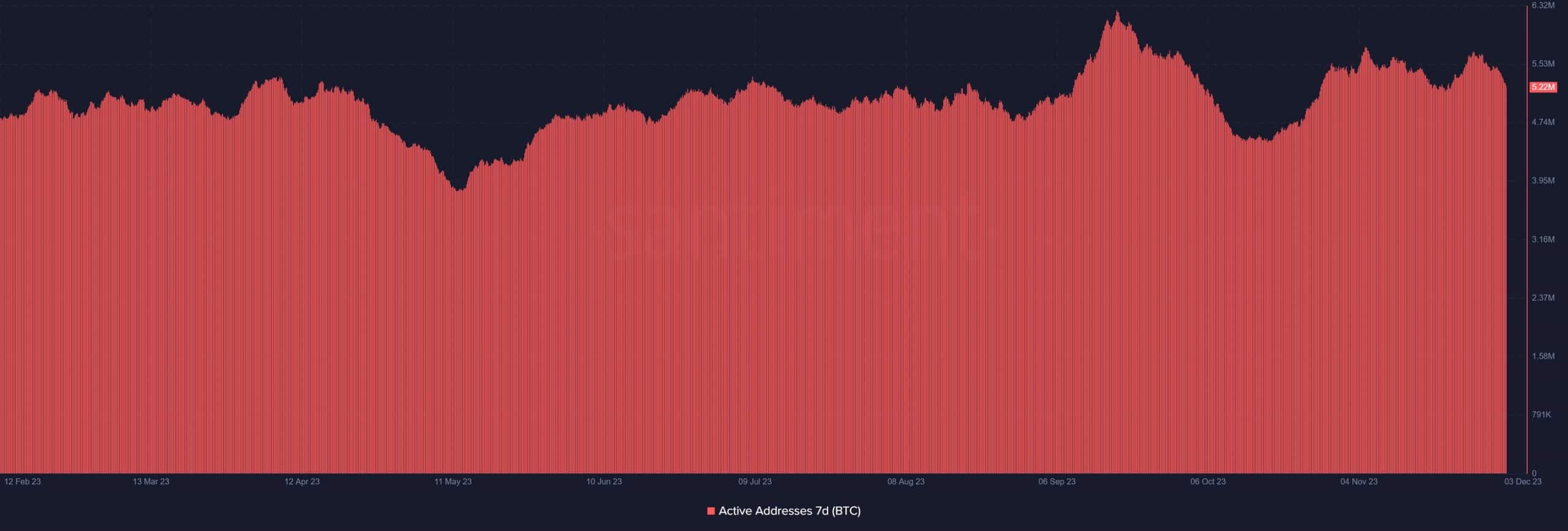

AMBCrypto’s examination of the Active Addresses metric on Santimet showed that, despite the recent increase in price, the number of active addresses has remained the same.

On the 2nd of December, the Active Addresses numbered around 5.3 million. Also, the day before that, there were nearly 3.5 million active addresses. At the time of this analysis, the Active Addresses metric numbered 5.2 million.

This suggests that the surge in Bitcoin’s price had not yet translated into an increase in the active addresses trading BTC.

This observation was further supported by the volume metric, which also showed no significant uptick. At press time, the volume was around $15.8 billion, maintaining regular trends.

A breakthrough above the $40,000 price range might trigger more reactions in both active addresses and trading volume.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Derivative traders place more bets on BTC

The upswing in Bitcoin’s price prompted noteworthy responses from derivative traders. An examination of the Funding Rate on Coinglass revealed persistent positivity, coupled with a price rise.

At the close of trading on the 2nd of December, the Funding Rate stood at around 0.008%. However, at the time of this writing, the Funding Rate had risen to around 0.01%. Thus, more traders were betting on Bitcoin’s rising prices.