Bitcoin derivatives traders are on the move – Is $40K their next target?

- Derivatives traders were attempting a breakout from the $37,000-$38,000 region.

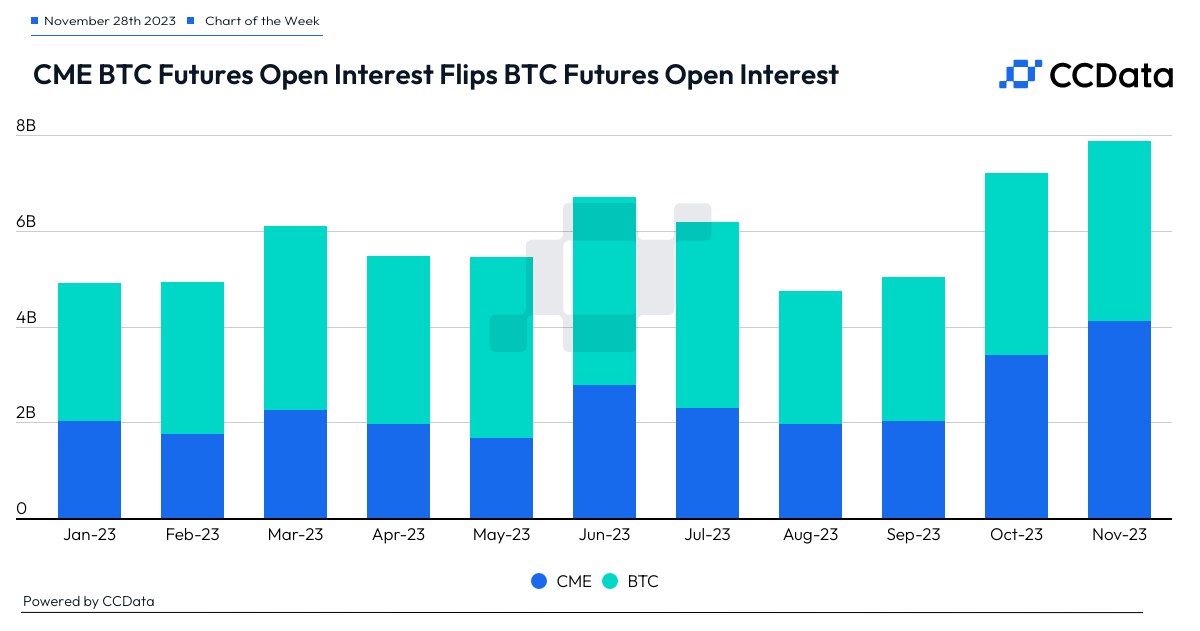

- The OI in BTC futures on CME surpassed that of Binance in November.

Bitcoin [BTC] gained back its bullish strength in the last 24 hours, rising by 2.47% to revisit the $38,000-mark, AMBCrypto learned using CoinMarketCap’s data.

Profit-taking by weak hands dragged the king coin back to $37,912 as of press time, but odds of a breakout were getting stronger.

Bitcoin derivatives traders in action

The price rise was matched by a spike in speculative bets taken for the world’s largest cryptocurrency.

The Open Interest (OI) in BTC futures and perpetual futures contracts rose by 4.22% over the last 24 hours, Coinalyze data accessed by AMBCrypto showed.

Typically, a rise in Open Interest coming alongside a rise in price indicates growing bullish sentiment. Popular on-chain analyst Maartunn echoed similar thoughts in a post on X, adding that derivatives traders were attempting a breakout from the $37,000-$38,000 region.

The speculative interest wasn’t just restricted to retail traders. The OI in BTC futures on global derivatives giant Chicago Mercantile Exchange (CME) bounced nearly 21% in November, as per crypto market data provider CCData.

With the latest flourish, CME surpassed Binance to become the largest Bitcoin futures exchange.

CME’s standard Bitcoin futures contract is worth five BTC and is a barometer of institutional interest in digital assets. Needless to say, the expectation of a spot Bitcoin ETF approval was catalyzing the growth.

Whales make a splash

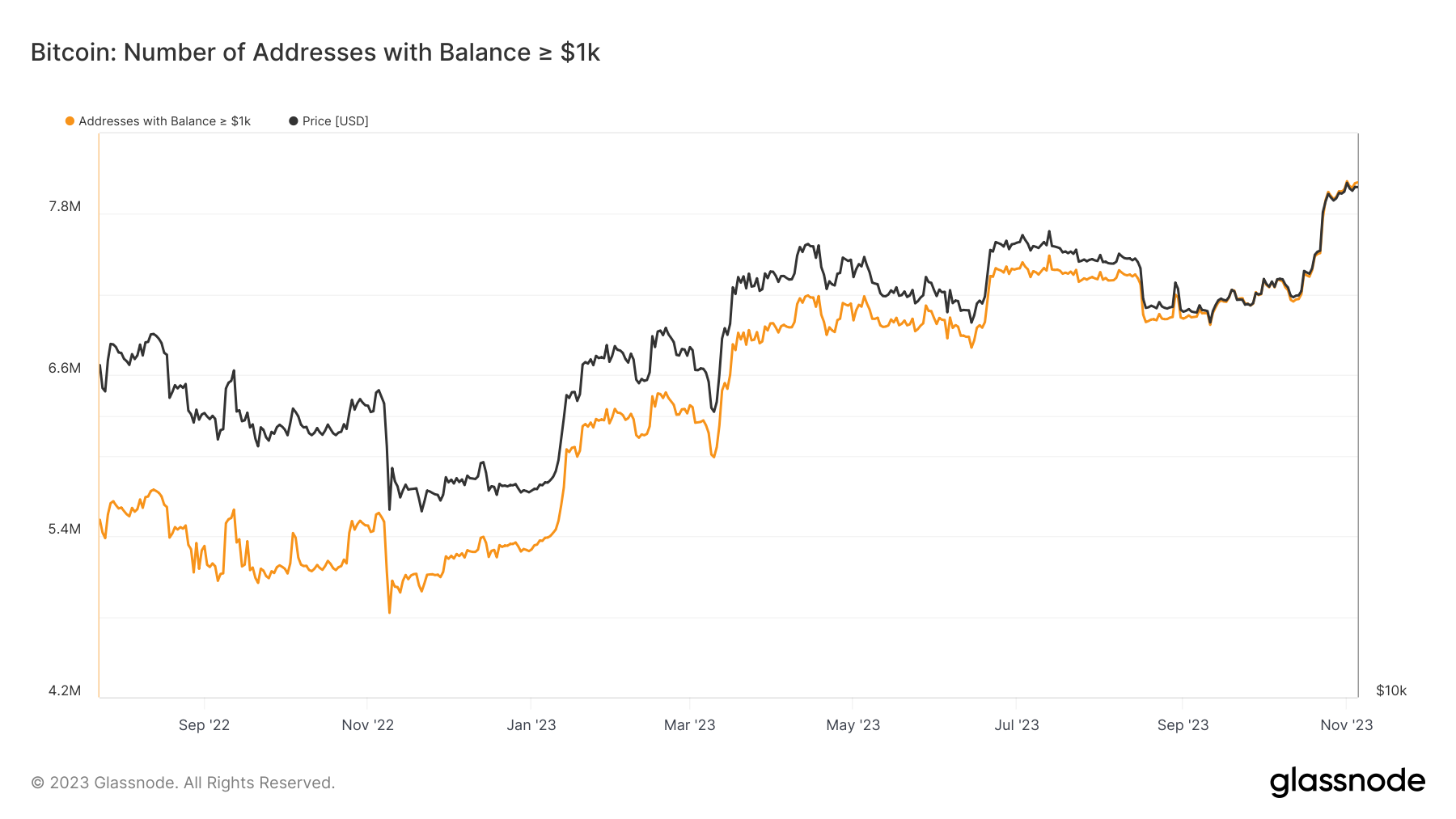

Growing institutional interest was also reflected in the steady increase in the number of BTC whales. According to AMBCrypto’s examination of Glassnode’s data, addresses having at least $1,000 worth of coins increased by 11% since the rally began in mid-October.

Whales, who usually trade in large blocks of assets, exert significant influence on the price movements. The strong buying pressure was therefore a bullish driver for BTC.

Is your portfolio green? Check out the BTC Profit Calculator

Whales’ optimism on BTC was also seen in the long positions taken by them. According to Hyblock Capital’s Whale vs Retail Delta indicator, whales had higher long exposure than the retail investors at press time.

In fact, AMBCrypto observed a similar pattern in most of the trading days since the rally began. This was a clear endorsement for Bitcoin from whales.