SUI risks another slide as token unlock inches closer

- SUI will release millions of tokens valued at almost $50 million on the 28th of November.

- The token’s price may plunge because of the increase in circulation.

Decentralized Layer-one (L1) blockchain Sui Network [SUI] is set to unlock another round of tokens, worth around $49.77 million. According to Token Unlocks, the event is scheduled to occur on the 28th of November.

If unlocked, then 17.74% of the total SUI supply would be in circulation.

The impact of token unlocks can be intense because it causes inflation, in a nutshell. As a result, the value of the coin in question decreases. Coming back to SUI — though its unlock is not yet in progress, the price action is already acting as a precursor for things to come.

At press time, the value of the 79th most valuable cryptocurrency was $0.60, after a 5.32% drop in value over the past 24 hours. AMBCrypto’s analysis of the SUI/USD chart showed that more downward pressure may be on the way for the token.

SUI below $0.60 is mapped out

First, the Money Flow Index (MFI) fell to 35.10. The MFI swings between zero and 100. When the indicator rises above 80, it means the asset is overbought. On the other hand, readings of the MFI lower than 20 means that the token is oversold.

While SUI was neither overbought nor oversold, the drop in the MFI signaled that most of the volume around the cryptocurrency was due to selling pressure. If market players continue to sell, then SUI could be in place to decrease to $0.56.

This bearish notion was also reinforced by the Awesome Oscillator (AO) as shown above. With the reappearing red bars, the AO showed that SUI’s decelerating momentum continues in the short term.

A look at the Bollinger Bands (BB), however, revealed that the price fluctuation may not be wide. So, if SUI decreases because of the upcoming token unlock, the support at $0.56 might restrict it from falling below the area.

Not impressed by the hype

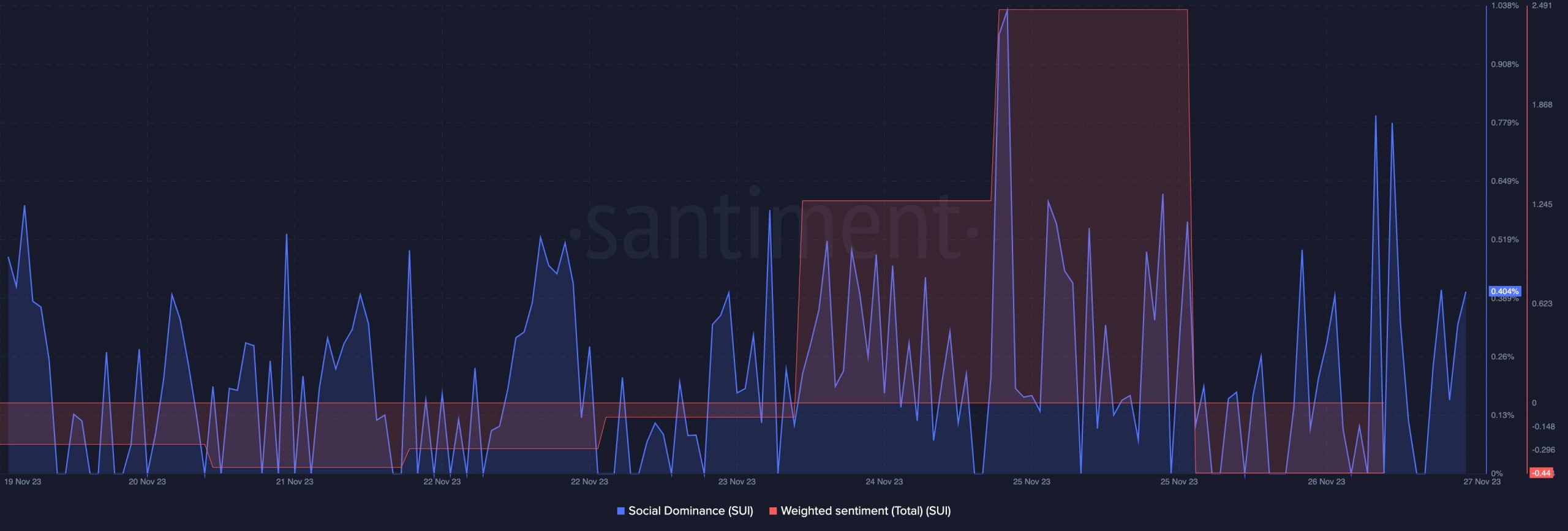

AMBCrypto also considered the social dominance around the Sui project. According to on-chain data extracted from Santiment, the social dominance had increased to 0.40%.

The increase in the metric showed that discussions about SUI had improved at press time, when compared to other assets in the top 100.

Price-wise, the jump in social dominance is a sign that SUI is not trading at a fair price. But this assertion was because of considering the current market conditions. Therefore, its local top may have been $0.68— a value it hit on the 25th of November.

How much are 1,10,100 SUIs worth today?

Per its Weighted Sentiment, Santiment showed that the reading had fallen into the negative region. This metric gauges the positive and negative commentary about a project on social platforms.

Thus, the Weighted Sentiment decrease implies that most market participants are not bullish on SUI’s short-term price action.