Arbitrum’s grant program opens new doors for ARB – Here’s how

- Arbitrum recorded an influx of new account interacting with the network.

- ARB price increased and may retest $1.10 soon.

New addresses on the Arbitrum [ARB] network have increased by 27% ever since the project launched the Short Term Incentive Program (STIP), data from IntoTheBlock revealed.

According to AMBCrypto’s assessment of the network growth, new addresses on Arbitrum crossed 60,000 on 17th November.

Since the start of the Arbitrum STIP program, the number of daily new addresses on Arbitrum making their first ETH transaction has grown by 27%.

?https://t.co/3jvFTabDSV pic.twitter.com/wH46fA2O81— IntoTheBlock (@intotheblock) November 25, 2023

The move shows its potential

When AMBCrypto reported about the STIP project, it was mentioned that the program could bring in additional users for Arbitrum.

So, it was not an unexpected event that these new wallets decided to make their first Ethereum [ETH]-based transactions on the network.

For the curious, Arbitrum introduced the STIP program as a community initiative aimed at funding other projects while driving growth within the ecosystem. After the first round of voting, projects including GMX and PancakeSwap [CAKE] got a share of the stash.

Apart from the network, the program also seemed to have a positive effect on the ARB price. Despite being 91% down from its All-Time High (ATH), ARB’s value increased by 19.05% in the last 30 days. This increase also allowed the token to cross the crucial $1 mark.

On looking at the ARB/USD 4-hour chart, it may seem that the token could be ready for another increase. This was because the Moving Average Convergence Divergence (MADC) had increased to 0.0059.

Also, the 12-day EMA (blue) had flipped the 26-day EMA (orange), suggesting increasing bullish momentum. Although ARB had dropped to $1.05, an increase in buying pressure could lead the cryptocurrency above $1.10.

But that would only happen if bulls are able to defend the $1 support, and buying pressure overwhelms the resistance at $1.05.

ARB offers more than provided

From the chart above, the Chaikin Money Flow (CMF) also indicated that ARB could be targeting another uptrend. The reason for this inference was that the CMF was in positive territory, indicating buying pressure for the price.

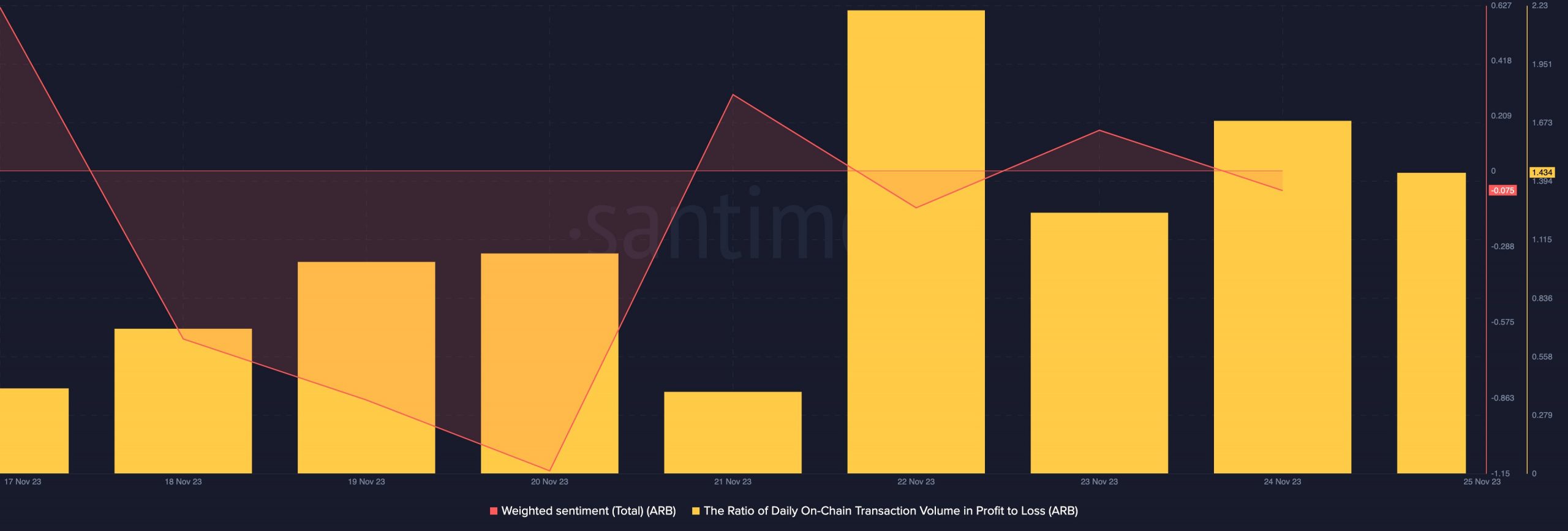

However, the Weighted Sentiment around Arbitrum had fallen into the negative region. At press time, the Weighted Sentiment was -0.075. Weighted sentiment uses the unique social volume to ascertain the perception market participants have about a token.

So, the drop in the metric reading implies that the broader market was not as bullish as they were on ARB on 23rd November.

How much are 1,10,100 ARBs worth today?

Another metric to consider in assessing ARB’s recent trend is the ratio of on-chain transaction volume in profit to loss.

At press time, the metric was 1.434. Values above 1 of the on-chain transaction volume in profit to loss ratio mean there have been more realized gains than losses in recent times.