LDO attracts institutional giants: What was the impact?

- Over 2.9 million LDO tokens have left exchanges.

- LDO hit the $2.4 price range for the first time in months.

Of late, two prominent institutions have started amassing Lido Finance [LDO]. Given the ongoing accumulation, has there been any observable influence on the token’s flow and trend?

Millions of Lido Finance tokens accumulated

According to LookOnChain, analyzing wallets associated with the Amber group and Falcon revealed accumulation trends. On the 20th of November, the wallet linked to Amber withdrew approximately 1.47 million LDO tokens, equivalent to about $3.6 million, from Binance [BNB].

This latest withdrawal brings the total withdrawal to around 5.9 million LDO tokens in the last three months. Also, the total withdrawals were valued at around $14.5 million.

Similarly, Falcon X withdrew around 1.26 million LDO tokens, valued at around $3.1 million, from Binance on the same day. Like Amber, this wallet has withdrawn about 4.9 million tokens, worth $12 million, in recent weeks.

This recent withdrawal is the largest observed in the past few months and is reflected in the netflow.

Lido Finance sees the highest outflow of tokens in months

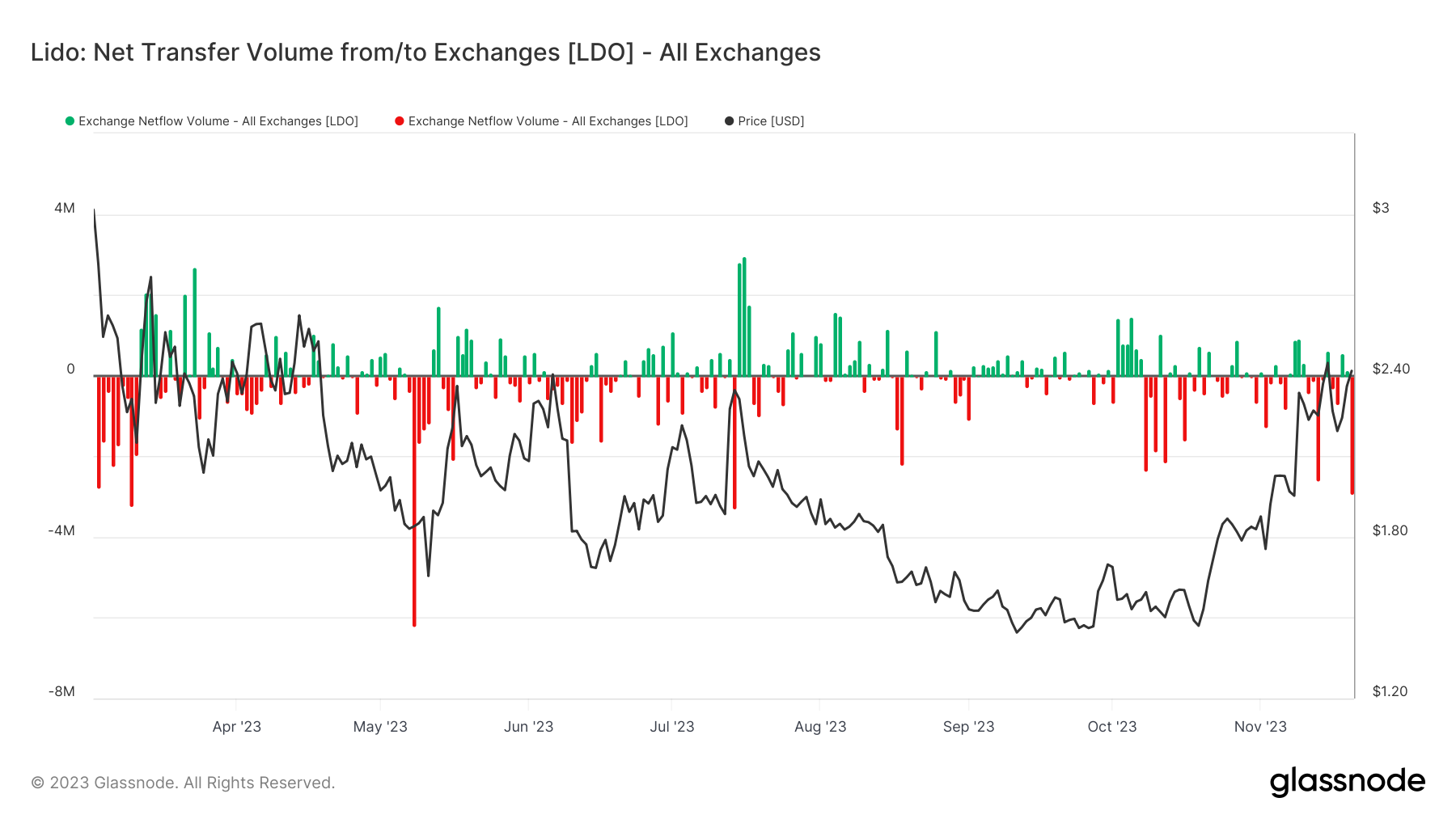

AMBCrypto’s examination of the exchange netflow chart on Glassnode revealed that the Lido Finance token witnessed its most significant outflow in recent months. The chart indicated that by the close of trading on the 20th of November, the netflow was negative.

It showed a departure of over 2.9 million tokens from exchanges.

This signified that more LDO tokens were leaving all exchanges than entering them.

Further analysis revealed that this marked the second occurrence of a substantial outflow in the month. Also, it represented the most significant outflow volume in the past three months.

Could the motivation behind this increased outflow be linked to the token’s price dynamics?

LDO’s golden cross

The daily timeframe chart analysis revealed that LDO concluded the day by trading positively on the 20th of November. The chart showed a closing value of around $2.4, reflecting a gain of over 1.8%.

This positive trend marked the third consecutive day of an upward movement in the token’s price.

How much are 1,10,100 LDOs worth today?

AMBCrypto also observed the occurrence of a golden cross, where the short moving average (yellow line) crossed over the long moving average (blue line), indicating a more favorable price trend.

As of the latest update, the token was trading with over 2% decline while maintaining the $2.3 price range. The accumulation within this price range suggested an anticipation of further upward movement in LDO’s value.