Why does Ethereum options OI hitting a new high matter, apart from the obvious

Ethereum’s price has rallied from $130.47 to $606.65 as of November 24, 2020. With an increase of nearly 365% YTD, Ethereum’s price is on a parabolic trajectory. The ETH 2.0 launch event that is drawing closer every week may be one of the drivers of this price rally. The other driver of price is Ethereum’s correlation with Bitcoin, which has sustained at 0.76, above $0.70 since June 2018, based on data from CoinMetrics.

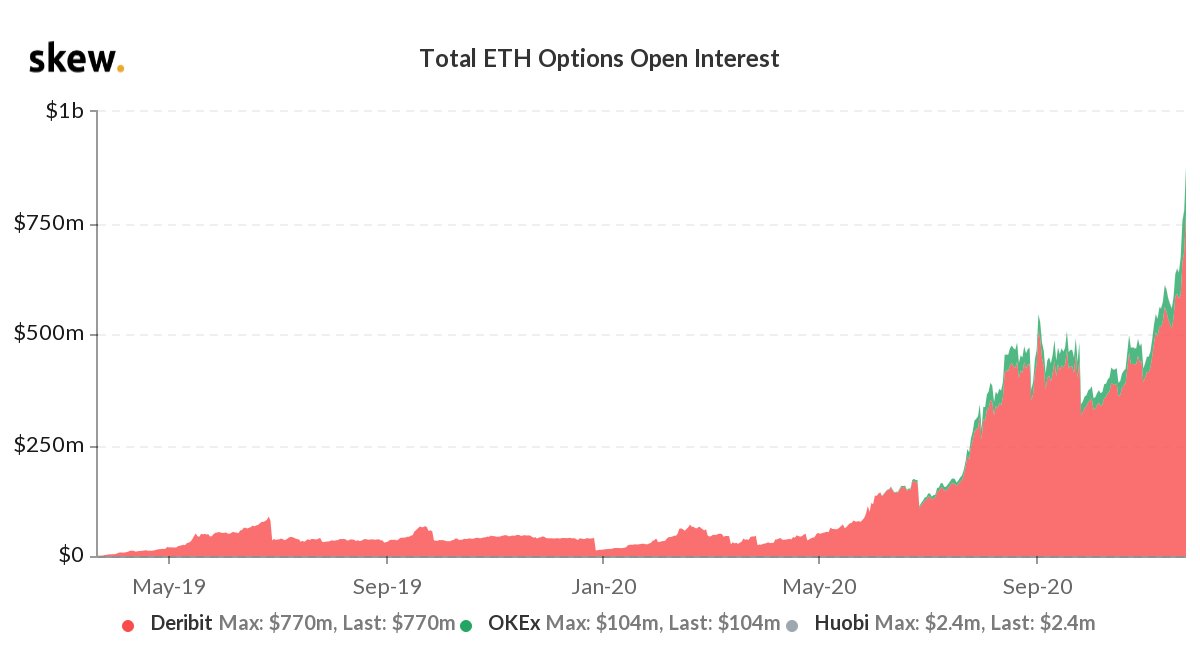

The bullish sentiment of institutional and retail traders on derivatives exchanges is evident from the increase in open interest. Open Interest has hit a new ATH on top derivatives exchanges. In the 3-month OI chart by Skew, ETH crossed $500 Million in September 2020 and $600 Million in early November 2020.

ETH OI Chart || Source: Skew

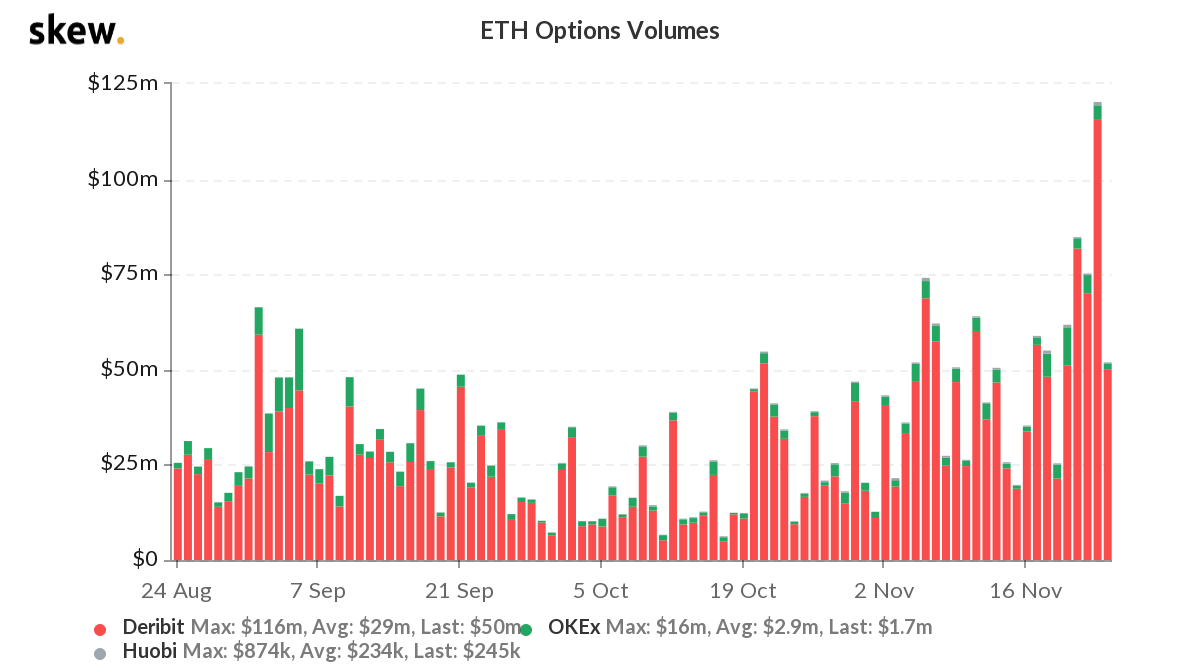

Open interest hit $976.4 Million based on data from the above chart. Additionally, the bullish sentiment is evident from the jump of 60% in the options trade volume chart from Skew, on Nov 23, 2020. An increase in open interest and trade volume contributed to the deposited funds on ETH 2.0 taking the total to 100% in less than 48 hours from the parabolic rise. The enthusiasm of the ETH community and maximalists was reflected in Options Volume and OI.

ETH Options Volume || Source: Skew

The bullish sentiment had an impact on spot exchange prices as well and with a 24-hour gain of 33.63% in Ethereum’s price has left Bitcoin at 10.83%. Despite a full-blown alt season and a galore of profit booking opportunities in the top 20 altcoins based on market capitalization, BTC traders and maximalists are HODLing through the $18900 level. This wasn’t anticipated, based on past bull runs, however retail is eagerly waiting for Bitcoin to hit the ATH of $20000 from the historic bull run. Beside BTC, altcoins like XRP +135.62%, BCH +44.53%, LTC +26.72%, LINK +25.02% and ADA +61.86% are posting double-digit gains in the backdrop of ETH’s rally.

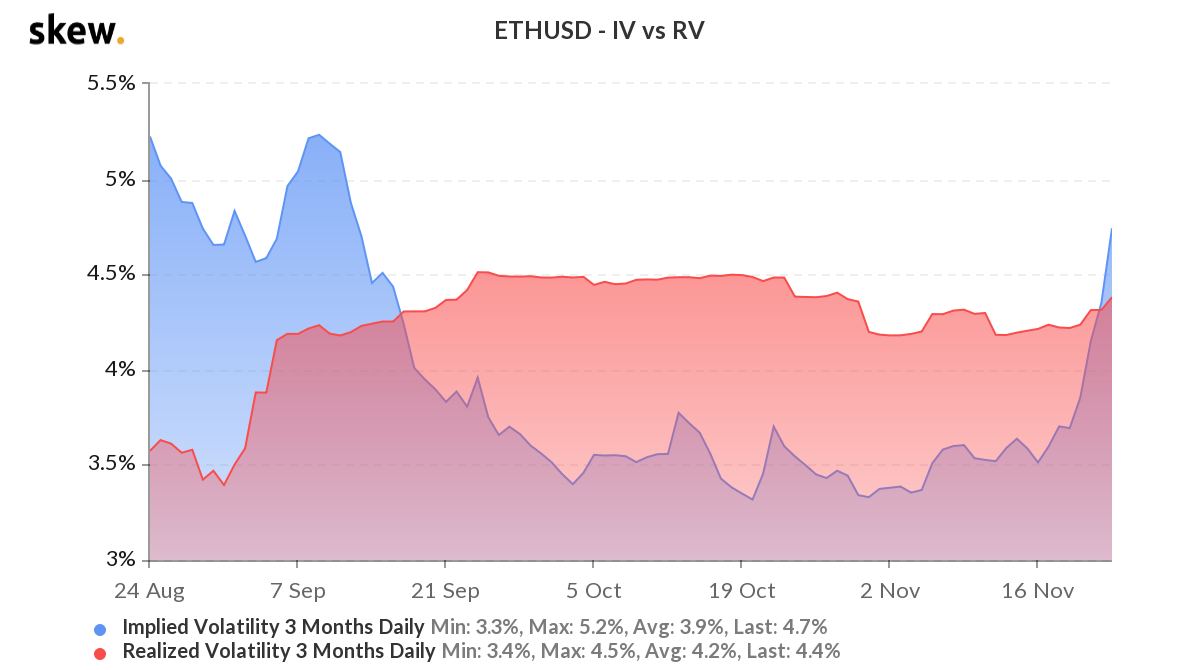

ETH IV v RV || Source: Skew

The entire crypto market capitalization has hit $571.68 Billion. ETH’s market cap has increased by 18.3% YTD and this means 87% ETH HODLers are profitable based on the on-chain analysis. For the first time in the past 3 months, IV has crossed over RV for ETH and the critical question is how far ETH’s price on spot exchanges can go? In that case, derivatives exchanges could possibly see more shorts and the sentiment may turn bullish soon after the launch event.