Tether flips Bitcoin: 20B+ on the cards for USDT in 2020?

The cryptocurrency market has provided an alternative to the age-old banking system, with the year 2020 at the fore of showcasing its ability to swiftly bounce back after the pandemic hit global markets. More and more people have been shifting their focus to Bitcoin and other cryptocurrencies as a hedge against global events. Joining Bitcoin and other cryptos, in terms of market share, was the stablecoin Tether [USDT], with the crypto managing to surge in popularity this year.

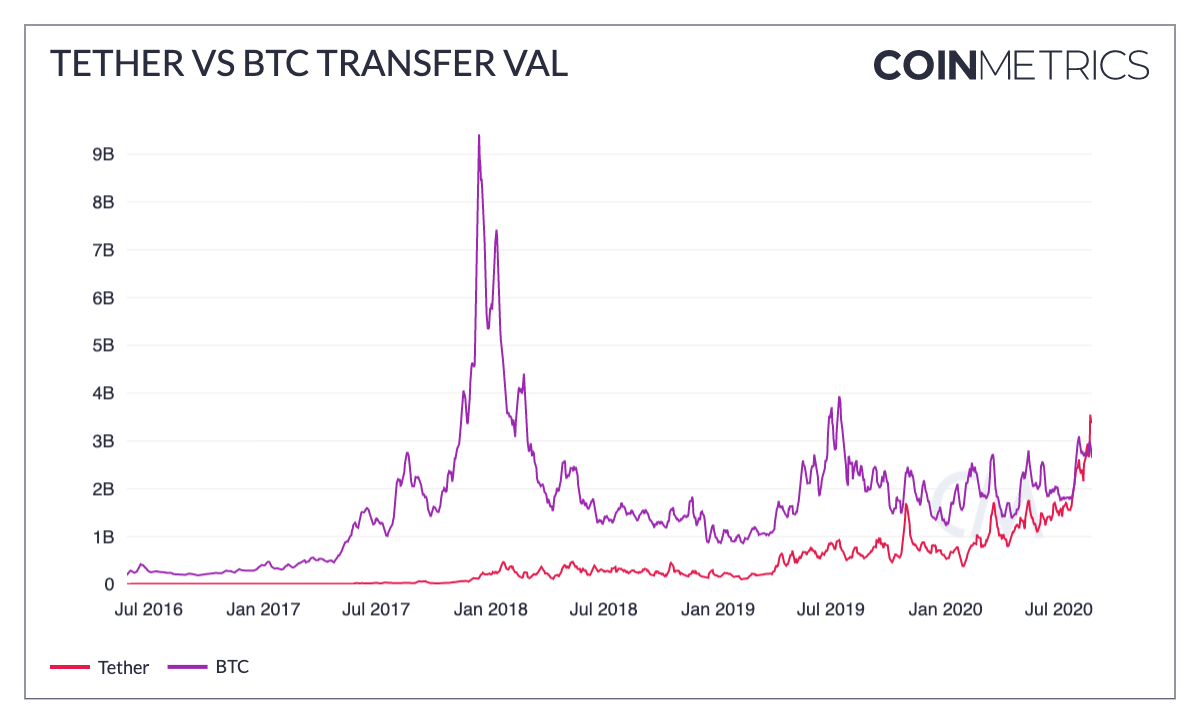

Tether’s market cap had been rising since the beginning of the year and at press time, stood at $10.02 billion, hanging on to the fourth place on CoinMarketCap’s list. Now, after months of rapid growth, it would seem that the 7-day average adjusted transfer value of Tether has reached $3.55 billion and flipped Bitcoin’s, according to data provided by CoinMetrics.

Source: CoinMetrics

Tether’s average adjusted value transfer was almost 20% more than that of Bitcoin’s, which was reporting a figure of $2.94 billion. This indicated that the market share of on-chain Tether transfers was surging and had reached a point where it finally flipped Bitcoin’s daily transfer value. The aforementioned development came in the backdrop of stablecoins getting popular among decentralized finance [DeFi] users and token swapping protocols like Uniswap and Curve.

Even though Tether has had its share of skeptics, its daily transfer value of $3.55 billion surpassed Paypal’s figures of $2.94 billion in Q2 of 2020. Here, the interesting part was that this value did not even include trading volume, but only on-chain transfers.

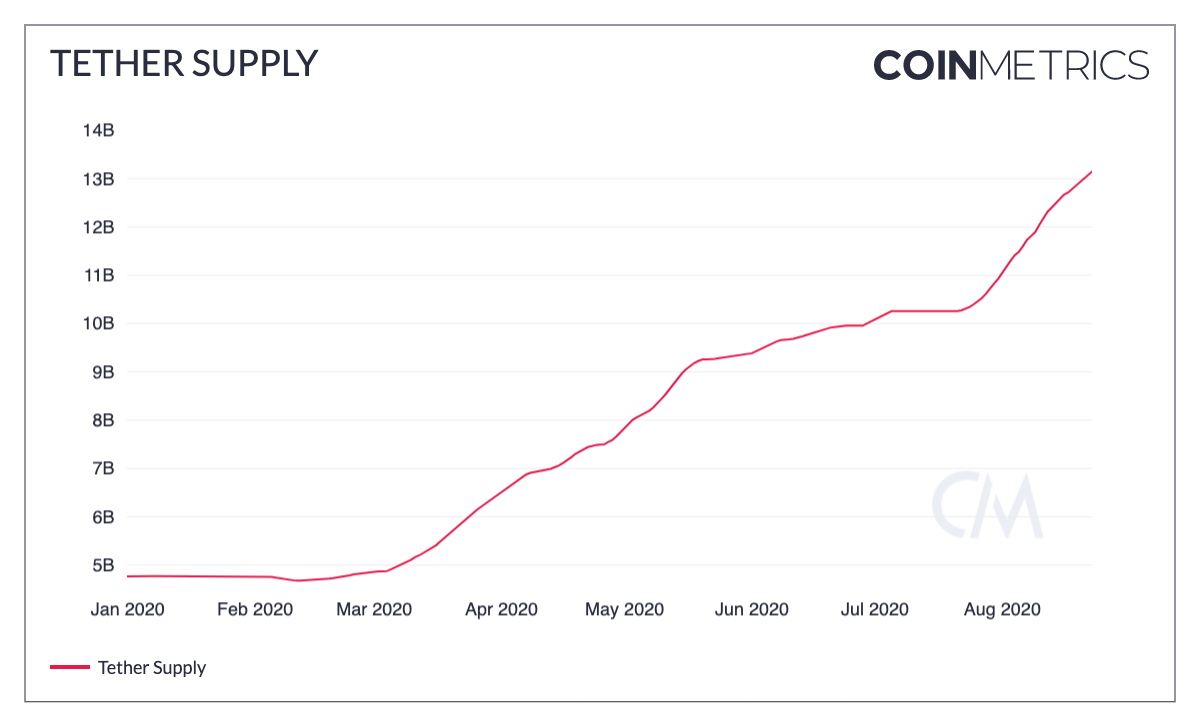

Beating a giant like Paypal in one round, Tether’s supply also touched another milestone after it climbed to 13 billion on 21 August.

Source: CoinMetrics

The supply was close to 5 billion on 1 March, a figure that soon increased exponentially within five months to mark a peak. In fact, Tether CTO Paolo Ardoino believes that the supply could hit 20 billion+ by the end of 2020. Ardoino said,

“2020, the year of Tether.

The road to 20B+ and beyond.”

Further, Tether recently moved to another platform, OMG network, on 19 August. This on-boarding was done to decongest the Ethereum blockchain and resulted in a dramatic surge in daily active addresses. Crypto has been proving to be a banking alternative in 2020, while Tether has emerged as the go-to stablecoin. With such growth rate, Ardoino’s claim of a $20 billion Tether supply may turn into a reality.