Chart Analysis of Bitcoin, Ethereum and Credits for October

The Current Market Situation

As of October 4rd, crypto markets are still struggling to recover. Since its last sharp drop, BTC fails to retrace to $8500 level while many other currencies see significant losses. As of publishing time BTC dominance remains around 67%.

BTC/USDT Daily Chart

On the chart, we can see that the price made a break of the lower boundary of the resistance of the “triangle with a flat bottom” formation in the zone of 9560-9580 USD. At the same time, 157 SMA was broken, which confirmed the dominance of sellers. Now the price is trading around 8100-8250 USD at the border of the resistance of the descending channel. Consolidation of the price indicates the current period of accumulation, interest of buyers and a potential return to the upper boundary of the descending channel to the zone 9100-9200 USD. After the middle of the month, the price may rebound from the support level of the descending channel and return to the area of 8900-9300 USD, where there is a strong resistance. Also, the other day the level of 8200 was traded and once again protected. The common mood is to fall, and we know that often the market goes against the majority. A lot of people are in shorts and this is an excellent point for growth [their stops and liquidation of positions, as was the case recently with longsters].

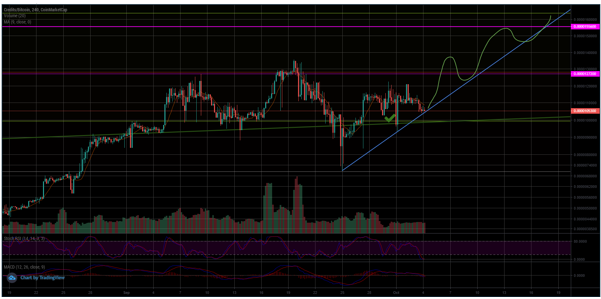

CS/BTC 4H Chart

Against the background of the general market decline, the CS / BTC trading pair shows a positive trend in terms of growth in volumes and prices. On the chart, we can see that the price once again has rebounded from the support line in the zone of 0.0000105-0.0000110 BTC and is preparing for a retest of the resistance zone around 0.0000127-0.0000130 BTC. Breaking this zone will enable the price to go up to the zone of 0.000015-0.000016 BTC. The overselling of technical indicators as well as fundamental news performance can be an additional incentive for investors when deciding to enter a position.

ETH/BTC Daily Chart

On this chart, we see that the ETH / BTC pair is in a deep downtrend that has been going on for a year. However, the price has been able to demonstrate positive dynamics, pushing away from support in the zone of 0.0155-0.0160 BTC, which is a historical low. Currently, the price is being traded to the midline of the descending channel, next to the 157 moving average. The downtrend to BTC indicates the possibility of diversification of investor assets and the potential growth of the ETH / BTC pair. An important resistance level is the zone 0.025-0.026 BTC, a break of which can signal a return to the zone 0.0308-0.0309 and the beginning of a new uptrend.

Fear & Greed Index

Currently, the Crypto Market Sentiment displays a “Fear-30” meter that correlates quite correctly with the general market situation and recent price movements. The investors are worried which means it is a signal for buying at an undervalue.

Disclaimer: This article has not been written by AMBCrypto. Readers are advised to do their due diligence before making any financial decisions.