73% and falling: Why Bitcoin’s long-term holders are selling now

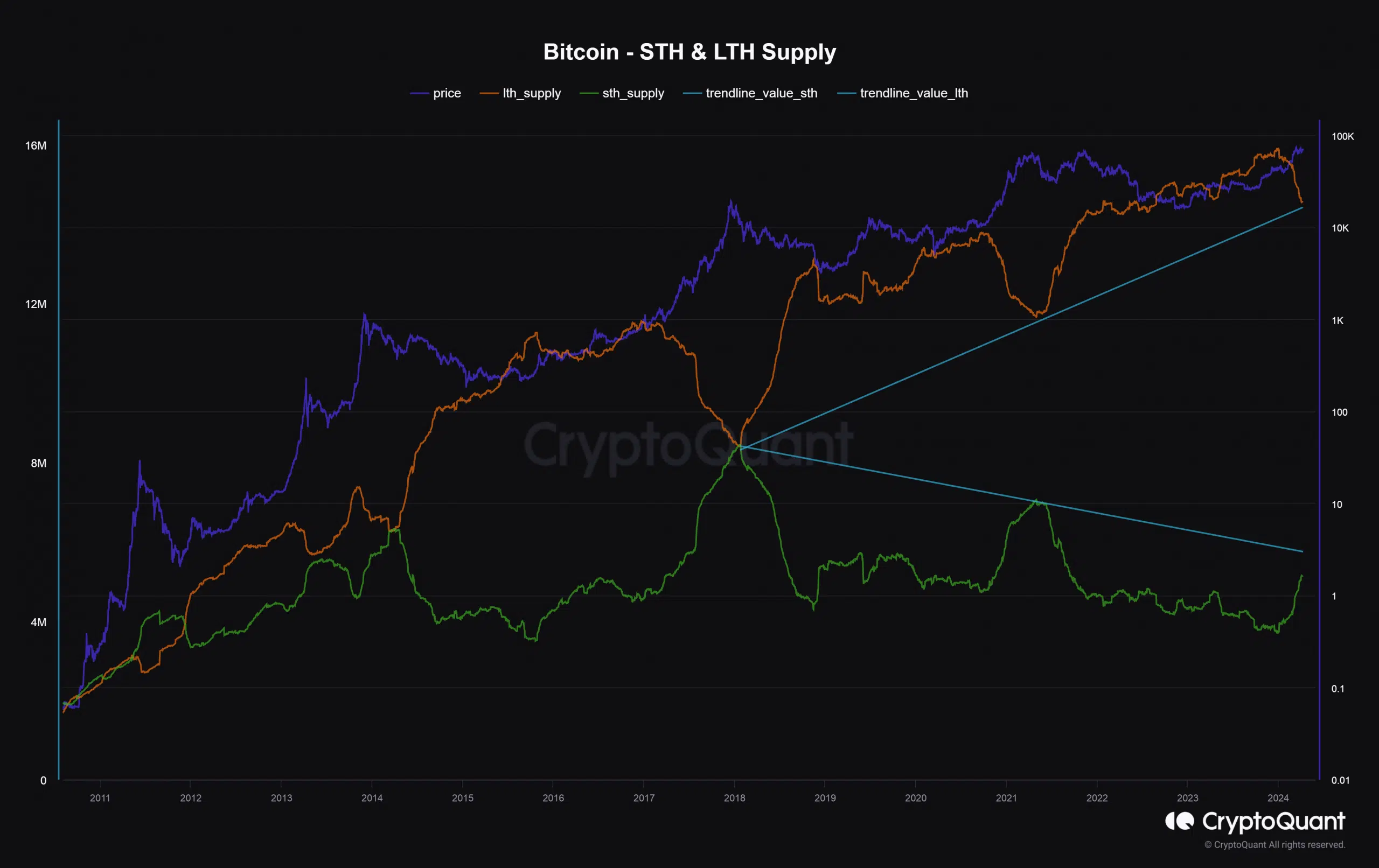

- LTH supply as percentage of Bitcoin’s total supply dropped from 80% to 73% in 2024.

- The distribution-induced selling pressure was offset by ETF inflows.

After patiently accumulating during bearish conditions, long-term holders (LTH) were distributing their Bitcoin [BTC] holdings at profits in the ongoing bull market.

Releasing clenched fists

According to AMBCrypto’s analysis of a CryptoQuant dashboard, Bitcoin supply that has remained inactive for 155 days or more plunged in recent months.

As of the 10th of April, around 73% of the total circulating supply was in possession of LTH, down significantly from 80% at the beginning of 2024.

In the same time, the supply held by short-term holders (STH), or weak hands, surged from 20% of the total Bitcoin in circulation to 26%. This implied that LTH have been selling their coins to newer market entrants.

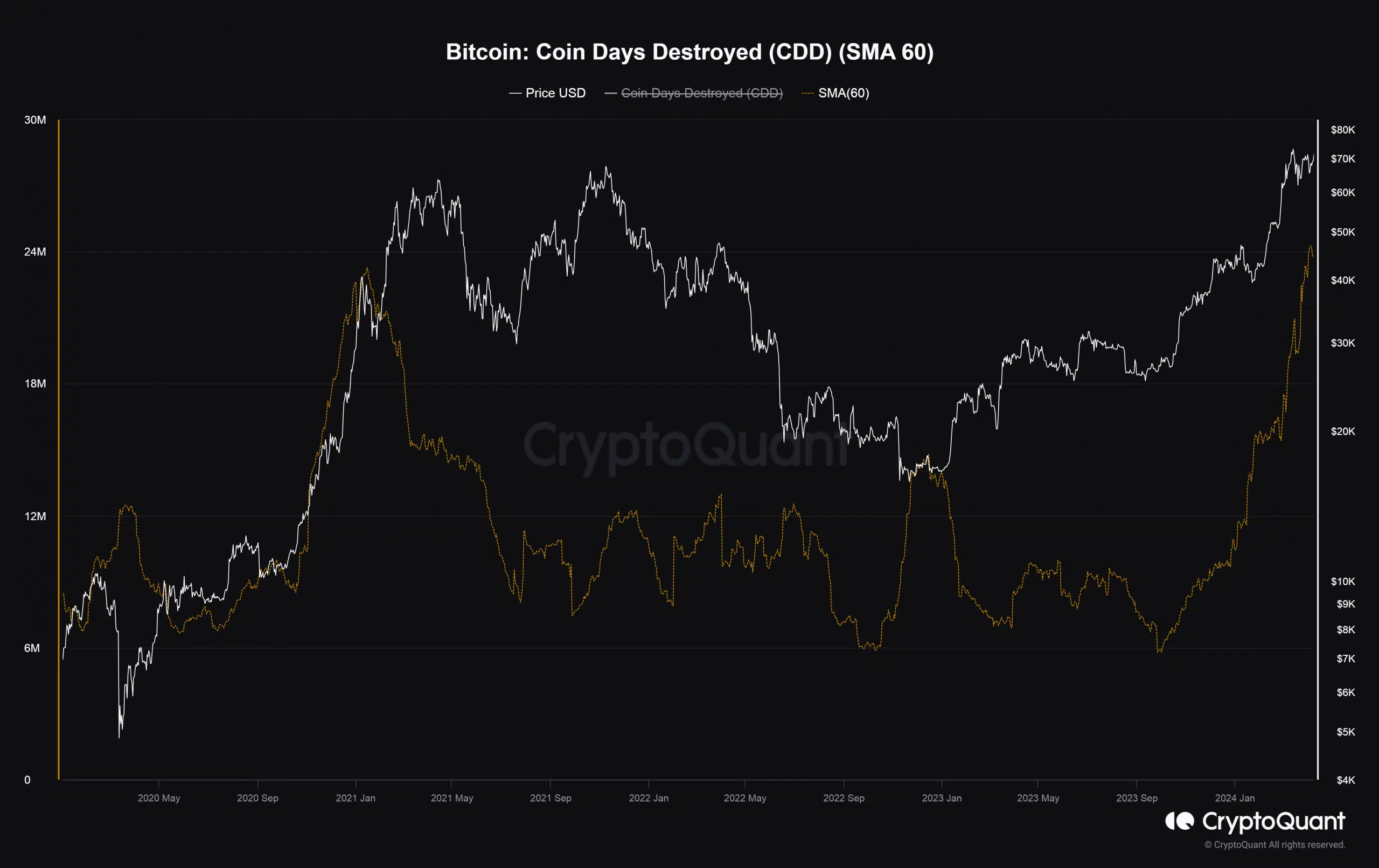

Another way to look at this is by assessing CryptoQuant’s “Coin Days Destroyed (CDD)” indicator. During bull markets, it’s common to see transactions involving Bitcoins that have been dormant for a long time.

The 60-day Simple Moving Average (SMA) of CDD rose sharply since February. Higher values indicated that LTH were moving their coins with an intention to sell.

LTHs contribute to selling pressure

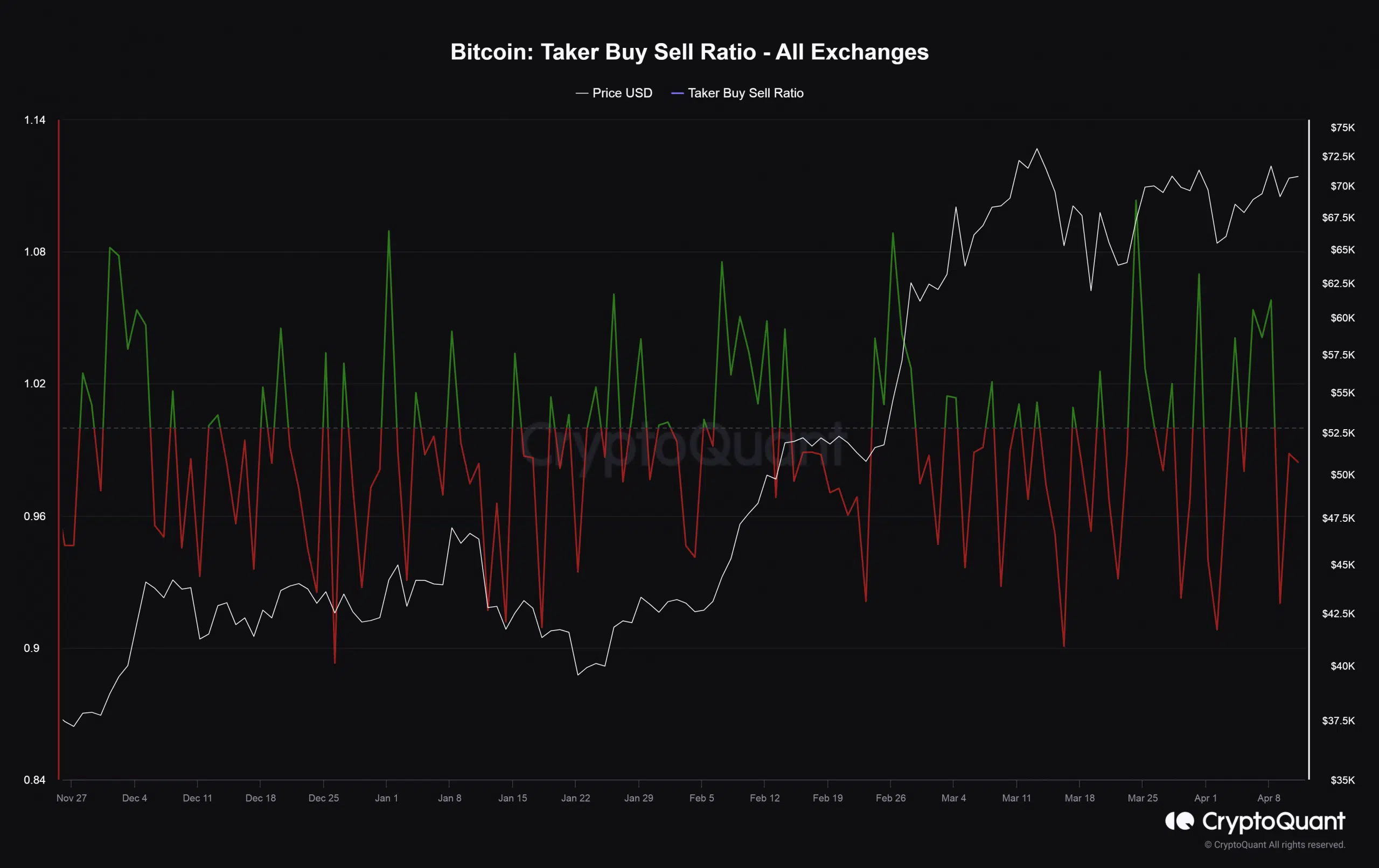

Sell-offs by LTHs create a degree of panic in the market as they can impede Bitcoin’s bullish momentum.

An examination of Bitcoin’s Taker Buy Sell Ratio showed selling pressure strengthening in the last two days, likely due to profit-taking by LTHs.

But contrary to fears, Bitcoin rose above $70k over the last 24 hours, following a 1.89% increase, data from CoinMarkerCap showed.

Is your portfolio green? Check out the BTC Profit Calculator

ETF demand remains strong

Well, a plausible reason could be a net positive day for spot Bitcoin ETF inflows. As per AMBCrypto’s analysis of SoSo Value data, more than $123 million worth of Bitcoins was scooped up by these U.S.-based investment vehicles that started trading early January.

This robust demand likely supported Bitcoin’s price and could well continue to do in the future, nullifying the impact of supply distribution by long-term holders.