54M Ethereum staked in 2024 – Is this the first sign of a 2025 rally?

- Ethereum staking saw consistent growth this year, with over 54 million ETH at stake

- Technical indicators revealed the possibility of a price hike soon

Ethereum [ETH] staking has been consistently up in 2024, reflecting investors’ trust in the king of altcoins. A hike in Ethereum staking means that more Ether tokens are being committed to the Ethereum network to validate transactions and maintain security.

However, will this have a positive impact on the token’s price in the remaining days of 2024?

Will staking help Ethereum?

IntoTheBlock, a popular data analytics platform, recently shared a tweet, revealing that Ethereum staking saw consistent growth this year, with over 54 million ETH staked. The market also saw the explosive growth of ETH restaking, which currently accounts for nearly 10% of staked ETH.

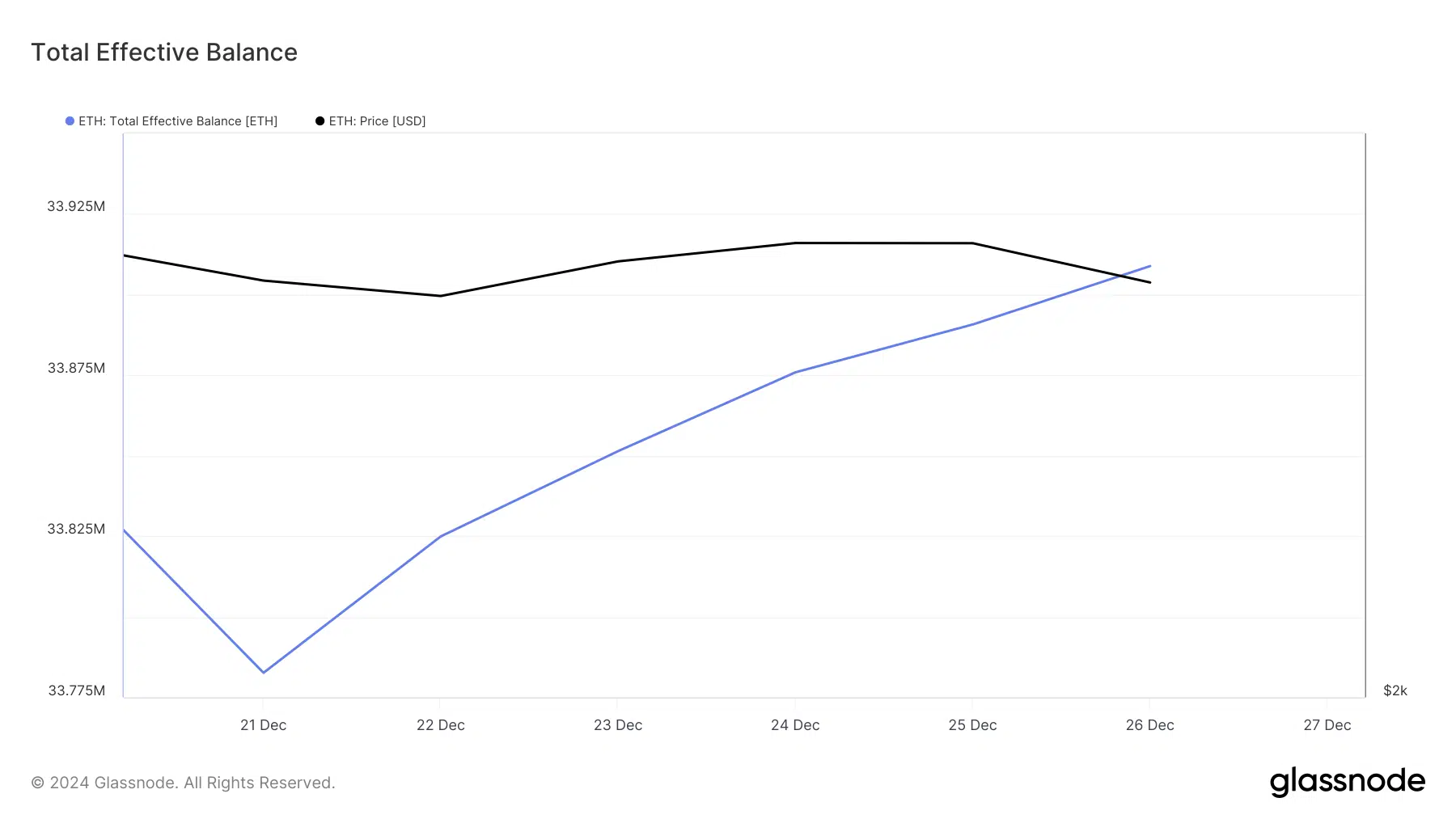

In fact, AMBCrypto’s analysis of Glassnode’s data revealed that related datasets also moved up in the last seven days. For instance, Ethereum’s total effective balance shot up. The total staked balance is that which is actively participating in Proof-of-Stake consensus.

What’s happening with ETH’s price?

While all this happened, ETH’s price was somewhat consolidating. At the time of writing, the token’s daily and weekly charts remained red. Ethereum was trading at $3.38k with a market capitalization of over $406 billion.

CryptoQuant’s data revealed that ETH’s exchange reserve has been dropping, meaning that buying pressure on the token was high. However, despite declining exchange reserves, the blockchain’s active addresses and transfer volume declined in the recent past.

Nonetheless, Ethereum’s funding rate has been rising. In the crypto market, an increase in funding rates can mean that traders are optimistic about the market and expect the price to rise. This can also mean that the market is overheated. Funding rates can increase market volatility, causing price changes to be more dramatic.

Therefore, AMBCrypto checked the token’s daily chart to find out more about which way the token may be heading. As per our analysis, ETH’s price had already touched and rebounded from the lower limit of the Bollinger Bands.

Whenever that happens, it hints at a price hike. Additionally, the Relative Strength Index (RSI) also registered a slight uptick, further suggesting a price hike in the coming days. If that happens, then ETH might first test its resistance at the 20-day SMA.

Read Ethereum’s [ETH] Price Prediction 2024-25

A successful breakout could lead the altcoin to $4k once again. However, a failed test can pull the token down to $3k.