3 coins revived in 2024 poised for a 2025 surge – Are they worth the hype?

- Litecoin and Synthetix’s metrics showed potential for further gains, but LTC was overvalued

- Performance of Theta had been markedly stronger in 2021, but the difference was much smaller in 2024

The crypto market has seen some volatility over the past two weeks. Bitcoin [BTC] was rejected at the $108k mark, and its price discovery phase was temporarily halted. Some coins that were among the biggest gainers in the 2020-21 cycle made a resurgence over the past 4-6 weeks.

Measured from 04 November’s lows to their local highs, Theta Network [THETA] made 235% gains, Synthetix [SNX] 199%, and Litecoin [LTC] 128%. Their rallies began on the same day and ended around the same time, towards the end of the first week of December. Since then, they have retraced by 33.9%, 43%, and 29.3% respectively.

Will these massive performers from the previous cycle get another chance to run higher? The comparison of on-chain metrics and price action offered some insights.

MDIA drop shows another period of accumulation is needed before next rally

Litecoin was not one of the biggest winners from the previous cycle, but it occupied a compelling narrative a few years ago. Touted as “the silver to Bitcoin’s gold” and the lighter, faster alternative to BTC, the tall claims did not translate to positive performance over the years. This was exacerbated by the arrival of newer tokens, driving LTC further from the public’s eye.

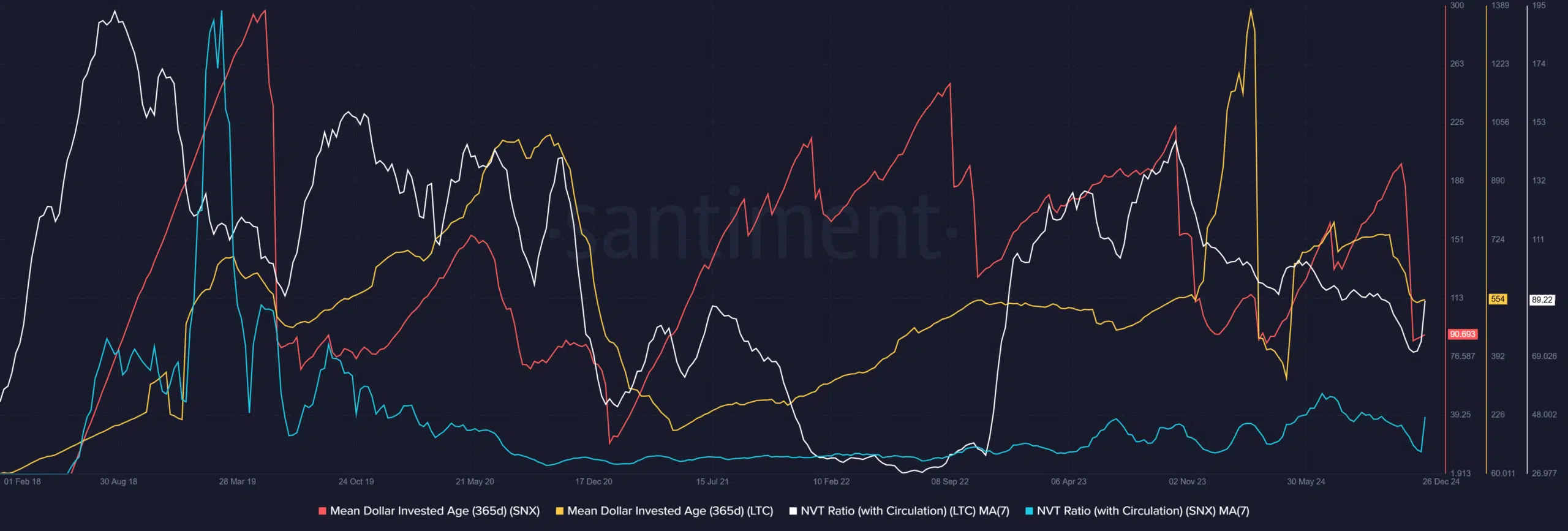

Source: Santiment

The on-chain metrics of LTC and SNX showed that there was potential for further gains. The Mean Dollar Invested Age (MDIA) of SNX had been falling over the past month. This highlighted investments flowing back into regular circulation and was a sign of increased network activity.

The MDIA of LTC rose higher in February 2024 than it did at any point in the last six years. And yet, this hike, and the sharp decline that followed, were not accompanied by the massive price gains expected from new investments. Rather, LTC remained bound to its long-term range formation.

The Network Value to Transactions ratio for both tokens has been trending south since June. This was a sign of higher transaction activity and more economic activity on the network. On the contrary, the high NVT for Litecoin revealed the token might be overvalued compared to its network activity. THETA metrics were not available on the platform.

Will THETA’s outperformance continue?

Set on the same percentage scale, the price performance of the three tokens displayed stark differences. Q1 2024’s rally saw THETA heftily outperform the other two in terms of price appreciation. November’s rally was also slightly stronger.

Read Synthetix’s [SNX] Price Prediction 2025-26

Over the last four years, the difference in performances was more apparent. Measured from May 2020, the gains THETA saw in 2021’s altcoin season far outstripped that of Synthetix token or Litecoin. The performance in 2024 and 2021 were persuasive evidence that Theta Network might be the best bet among the three altcoins.