Staking services on PoS-based networks touch $25.8 billion in market cap

Staking services for digital currencies are a tool for new and upcoming digital tokens, a tool through which they garner some interest and userbase by incentivizing the latter for holding their funds. Staking was first introduced on the Peercoin network as a feature for a hybrid of Proof-of-stake and Proof-of-work based networks, but the feature later transpired for only Proof-of-stake based networks.

These staking services have become a parameter to decide the validator of the next block on Proof-of-stake based chains. In PoS-based networks, a validator is chosen by a vote, one where the validator with better on-chain behavior and performance is selected to validate the next block on the network. In Delegated PoS (DPoS), the choice of the validator is directly proportional to the number of coins held by the participant. Thus, staking is becoming a mean to define on-chain consensus as well.

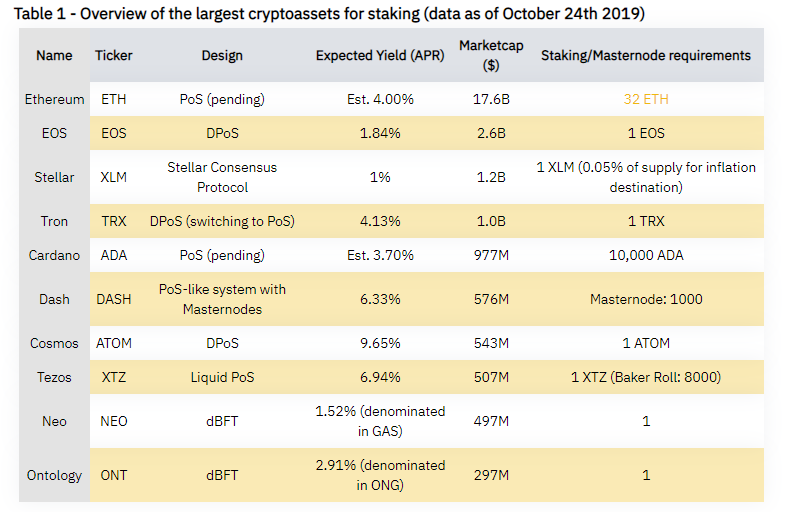

A recent report by Binance highlighted how staking as a service has evolved from a promotional gimmick in its early days to a consensus defining parameter. The report highlighted that the staking services on the top 10 chains accounted for a $25.8 billion in market cap.

Source: Binance

The report categorized stackable coins into 5 core groups based on the on-chain consensus which included,

- Pure Proof of Stake (PoS) based staking as seen on Algorand where the user can earn direct staking rewards without any intermediaries.

- Delegated Proof of Stake (DPoS) based staking with assets like EOS, where the staking reward is provided from the 5% fixed annual inflation rate

- Distribution model-based staking with assets like Stellar.

- Dual-coin systems with assets like NEO/GAS where the staking reward are issued in Gas tokens

- Masternode with assets like Dash, TomoChain, and ZCoin.

Ethereum’s switch to Proof-of-Stake would only make the staking services more popular and increase the market capitalization by many folds, the report added.

How is staking rewards different from block rewards?

Block rewards are awarded as per the participating miner’s contribution of hash power in mining the block, but the staking rewards have a completely different rewarding structure which varies from network to network and comes in different reward caps and lock-up periods.

Staking services aid the governance process and make it more transparent and allow equal opportunity to participants for staking their claims in becoming the next validator for the block.