DASH, Algorand, Cardano Price Analysis: 15 August

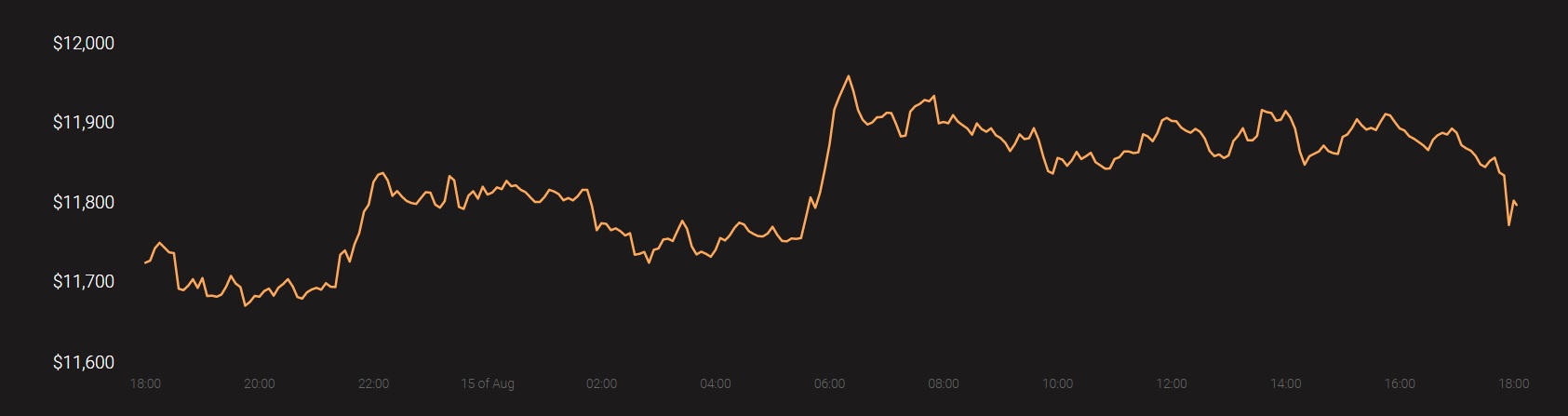

Owing to Bitcoin’s market dominance, the impact of its price performance on the rest of the market is often overwhelming. Since breaching its previous resistance level, Bitcoin’s charts seem to have plateaued, with BTC holding firm under the $12,000-mark for a few days now.

Source: Coinstats

However, Bitcoin’s consolidation meant that the rest of the market was noting falling momentum across the board. Such was the case with altcoins like Cardano.

Cardano [ADA]

Source: ADA/USD on TradingView

Cardano [ADA] has been one of the market’s best-performing cryptos this year, with ADA gaining particular steam in the months of June and July. August, however, hasn’t been kind to ADA, with the crypto trading within a tight trading channel since the month began. In fact, since hitting a local top towards the end of July, ADA has tapered off on the charts. At the time of writing, ADA was noting losses of over 7% over the past 7 days.

Recent depreciation aside, Cardano was still noting YTD gains of 312%, at press time. ADA was also trading at its August 2018 levels.

Cardano’s technical indicators underlined such bearishness as while the Parabolic SAR’s dotted markers were observed to be well over the price candles, the Chaikin Money Flow was barely holding on above zero.

Weeks after the much-anticipated Shelley upgrade, Cardano is in the news after it took the next step towards epoch 3 after external stake pools were allowed to validate blocks for the first time.

Algorand [ALGO]

Source: ALGO/USD on TradingView

Algorand, ranked 34th on CoinMarketCao’s charts, after weeks and months of tepid movement, surged on the charts in the month of August. In fact, over the last week, ALGO climbed by over 82% on the charts in a matter of just 5 days. At press time, however, corrections were ensuing in the ALGO market, with the crypto down by over 7% on the charts. The aforementioned surge in price, however, did push the crypto’s value to its August 2019 levels.

The price volatility in the Algorand market was highlighted by its technical indicators as while the mouth of the Bollinger Bands was expanding to account for the same, the Relative Strength Index was falling after peaking inside the overbought zone.

Algorand was in the news recently after the crypto-derivatives platform, Delta exchange, listed it.

DASH

Source: DASH/USD on TradingView

DASH, one of the market’s few privacy coins, has been steadily losing its market share to the likes of Monero over the past few months. Ranked 24th at the time of writing, like many alts in the market, DASH too rose on the charts towards the end of July and the beginning of August. However, corrections were soon to intervene as soon after hitting a local top, DASH fell, with the crypto’s value depreciating by almost 12%.

At the time of writing, however, recovery efforts were in full flow, with DASH up by almost 5% since the aforementioned fall.

While the Awesome Oscillator pictured falling bearish momentum in the market, the MACD line had just dipped under the Signal line on the charts, very contrary to the crypto’s recent price movements.